ARTICLE AD

The Turbo Points campaign might be responsible for the recent TVL surge on Ethereum’s L2 Mode.

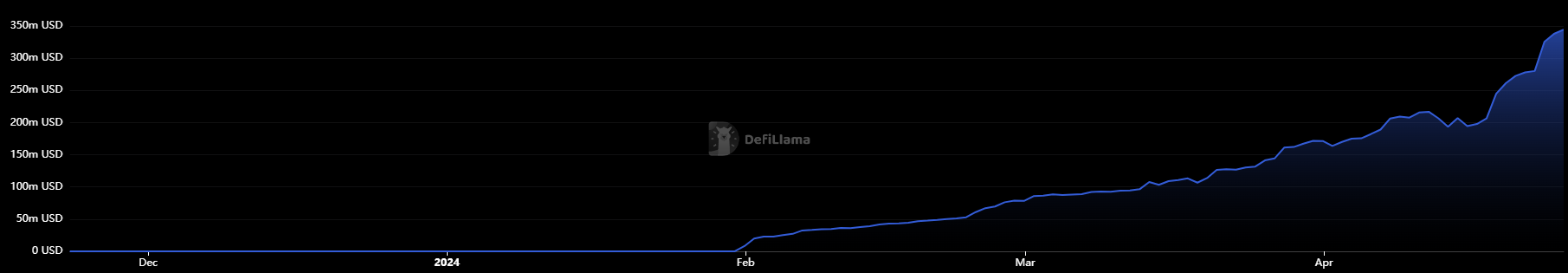

Mode surpassed $344 million in total value locked (TVL) and shows the largest growth among Ethereum layer-2 blockchains over the past 7 and 30 days, according to data aggregator DefiLlama. This huge leap in TVL could be related to users rushing to farm Mode’s native token airdropped, rumored to have a snapshot at the beginning of May.

For the past seven days, Mode leaped 40.4% in TVL, with an even more significant growth of 138% in the last month. Liquid restaking protocol Renzo leads in TVL dominance, nearing $140 million in funds locked and boasting an 85% rise during the last 30 days.

Mode TVL growth. Image: DefiLlama

Mode TVL growth. Image: DefiLlamaThe reason behind Renzo’s jump in TVL on Mode could be tied to the “Turbo Points” campaign that started on April 23, which benefits users looking to be eligible for airdrops of Mode and Renzo native tokens.

Users that restake Ether (ETH) on Renzo using Mode got double Mode points, criteria considered for airdrop eligibility, on top of the usual amount. Moreover, the campaign also includes other decentralized applications (dApps), which explains the growth in TVL on other platforms, such as Kim Exchange.

The Turbo Points campaign multiplies by three times Renzo’s points and by four times Mode points for users who provide liquidity in ezETH/WETH pools on Kim Exchange. As a result, Kim has shown the most significant growth in TVL for the past seven days at almost 30%.

Lending protocol Ionic also showed significant growth in value locked, with a 5.3% jump in the past week and 26% over the past month. Ionic is also included in the Turbo Points campaign, giving two times more Renzo and Mode points to users offering ezETH as collateral for loans.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

17

7 months ago

17