ARTICLE AD

The firm's total Bitcoin holdings now exceed $9.54 million after recent purchase.

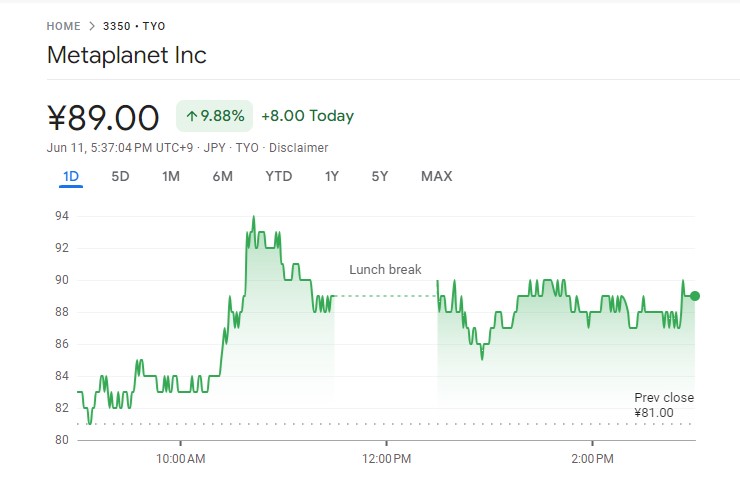

Shares of Metaplanet, a publicly traded company listed on the Tokyo Stock Exchange and often compared to MicroStrategy, have surged 9.88% after the company announced its third Bitcoin acquisition, according to data from Google Finance.

Metaplanet’s shares jump after its third Bitcoin purchase

Metaplanet’s shares jump after its third Bitcoin purchaseMetaplanet said Monday it had added 23.351 Bitcoin (BTC), worth around 250 million yen ($1.58 million), to its holdings. With the latest acquisition, the company now holds over 141 BTC, valued at approximately $9.54 million.

The fresh move, following the approval of the company’s board, also marks its third Bitcoin acquisition in two months. The company made previous purchases on April 23 and May 10.

The company’s average Bitcoin acquisition cost stands at around 10.27 million yen, roughly $65,300 per unit. Despite a recent downturn in Bitcoin’s price to around $67,500, Metaplanet’s investment strategy appears to be paying off.

The firm’s share price climbed to 89 yen at Tuesday’s close, a significant increase from 19 yen on April 9, when Metaplanet first announced its Bitcoin investment focus.

Metaplanet has reoriented its corporate strategy to focus on Bitcoin as its principal treasury reserve asset. This pivot comes as a response to Japan’s challenging economic conditions, characterized by high government debt, persistent negative real interest rates, and a weakening yen.

Yesterday, Canada-based DeFi Technologies said it started adding BTC to its treasury. The company bought 110 BTC, worth over $7.5 million at the time of purchase. Its shares ($DEFTF) jumped 11% following the announcement.

Global public companies hold a collective 308,688 bitcoins, with MicroStrategy at the forefront, owning 214,400 BTC, which constitutes over half of its market cap, as reported by BitcoinTreasuries.net.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

42

7 months ago

42