ARTICLE AD

Oil-producing states in Nigeria have received a total of N2.85tn in 13 per cent derivation revenue between 2022 and 2024, according to findings by The PUNCH.

The findings are based on analysis of data from each state’s budget implementation reports for the period under review.

The eight states that benefitted from the 13 per cent derivation revenue are Akwa Ibom, Bayelsa, Delta, Edo, Ondo, Rivers, Imo, and Abia.

Despite the increase in derivation revenue, The PUNCH observed that the states’ domestic debt burden remains at N1.34tn as of the third quarter of 2024, according to the latest data from the Debt Management Office.

The revenue, designed to compensate these states for oil exploration’s environmental and economic impact, has continued to rise, but questions linger over the management of these funds in the face of mounting liabilities.

The 13 per cent derivation fund is a constitutional provision ensuring that states producing crude oil receive additional allocations from the Federation Account.

The principle is meant to address the effects of oil extraction, foster local development, and reduce infrastructural deficits in these regions.

Nigeria’s crude oil production recorded a significant increase in 2024. Data obtained from the Nigerian Upstream Petroleum Regulatory Commission, an agency of the Federal Government, confirmed that Nigeria produced a total of 408,680,457 barrels of crude oil in 2024.

According to the NUPRC data, the country’s daily average crude production was 1.484 million barrels per day in December. This is below the Organisation of the Petroleum Exporting Countries’ quota allocated to Nigeria.

It was observed that the daily average production dropped from 1.485mbpd in November to 1.484mbpd in December. This is coming at a time when the country is making efforts to ramp up crude production to 2mbpd in the next year.

In 2024, the daily average production was unstable throughout the year. In January, crude production was 1.42mbpd. It dropped to 1.32mbpd in February and dipped further in March to 1.23mbpd.

The production was 1.28mpd, 1.25mpd and 1.27mpd in April, May and June respectively. From July, there was an upward swing as crude output returned to 1.30mbpd. The output was 1.35mbpd in August, 1.32mpd in September, and 1.33mbpd in October.

There was a significant improvement in November and December as the production rose to 1.48mbpd.

The PUNCH reports that there was no time the country met its OPEC quota in the entire 2024. However, the general increase in production in 2024 comes as the Federal Government intensifies efforts to combat oil theft and pipeline vandalism, which have long hindered the country’s ability to meet its production targets.

Security measures have been strengthened in the Niger Delta region, with the deployment of armed drones, attack helicopters, and enhanced intelligence operations to protect oil facilities.

These interventions have contributed to a more stable production environment, leading to increased output. The surge in oil production has direct implications for the 13 per cent derivation fund allocated to oil-producing states.

As production levels rise, the revenue generated from oil sales increases, leading to higher allocations for these states.

This revenue, meant to compensate for environmental degradation and fund development projects in oil-producing regions, has seen a corresponding increase in line with the country’s improved production figures.

However, despite the increase in allocations, concerns persist over how effectively these funds are managed. While the additional revenue provides an opportunity for infrastructural development and improved public services, the rising debt burden in some of the oil-producing states raises questions about fiscal prudence.

Many of these states continue to grapple with rising debt, suggesting a disconnect between revenue generation and financial sustainability. An analysis of the funds received over the last three years reveals that Delta State emerged as the highest recipient, receiving N1.14tn in total.

The state’s derivation revenue stood at N296.63bn in 2022, increased to N331.45bn in 2023, and jumped significantly to N515.09bn in 2024. Akwa Ibom followed with N659.21bn over the period, receiving N237.57bn in 2022, N229.76bn in 2023, and N191.88bn in 2024.

Rivers State secured N438.63bn in total, with N169.79bn in 2022, N137.48bn in 2023, and N131.36bn in 2024. Bayelsa State received N327.42bn, Imo got N79.87bn, while Edo received N87.52bn. Ondo’s total derivation revenue stood at N73.66bn, Abia received N17.32bn, and Anambra got N18.41bn.

The distribution of the funds over the three years shows fluctuations in earnings, with some states witnessing increases while others recorded declines.

Delta State saw a remarkable increase of 55.4 per cent in its derivation revenue from 2023 to 2024, marking it as the biggest gainer. In contrast, Akwa Ibom experienced a decline of 19.8 per cent in earnings between 2022 and 2024.

Rivers State, another major oil-producing state, recorded a consistent reduction in revenue over the three-year period, reflecting a 22.6 per cent drop. While these states have benefitted from significant revenue inflows, their financial obligations have remained a cause for concern.

The DMO’s latest report indicates that the total domestic debt of oil-producing states stood at N1.34tn as of Q3 2024, a slight decline from N1.45tn in Q3 2022. Rivers and Delta states, however, bucked the trend, recording notable increases in their debt stock despite rising derivation revenue.

Rivers State, in particular, witnessed an alarming surge in its debt profile, climbing from N225.51bn in Q3 2022 to N389.20bn in Q3 2024, reflecting a sharp increase of N163.69bn.

Delta’s debt also rose from N272.61bn in Q3 2022 to N342.53bn in Q3 2024, representing an increment of N69.92bn. This upward trajectory in debt accumulation, despite the substantial revenue inflows, raises concerns about the fiscal policies governing these states.

Akwa Ibom, which ranked as the second-largest recipient of derivation revenue over the three-year period, saw a notable reduction in its debt stock. The state’s domestic debt fell from N219.62bn in Q3 2022 to N126.00bn in Q3 2024, reflecting a reduction of N93.62bn.

Imo also reduced its debt burden from N207.52bn in Q3 2022 to N155.38bn in Q3 2024, marking a decline of N52.14bn. Bayelsa, another oil-producing state, recorded a drop in its debt profile from N151.16bn to N93.37bn over the same period, showing a decrease of N57.79bn.

Edo State’s debt stood at N95.81bn as of Q3 2024, down from N110.99bn in Q3 2022, reflecting a reduction of N15.19bn. Ondo also witnessed a significant decline, with its debt falling from N78.82bn to N13.99bn, translating to a decrease of N64.84bn.

Abia’s debt dropped from N104.57bn to N89.35bn, a decline of N15.22bn, while Anambra recorded a decline from N75.70bn to N30.36bn, showing a reduction of N45.33bn.

Despite the overall drop in domestic debt across the states, the growing liabilities of Rivers and Delta remain an issue. Rivers recorded a 72.6 per cent rise in debt within two years, while Delta saw a 25.7 per cent increase.

These figures indicate that while some states are actively managing their debt profiles, others continue to accumulate obligations despite significant revenue inflows.

The disparity between revenue inflows and debt accumulation raises several critical concerns. While derivation revenue has continued to flow into state coffers, many states still struggle with infrastructural deficits, underdeveloped social amenities, and poor public service delivery.

Transparency and accountability in public finance management remain key issues that require urgent attention. One notable trend in the data is the contrasting fiscal approach of different states. Akwa Ibom, Imo, Bayelsa, Edo, Ondo, Abia, and Anambra all recorded reductions in their debt burdens, suggesting efforts to either repay existing debts or adopt more conservative borrowing policies.

However, Rivers and Delta, despite being top revenue earners, have continued to expand their borrowing, raising concerns about their long-term financial sustainability. Delta State remains the biggest beneficiary of the derivation fund, accounting for approximately 40 per cent of the total allocations to oil-producing states over the last three years.

This figure affirms the state’s significance in Nigeria’s oil production landscape. Akwa Ibom and Rivers also received substantial amounts, with their combined derivation revenue exceeding N1.1tn. Bayelsa, Imo, and Edo, while receiving lower allocations, still secured significant inflows.

CSOs speak

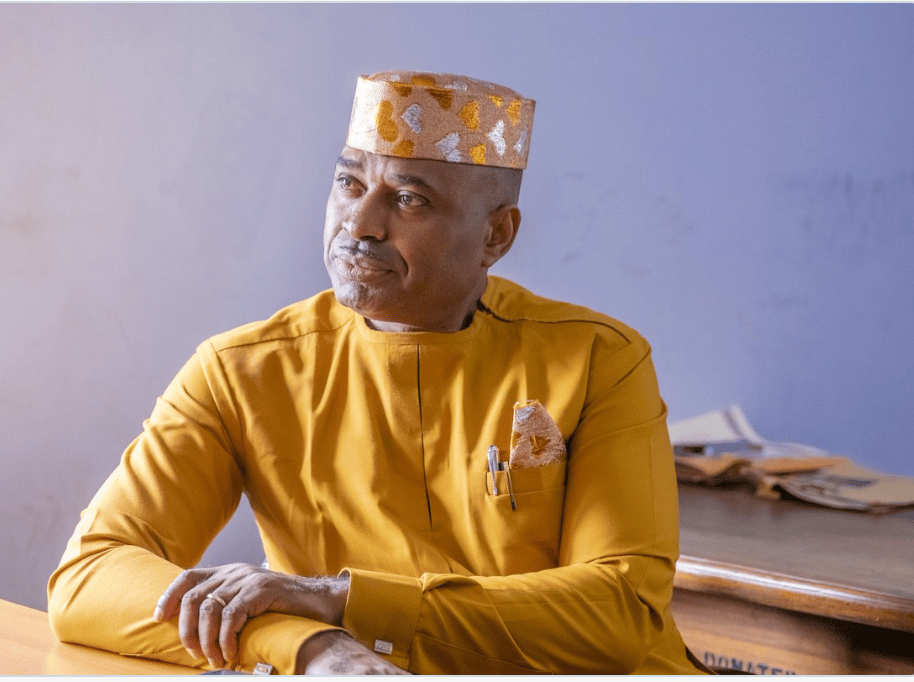

The Chairman of the Civil Societies Legislative Advocacy Centre, Auwal Musa Rafsanjani, said the inability of the states to justify the allocation received from the Federal Government, raised concern among civil society groups, adding that it was also a pointer to the challenge of accountability and transparency by the sub-national governments.

“If you look at how much Rivers State, how much Akwa Ibom, Bayelsa, Delta and Cross River collect, at least the living conditions in those states should improve dramatically, especially in terms of healthcare, education, and economic development. But sadly, you cannot find visible, tangible, developmental projects that can match the revenue or rather the income they collect.

“So, this raises concern for many civil society organisations working on budget monitoring, good governance, and anti-corruption. Ideally, you would have expected that each state should have state-owned or even public-private partnership companies that are yielding revenue to the states. But you do not see those things,” he said.

On his part, the National Coordinator of the Human Rights Writers Association of Nigeria, Emmanuel Onwubiko, argued that some of the states made efforts to ensure infrastructure developments, noting however that the law should take “full course” against states that had not executed projects to justify the monies they have received.

“Whatever allocations have been given to the states, if there is no commensurate development, if the governor, commissioners and the rest of them, cannot give adequate justification for the budgetary releases we have made to their respective ministries, there are sufficient legal mechanisms for tracing such disappearances if funds are provided for the construction of certain developmental projects and building of infrastructure in those oil-producing states that have not been executed,” he said.

2 hours ago

1

2 hours ago

1