ARTICLE AD

A short squeeze might be related to MicroStrategy performance.

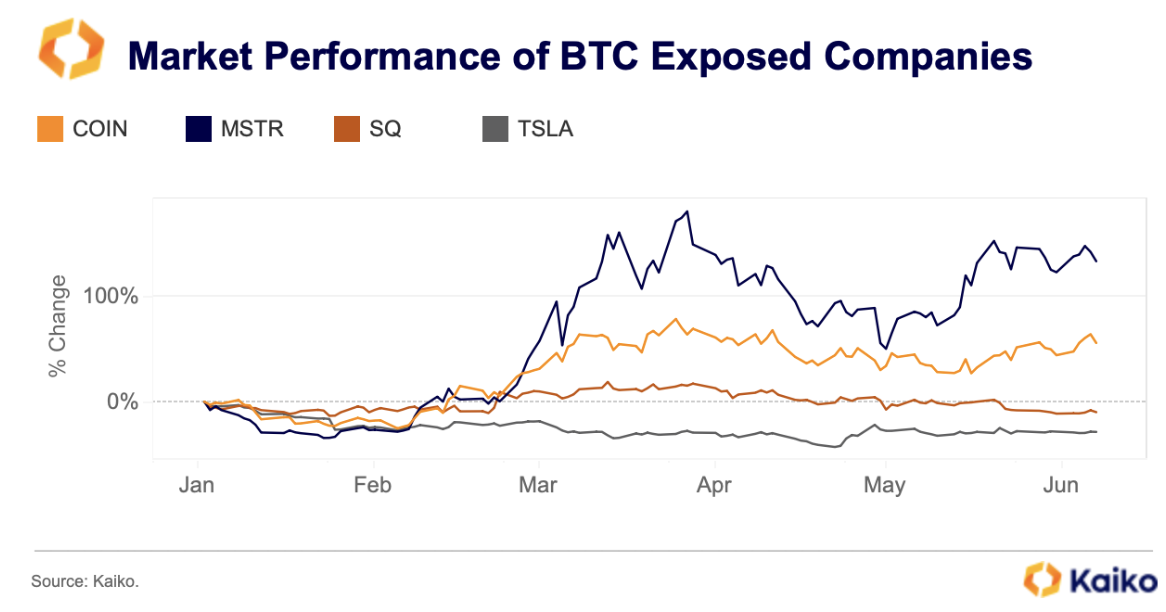

MicroStrategy’s stock has experienced a remarkable 132% increase this year, outpacing Bitcoin (BTC) and other companies with BTC exposure, as reported by research firm Kaiko. The surge is partially due to a short squeeze and is particularly significant in light of the new spot Bitcoin exchange-traded funds (ETFs) in the US, which provide an easy way to invest in BTC.

Despite holding BTC, Tesla and the Block (SQ) have not seen similar gains, with their stocks down by 10% and 29% year-to-date, respectively. These companies have shown a lower correlation with Bitcoin, moving more closely with the broader tech market.

Image: Kaiko

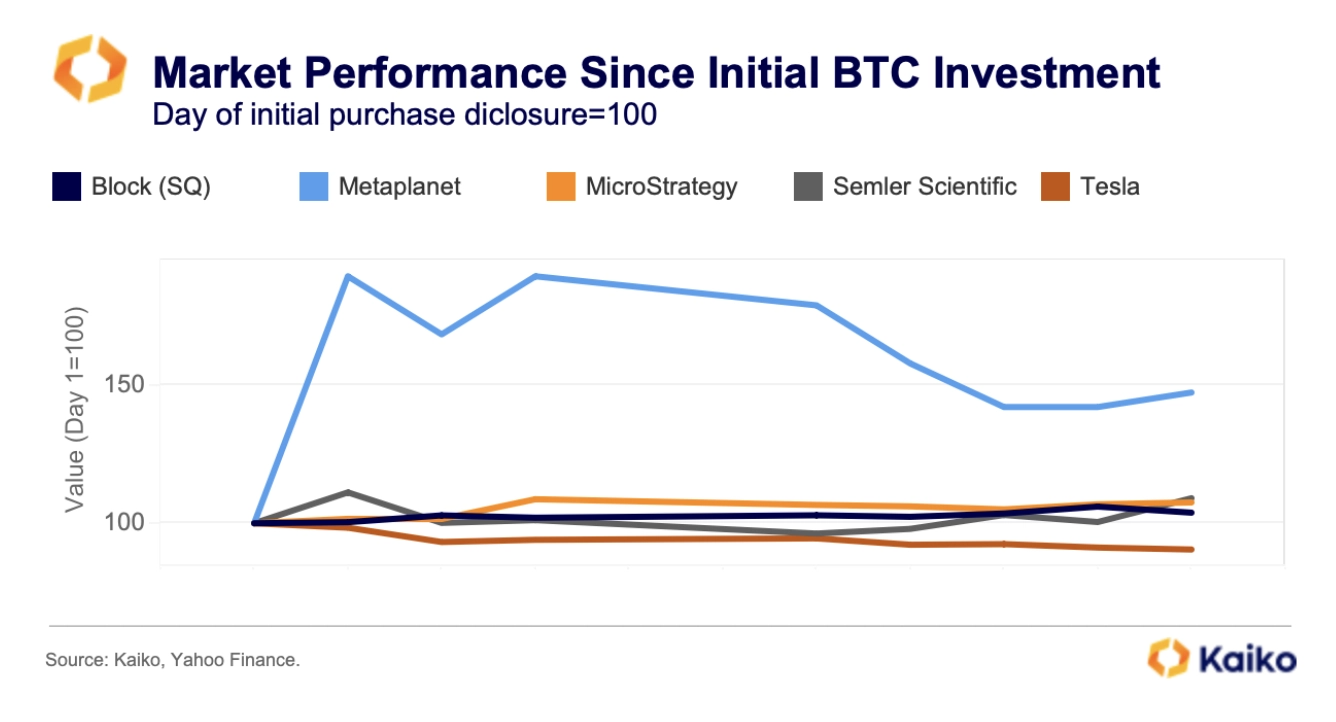

Image: KaikoOther firms, including Japan’s Metaplanet and Semler Scientific, have recently added Bitcoin to their balance sheets, following the lead of MicroStrategy, Tesla, and The Block. Metaplanet’s shares jumped by 85% post-announcement, and Semler Scientific saw a 10% increase, surpassing the performance of MSTR, SQ, and TSLA after their initial BTC investment disclosures.

Image: Kaiko

Image: KaikoThe attractiveness of Bitcoin as a corporate asset has grown with the US Financial Accounting Standards Board’s approval of new crypto accounting rules in December 2023, Kaiko highlights.

These rules, to be implemented in December 2024, will allow companies to list Bitcoin and certain other crypto assets at their fair market value, a change from the previous classification as an indefinite-lived intangible asset.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

3 months ago

29

3 months ago

29