ARTICLE AD

Bithumb's market share triples despite a drop in annual revenue.

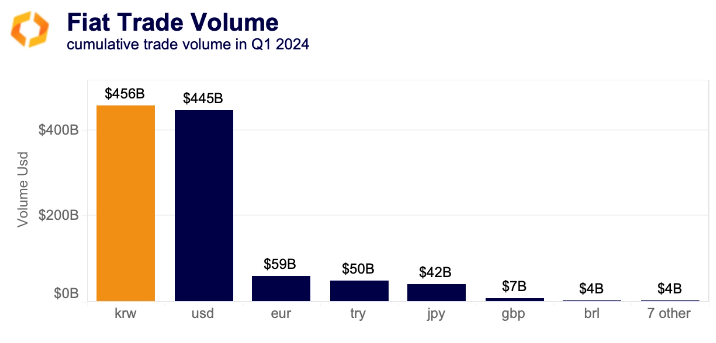

The South Korean Won (KRW) has emerged as the leading currency for crypto trading in the first quarter of 2024, outstripping the US Dollar (USD) in cumulative trade volume, according to a report by research firm Kaiko. This marks the highest trade volume for Korean markets in over two years, achieved in early March. The rise in volume is attributed to the improving macroeconomic environment and intense competition among Korean exchanges.

Upbit has maintained its position as the foremost exchange in the South Korean crypto market, commanding an average market share of 82% since early 2021. Despite this dominance, rivals Bithumb and Korbit have escalated competition by implementing zero-fee campaigns towards the end of 2023.

Korbit’s market share remained relatively unchanged, averaging below 1% in 2024. In contrast, Bithumb experienced a threefold increase in market share following its zero-fee policy initiation in October 2023. Nevertheless, Bithumb’s annual revenue saw a 60% decrease in 2023, leading to the termination of the zero-fee campaign on February 5th, a mere five months after its inception.

While KRW trading volumes have seen a downturn in early April, the recent approval of spot BTC and ETH ETFs in Hong Kong is anticipated to positively influence sentiment in the APAC crypto markets.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

52

7 months ago

52