ARTICLE AD

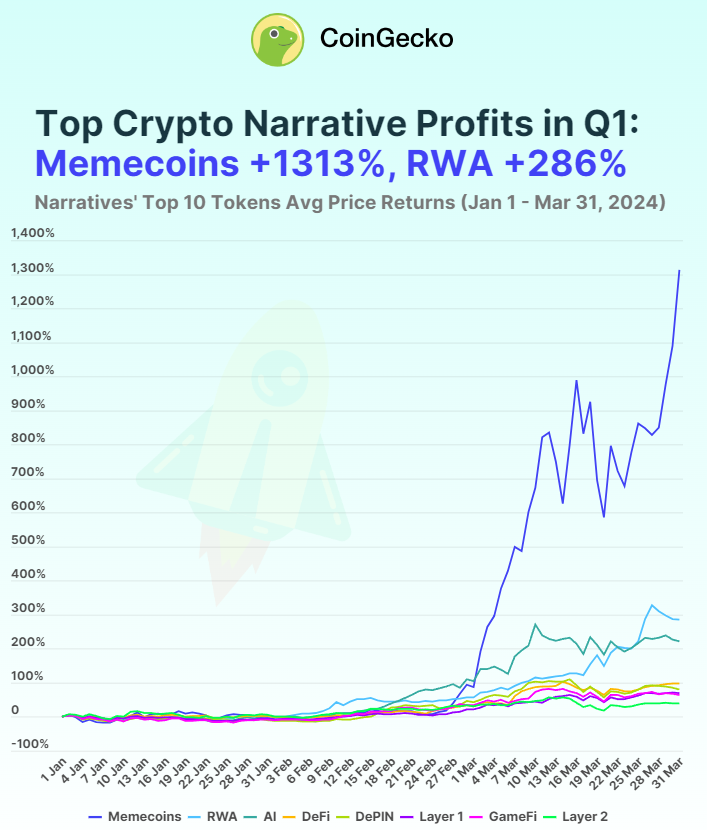

Memecoins have emerged as the top-performing crypto narrative in the first quarter of 2024, with an average return of over 1300% across its leading tokens, according to an April 3 report by data aggregator CoinGecko. Notably, Brett (BRETT), BOOK OF MEME (BOME), and cat in a dogs world (MEW) have significantly contributed to this surge.

BRETT, in particular, saw a staggering 7727.6% increase in value by the end of Q1 from its launch price. The dogwifhat (WIF) token also experienced a substantial gain of 2721.2% quarter-to-date after going viral, fueling the current meme coin frenzy.

The profitability of meme coins was 4.6 times higher than the next best-performing narrative of real-world assets (RWA), and 33.3 times more than the Layer-2 (L2) narrative, which had the lowest returns in Q1. RWA tokens also performed well, with MANTRA (OM) and TokenFi (TOKEN) seeing QTD gains of 1074.4% and 419.7%, respectively. However, XDC Network (XDC) experienced a 15.6% decline.

The artificial intelligence (AI) narrative closely followed, with a 222% return in Q1. All large-cap AI tokens posted gains, with AIOZ Network (AIOZ) leading at 480.2% and Fetch.ai (FET) at 378.3%. Even the lowest gainer, OriginTrail (TRAC), returned 74.9% in Q1, indicating a collective interest in AI tokens.

The decentralized finance (DeFi) narrative saw moderate gains of 98.9% in Q1, with Ribbon Finance (RBN) leading at 430.8% QTD after pivoting to Aevo. Other DeFi tokens like Jupiter (JUP), Maker (MKR), and The Graph (GRT) also reported strong returns. DePIN, despite initial losses, ended the quarter with 81% returns, with Arweave (AR), Livepeer (LPT), and Theta Network (THETA) as top performers.

Alternative layer-1 narratives posted 70% returns, with Toncoin (TON) and Bitcoin Cash (BCH) outperforming others. GameFi narratives matched Layer 1 with 64.4% returns, led by Echelon Prime (PRIME), Gala (GALA), and Ronin (RON). Layer 2 narratives lagged, with only 39.5% gains, as established Ethereum L2s like Arbitrum (ARB), Polygon (MATIC), and Optimism (OP) underperformed, while Stacks (STX) and Mantle (MNT) saw stronger returns.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

9 months ago

49

9 months ago

49