ARTICLE AD

Meme tokens maintain market strength with $11 billion weekly volume.

Meme tokens are defying the typical market downturn behavior, maintaining their position as some of the year’s top performers, according to a report by research firm Kaiko. Despite a recent market correction, these tokens have seen year-to-date returns ranging from 80% to 1,800%.

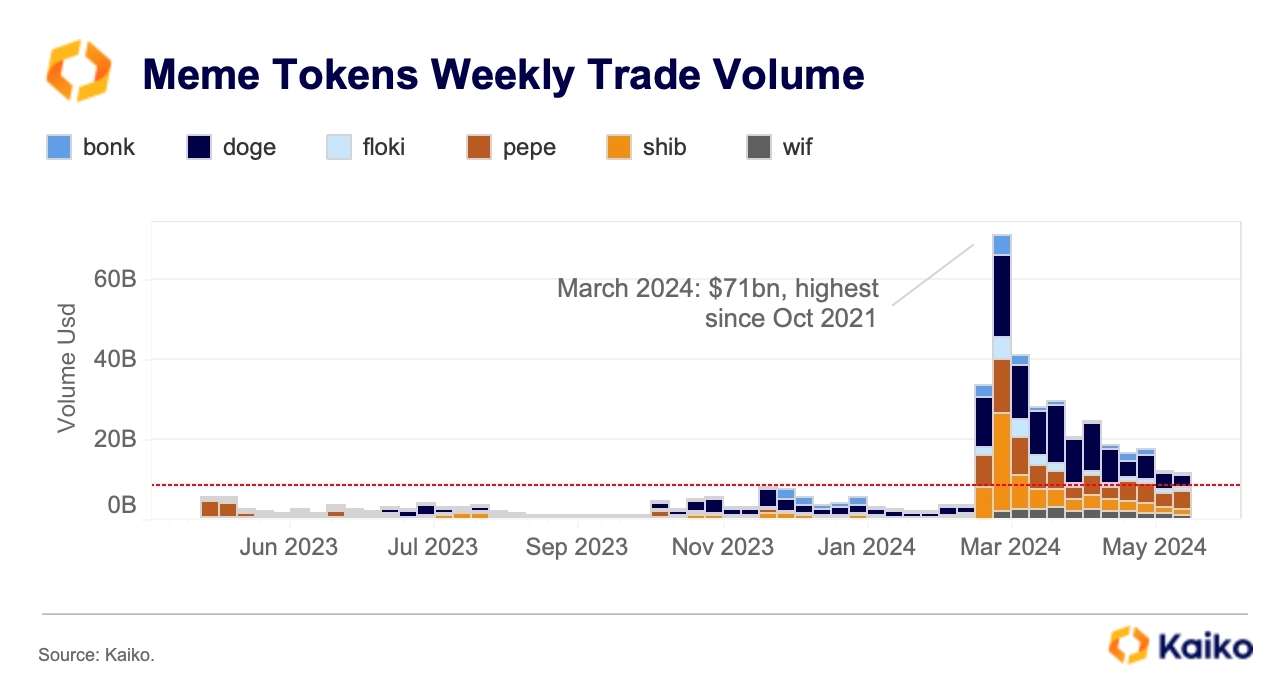

Moreover, meme coin trading volume remains strong, with a more than 200% increase year-to-date, totaling around $11 billion weekly.

Image: Kaiko

Image: KaikoThe sustained interest in meme tokens may stem from their adaptability to market trends and accessibility, which continues to draw substantial community engagement, highlights the report. Yet, it’s crucial to acknowledge the higher leverage meme coins carry compared to most altcoins, often fueled by speculative trading.

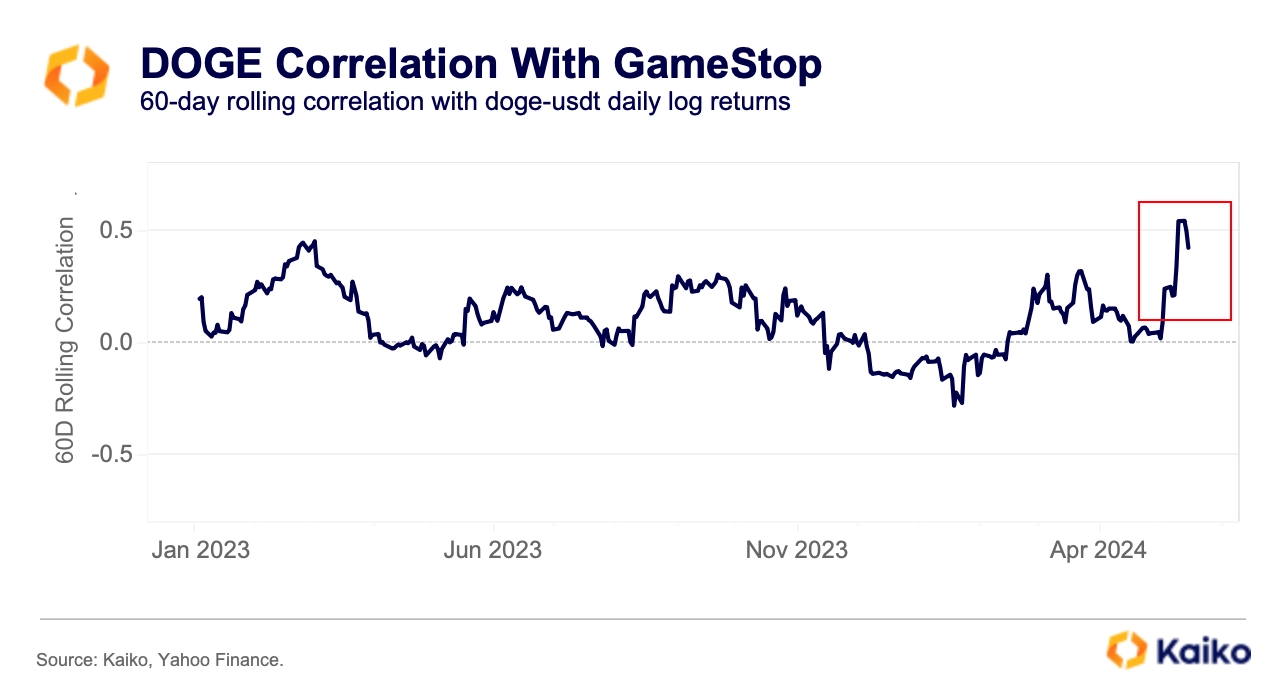

In an interesting twist, the correlation between meme coins and other speculative retail assets, such as meme stocks, has been inconsistent and volatile. For example, the 60-day rolling correlation between DOGE and GameStop (GME) has generally stayed below 0.3 over the past year.

Last week, meme stocks like GME and AMC Entertainment saw unexpected gains, which led to a spike in the correlation between DOGE and GME, marking the highest point in over a year.

The sudden spike in GME and AMC stock prices is related to the return of RoaringKitty, one of the key figures behind the GME pump seen in late 2020.

Image: Kaiko

Image: KaikoCrypto liquidity remains divided among exchanges and assets, with Bitcoin and Ethereum holding the lion’s share. In 2024, Bitcoin’s average daily 1% market depth was over $270 million, dwarfing the liquidity of most top altcoins by more than tenfold. Ethereum followed as the second most liquid asset, with an average market depth of $190 million.

However, the landscape is shifting. Altcoin liquidity, in comparison to Bitcoin’s daily market depth, has been on the rise for the past two years. This change aligns with a decrease in Ethereum’s liquidity relative to Bitcoin’s, dropping from 83% in 2022 to 72% in 2024.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

4 months ago

19

4 months ago

19