ARTICLE AD

Europe is suffering from a big hangover after the tech investment party of the 2020-2021 period. That said, compared to pre-pandemic levels, VC investment in European startups is up, historically speaking, and reached $60 billion, according to a new report. However, the anomaly of the surge in investment over the pandemic stands in marked contrast to that growth and has created significant headwinds, even though there are signs of ‘green shoots’.

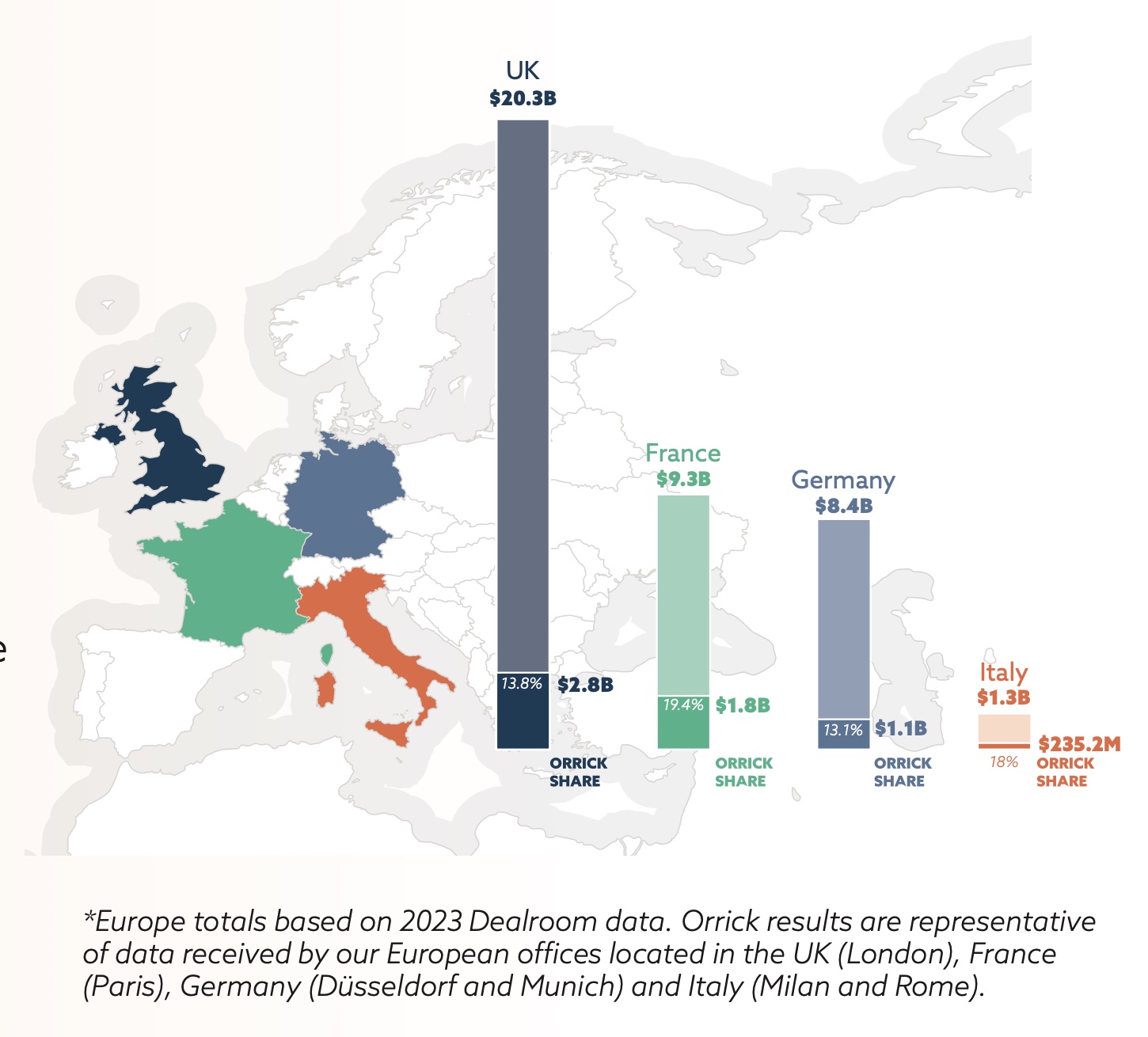

Global law firm Orrick analyzed over 350 VC and growth equity investments its clients completed in Europe last year.

The Total capital raised in Europe was $61.8 billion. 2023 marked a reset and major correction in investment levels globally. Of the top 3 global regions for VC – Europe, Asia, and North America – Europe is the only one to exceed 2019 levels in 2023.

According to the report, Europe is sitting on “record levels of dry powder” and “producing more new founders than the U.S.”, funding remains slow.

Only 11 new unicorns emerged from Europe last year, the fewest in a decade, and a growing number of unicorns lost their status.

Climate Tech overtook FinTech as Europe’s most popular sector

AI’s share of total investment in Europe soared to a record high of 17%5.

Orrick found that investors — emboldened by the downturn in funding — are ‘turning the screws’, exercising greater control over investments, with founders being required to stand behind warranties in 39% of venture deals.

There was a clear drop in later-stage financings, deal volume dropped, and founders have been thrown towards other strategies such as alternative financing methods, or racing towards revenues and profits.

There was an “unprecedented spike” in the ability of new investors to enter tech, as founders looked for new lead investors, and an “uptick” in convertible debt, SAFEs, and ASAs, with convertible financings representing 23% of rounds in 2023.

Investors generally focused on managing their existing portfolios, secondary transactions increased, and SaaS and AI continued to be popular. Interestingly, the number of FinTech investments declined.

European 2023 tech investment deals (Orrick)

At each stage, deal value is down, with the most dramatic fall in later-stage deals.

Early-stage deal value dropped by 40%, even though early-stage investors are still the most active.

There was a decline in ‘mega-rounds’ exceeding $100M+. However, the IPO landscape showed “signs of life” with ARM’s $55 billion IPO, and M&A activity showed “green shoots.”

In the UK, VCs are under pressure to deliver returns, which is likely to lead to increased demand for secondaries, greater M&A activity and consolidation.

In France there’s been a shift from ‘founder-friendly’ terms towards more investor-friendly terms, in marked contrast to the Uk, where the opposite is true.

In Germany, a growing demand from LPs for liquidity is expected to “energize the tech M&A pipeline.”

8 months ago

34

8 months ago

34