ARTICLE AD

Key developments in the Litecoin ecosystem has attracted whale attention to the altcoin as bulls gear up for the LTC price rally to $150.

Despite the recent pullback in the broader altcoin space, Litecoin’s native cryptocurrency, LTC, has shown extreme strength, shooting past $105 on Tuesday, April 2. At the time of writing, LTC is trading 1.45% lower at $100.32 while holding a market cap of 7.461 billion. Moreover, Litecoin’s daily trading volume has shot up to 1.34 billion.

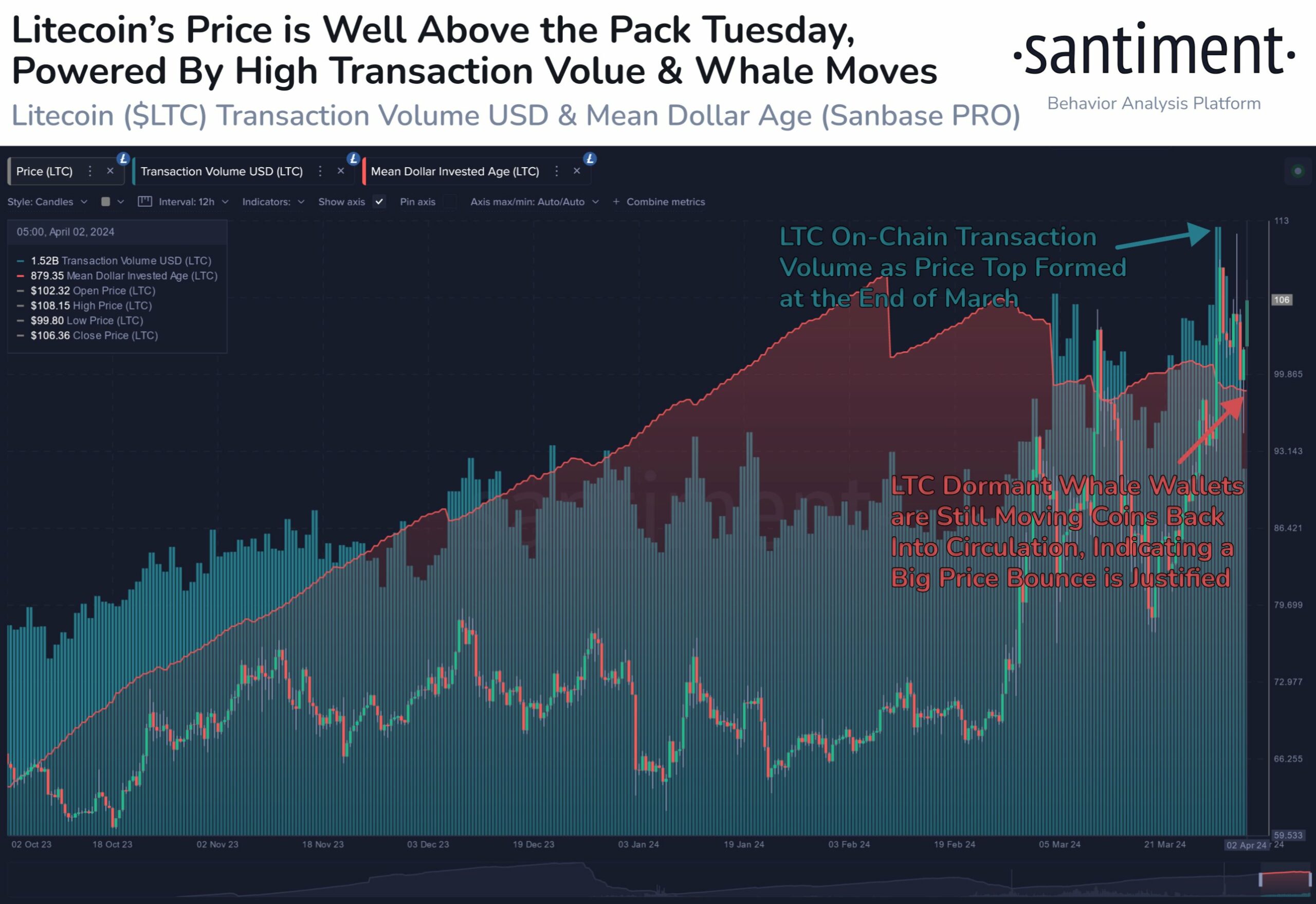

As per the on-chain leading data provider Santiment, there has been growing activity in the altcoin space in the last 24 hours. During this period, Litecoin has outperformed its counterparts, showing much higher transaction volume in comparison to that observed in the past month. This clearly highlights the growing investor interest and engagement in Litecoin.

Additionally, another essential note is the significant decline in the average age of the Litecoin investment. This most likely indicates that the LTC “whales” and significant holders have largely redistributed their balances and thrown them into circulation. This massive whale activity may be “bullish” on Litecoin’s pricing dynamic and the Holders Composition indicator.

Photo: Santiment

Earlier this week, the US CFTC officially recognized Litecoin (LTC) as a commodity along with Ethereum (ETH). This disclosure came during the ongoing legal dispute involving crypto exchange KuCoin. The complaint noted:

“KuCoin solicited and accepted orders, accepted property to margin, and operated a facility for the trading of futures, swaps, and leveraged, margined, or financed retail transactions involving digital assets that are commodities including Bitcoin (BTC), Ether (ETH), and Litecoin (LTC).”

Also, the launch of Litecoin Futures by the Coinbase Institutional has given new confidence to the traders. However, one can be sure about the process of the developers, and that is that they continue to develop Core v0.21.3 to improve the abilities and operability of Litecoin.

In this upgrade, the most important part is the launch of the version with Mimble Wimble blocks MWEB. This possibility could be very important for the making of Litecoin more scalable or private. MWEB is a key parameter in protecting transactions and increasing privacy and reliability.

LTC Price Action

Several market analysts have been bullish about the Litecoin (LTC) price rally to continue up to $150. However, it could face major resistance at this desired target level.

$LTC is currently one of the select few assets in the top 100 that's in the green today, showing strong performance ever since it was labeled a commodity by the CFTC. This move has led to 75% of $LTC holders now being in profit.

Looking forward, we're eyeing a notable on-chain… pic.twitter.com/rkGaOSCHkB

— IntoTheBlock (@intotheblock) April 2, 2024

According to IntoTheBlock’s data, almost 8.16 million LTCs are held in 590,000 addresses around the $150 level. Many of the investors who acquired it in 2021 decided to hold their coins, expecting to be able to sell them soon as the coin price approaches the level at which they bought it. Therefore LTC is at risk of facing strong selling pressure going ahead.

9 months ago

48

9 months ago

48