ARTICLE AD

Smart money increases stablecoin holdings, anticipates new investments.

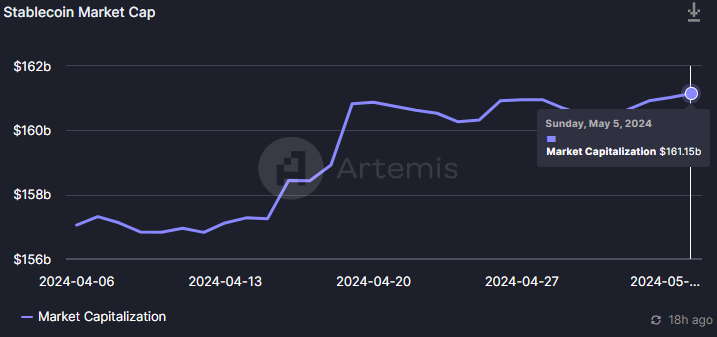

Despite the recent corrections in crypto prices, over $4 billion in stablecoins entered the market in the last 30 days, according to data aggregator Artemis. Bitcoin (BTC) closed April nearing a 15% pullback and fell below the $57,000 price level but this didn’t keep investors away.

The total market cap of stablecoins jumped from $157 billion to over $161 billion at the time of writing, a 2.5% monthly growth.

Image: Artemis

Image: ArtemisNew stablecoin inflows are a commonly used metric by analysts to measure the market’s liquidity. Since most cryptos are traded against stablecoin pairs on centralized exchanges, and even more so in decentralized platforms, the growth in the market cap of these tokens is seen as a positive movement.

Rotating capital

Moreover, investors labeled as “smart money” seemed to realize profits last week and are ready to rotate their stablecoins into new tokens. According to on-chain data firm Nansen, these traders’ “stablecoins holdings” jumped from 5.54% to 8.63% between April 28 and 30.

However, after reaching 8.69% on May 1, it started going down again and is at 6.82% at the time of writing. This movement of diminishing stablecoin holdings while the crypto market receives more liquidity suggests that smarter traders are betting on their next tokens.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

6 months ago

39

6 months ago

39