ARTICLE AD

Crypto research firm Messari found that between February and April, the total value locked of real-world asset protocols increased by almost 60%.

According to the report, the total value locked (TVL) of the real-world asset (RWA) market was close to $8 billion as of April 26. Experts note that the sector’s revival is driven by interest in high-yield investments related to lending.

The TVL specified in the document includes securities, commodities, real estate tokenization protocols, bond-backed stablecoins, and several other assets. However, it does not consider the fiat-backed stablecoins Tether (USDT) and Circle (USDC).

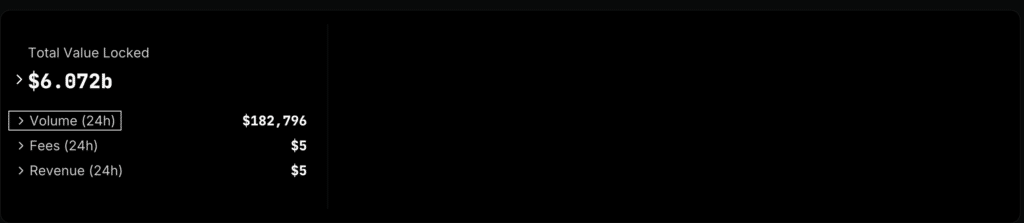

Data from the on-chain analytics platform DefiLlama indicate lower values at $6.07 billion. Since the beginning of 2023, this market sector has grown by 700%. The undisputed leader in the segment is Ethena, which has $2.32 billion.

Source: DefiLlama

Source: DefiLlama

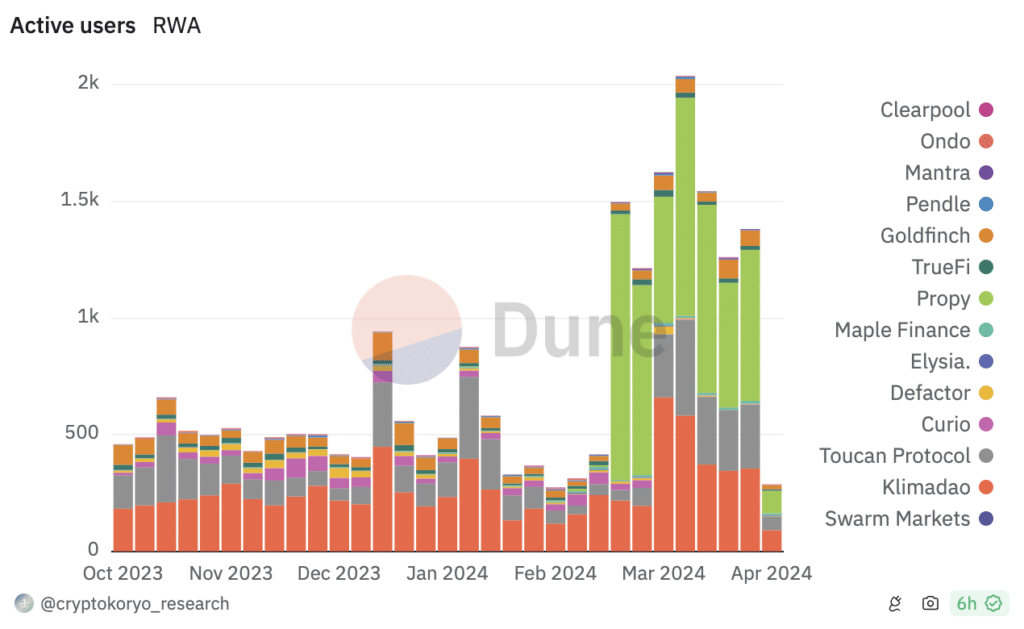

Since February 2024, the number of active users of RWA protocols has also increased. According to Dune Analytics, in early April, it exceeded 2,000. The largest influx of users was provided by projects such as Toucan and KlimaDAO, as well as the real estate tokenization protocol Propy.

Source: Dune Analytics

Source: Dune Analytics

Previously, K33 Research said in a report that the RWA tokenization story is accelerating in crypto. Chainlink’s native token, LINK, could have investors looking to profit from the hype.

David Zimmerman said in the report that there are still many obstacles before RWA can reach its full potential. However, the narrative will be compelling enough to trigger an isolated RWA crypto bubble before RWA has a large-scale real-world material impact.

11 months ago

47

11 months ago

47