ARTICLE AD

As Bitcoin usurped silver as the eighth most valuable asset, Michael Saylor’s MicroStrategy filled its digital coffers with more cryptocurrency.

Virginia-based enterprise software firm MicroStrategy scooped an additional $821.7 million worth of Bitcoin (BTC) following its convertible notes offering to stack more of the world’s leading crypto.

MicroStrategy acquired 12,000 BTC from its debt security sale proceeds and excess cash. The company founded by Bitcoin maxi Michael Saylor bought its latest stash at an average price of $68,477 per BTC, reaffirming Saylor’s promise always to buy the top.

The Tysons Corner, Va.-based giant has now spent nearly $7 billion on the digital asset and holds some 205,000 BTC worth over a staggering $14.8 billion, as the cryptocurrency traded at an all-time high (ATH) on March 11. MicroStrategy has momentarily inched ahead of spot BTC ETF issuer BlackRock as one of the largest corporate BTC holders.

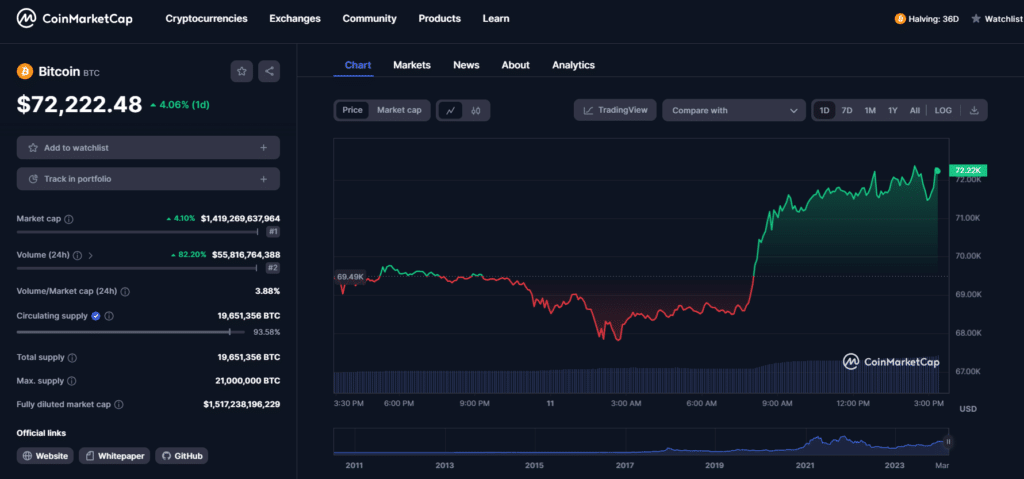

Per CoinMarketCap, BTC was up more than 4% in 24 hours, and it sold for more than $72,000 for the first time in its 15-year history. The leap also propelled BTC’s market cap to over $1.4 trillion, a landmark moment for crypto’s king token.

BTC at ATH | Source: CoinMarketCap

BTC at ATH | Source: CoinMarketCap

Saylor: Bitcoin is the superior digital asset

Speaking to CNBC about BTC’s value proposition amid ATH euphoria and MicroStrategy’s most recent addition, Saylor opined that crypto outclasses other assets for various reasons.

Bitcoin is digital property. It is superior to other investments such as gold, equity, or real estate because it is digital, available, global, ethical, and useful to millions of companies and billions of people.

Michael Saylor, MicroStrategy founderSaylor said MicroStrategy plans to hold BTC for over 100 years and will continue to buy the crypto with cash, debt, and other financial instruments the company can access.

10 months ago

63

10 months ago

63