ARTICLE AD

Euro stablecoin trading volume hits record highs amid regulatory shifts.

Impending Markets in Crypto Assets (MiCA) regulations are poised to transform the stablecoin landscape favorably to euro-backed stablecoins, as reported by Kaiko Research. Binance has announced restrictions on stablecoins that fall short of the new MiCA standards, while Kraken is assessing its stablecoin offerings to ensure compliance with the European Union’s criteria, which may result in the delisting of certain stablecoins for EU customers.

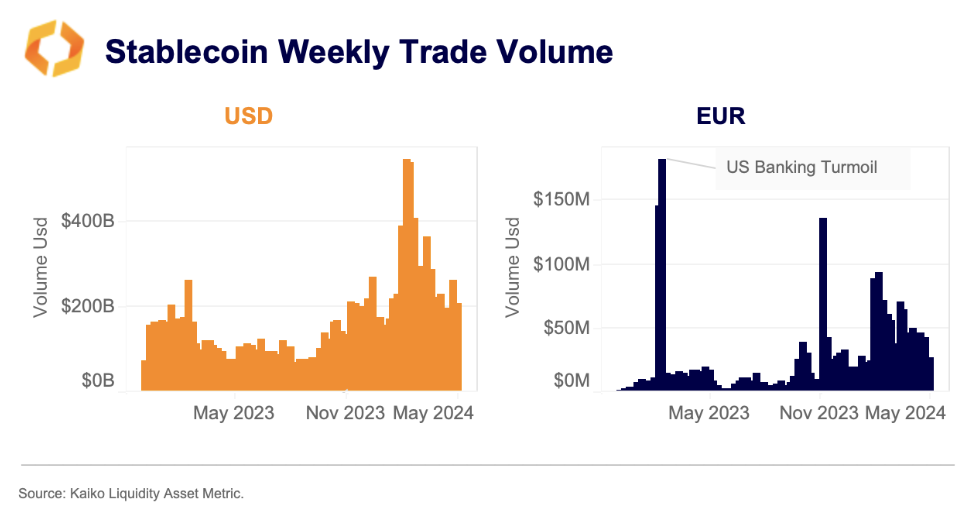

Despite Europe’s slower adoption rate compared to the US and APAC regions, euro-backed stablecoins have seen a surge in trading volume since the year’s start. This uptick indicates a growing demand within European markets. Notably, the combined weekly volume of prominent euro stablecoins, including Tether’s EURT, Stasis EURS, and Circle’s EURCV, has surpassed $40 million since March, marking a record duration of sustained high volume.

AEUR, introduced by Binance in December, has quickly dominated the euro stablecoin sector, accounting for over half of the total volume. While USD-backed stablecoins remain the market’s giants, with a staggering $270 billion in average weekly volume in 2024, euro-backed stablecoins have carved out a 1.1% transaction share, a significant rise from virtually none in 2020.

Image: Kaiko

Image: KaikoTrading pairs of USDT against the euro are now some of the most traded instruments, outpacing even EUR-denominated Bitcoin trading on Binance and Kraken. This trend highlights these platforms’ role as key fiat gateways for European traders.

The specific stablecoins to be deemed unauthorized remain undisclosed. However, Kraken’s review of Tether’s USDT, the world’s largest stablecoin, is particularly noteworthy given its past regulatory challenges. Despite its primary trade volume occurring during US market hours, USDT remains a vital asset for European traders.

While over-the-counter (OTC) trading will likely maintain USDT-EUR liquidity, the shift towards regulated alternatives such as USDC could become a preferred option for many traders, suggests the report.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

3 months ago

28

3 months ago

28