ARTICLE AD

In its recent analysis, market intelligence firm Messari has provided a comprehensive overview of the NEAR Protocol’s performance in Q4 2024. Despite facing headwinds in the broader crypto market, NEAR has demonstrated notable resilience through increased activity and strategic developments.

Drop In Market Cap Ranking But Resilience Through Increased Activity

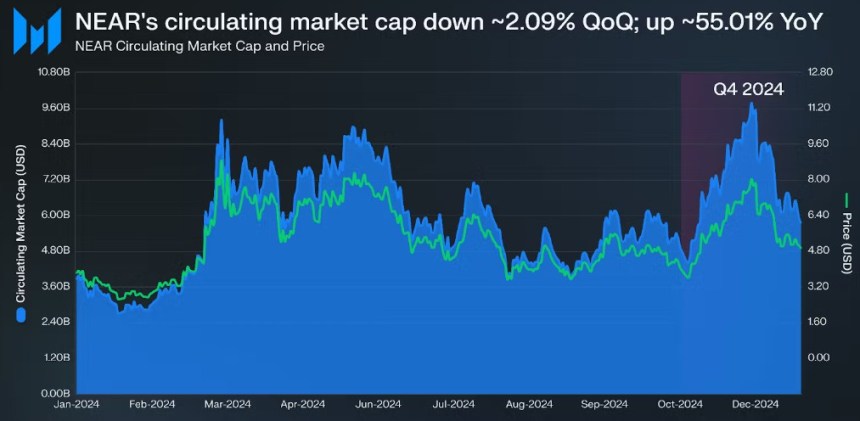

During Q4, NEAR Protocol initially surged, reaching a token price high of approximately $8.19 in December before retracing to around $4.91 by the quarter’s end.

This decline reflected a significant drop in market cap, which fell to approximately $5.73 billion—marking a 2.09% decrease quarter-over-quarter (QoQ).

Consequently, NEAR dropped ten spots in market cap rankings, now sitting at 21st overall, indicating a performance lag compared to other leading assets.

NEAR’s circulating market cap decline over the past year. Source: Messari

NEAR’s circulating market cap decline over the past year. Source: Messari

Despite the challenges in market pricing, NEAR’s revenue, derived from network transaction fees, saw a substantial increase. The revenue grew to about $2.11 million, representing a 26.81% QoQ rise. This growth can be attributed to heightened transaction volumes and decentralized exchange (DEX) activity.

The average transaction fee during the quarter was roughly $0.0031, a 15.91% increase from the previous quarter, further highlighting the network’s operational efficiency.

The NEAR token plays a multifaceted role within the ecosystem, being essential for staking, transaction fees, and storage fees. The protocol maintains a flexible supply model, characterized by an annual inflation rate of 5%.

Of the inflationary rewards, 90% are allocated to validators, while the remaining 10% supports the protocol’s treasury. As of the end of Q4, approximately 95.12% of NEAR’s total supply was in circulation, with about 49.08% actively staked.

The annualized nominal yield from staking was reported at around 8.95%, with a real yield of 4.55%, providing attractive incentives for holders to stake their tokens.

NEAR enjoyed a surge in address activity and transaction volume during Q4. The average daily active returning addresses rose by 15.82% QoQ, reaching 3.55 million, while the average daily new addresses surged by 29.05% to 361,046.

However, the protocol faced a decline in developer activity, with weekly active core developers decreasing by 13.95% to 159 and ecosystem developers falling by 30.34% to 129.

NEAR Balances Market Setbacks With Promising Innovations

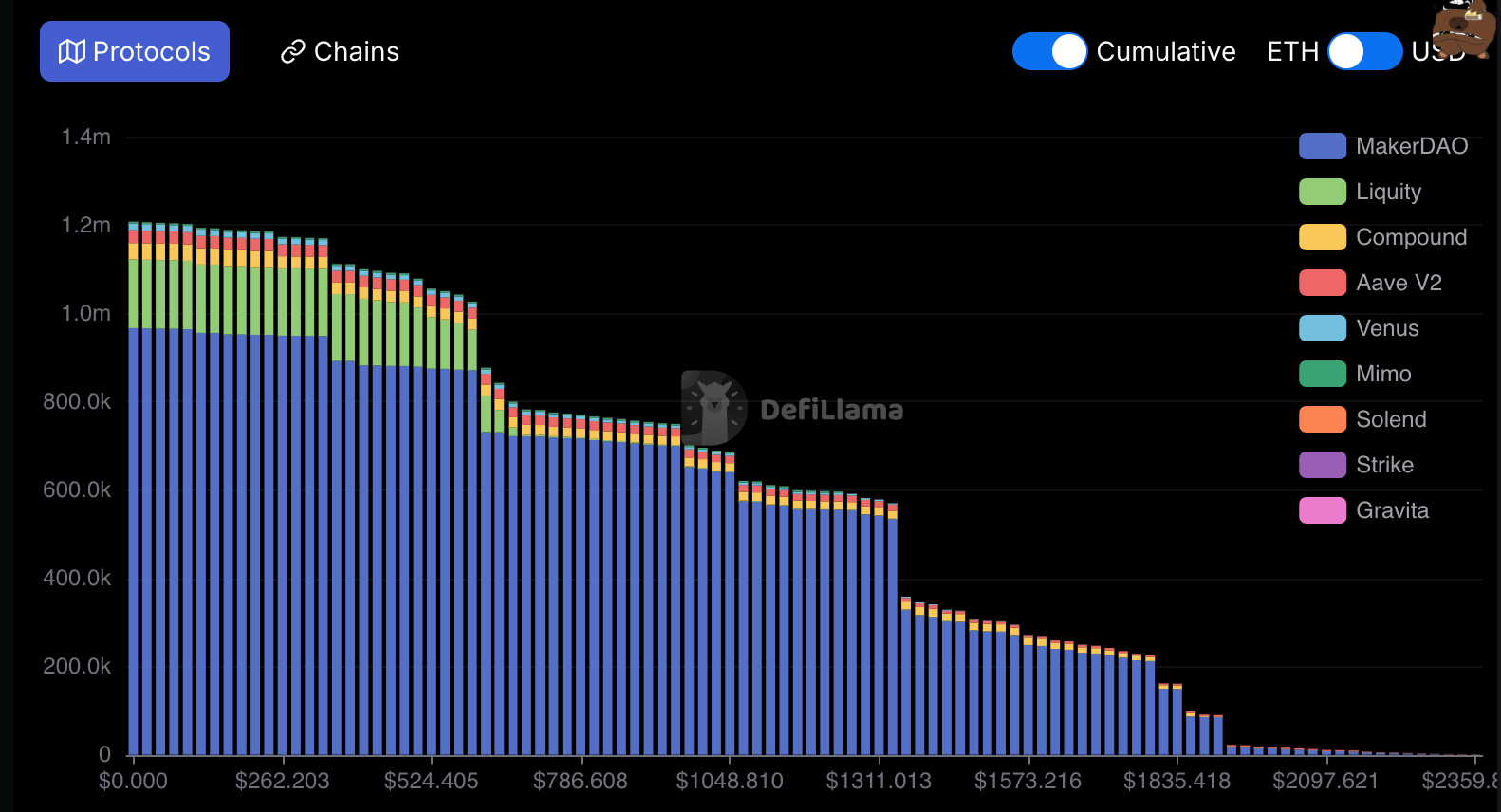

NEAR’s DeFi total value locked (TVL) concluded Q4 at approximately $240.16 million, reflecting a 4.48% decline from the previous quarter. The Liquid Staking TVL also experienced a decrease of around 10.32% QoQ, settling at about $250.81 million.

Notably, the LiNEAR Protocol’s TVL was approximately $132.41 million, down 8.77%, while Meta Pool’s TVL declined by 11.78% to around $111.70 million.

NEAR’s DeFi TVL during 2024. Source: Messari

NEAR’s DeFi TVL during 2024. Source: Messari

On a positive note, NEAR’s average daily DEX volume reached approximately $8.45 million, marking a 25.40% increase from the previous quarter. Ref Finance emerged as the leading DEX on the platform, accounting for an average daily volume of $8.35 million.

Q4 also saw an uptick in NEAR’s stablecoin market cap, which grew to about $683.69 million—an increase of 1.88% QoQ and a staggering 880.71% year-over-year (YoY).

As of now, the NEAR’s price stands at $3.52, recording a substantial 10% surge in the past two weeks. Yet, still 82% below its all-time record high.

Featured image from DALL-E, chart from TradingView.com

3 hours ago

3

3 hours ago

3