ARTICLE AD

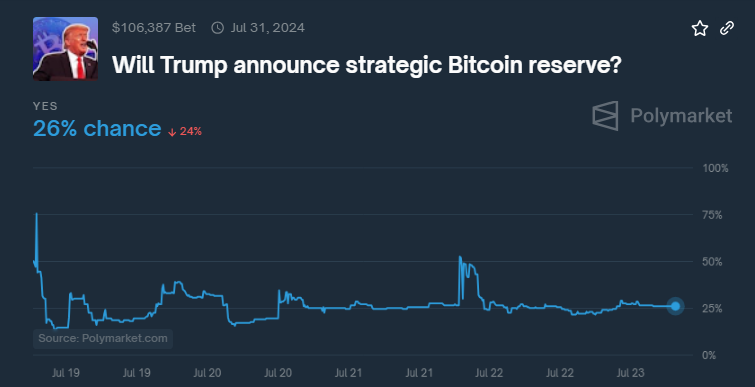

Polymarket bookmakers report that the chances of Former President Donald Trump declaring a US Bitcoin strategic reserve have dropped.

At first, speculations abound that Trump would reveal a daring strategy to include Bitcoin into the US strategic reserves during the Bitcoin 2024 conference this week.

The betting odds presently, however, point just to a 26% possibility of such a declaration by July 28. Reflecting a major change in market mood, this stands a sharp contrast to the 76% likelihood originally attributed to the concept.

There are other reasons for the abrupt loss of trust, including the current political events. The news of President Joe Biden’s withdrawal from the presidential contest could have taken focus away from the speculating on Bitcoin reserve. The community of cryptocurrencies and financial experts are adjusting their expectations as the thrill fades.

The Thrill Has Faded?

Starting with a tweet from Dennis Porter, co-founder of the Satoshi Act, the hype over Trump’s possible Bitcoin reserve announcement had realistic intentions to designate Bitcoin as a strategic national currency reserve, which fueled hope among investors and Bitcoin aficionados.

Though at once intense, the speculative flame has faded. Including Bitcoin into national reserves presents several difficulties, including administrative complexity and legal obstacles.

Should such a scheme be carried out, the present Bitcoin holdings of the US Department of Justice—about 200,000 units—would have to be transferred to the Department of Treasury. This approach by itself offers major political and administrative challenges.

Trump: The Strategic Reserve Dilemma

Including Bitcoin among the US strategic reserves might provide a special diversification of the asset portfolio of the nation. Such a move, according to analysts like Markus Thielen, CEO of 10x Research, might lessen reliance on conventional assets include gold and foreign currencies.

The possible advantages are obvious since the US owns around $15 billion in Bitcoin against its $600 billion gold holdings.

Still, there are really significant practical difficulties. DAIM CEO and founder Brian Korshain notes that although the idea of a Bitcoin strategic reserve is “feasible,” its implementation is rife with challenges.

Moving from DOJ-held Bitcoin to the Treasury would need overcoming major procedural and regulatory obstacles. Including Bitcoin into the reserve system would also force a basic change in American management and view of its national resources.

All eyes will be on Trump and his possible remarks on Bitcoin and the larger crypto market as Bitcoin 2024 plays out. The sharp decline in betting odds for now points to a possible fantasy more than reality around a US digital asset reserve. Both aficionados and investors will have to be tuned for more changes in the crypto terrain.

Featured image from Pexels, chart from TradingView

4 months ago

17

4 months ago

17