ARTICLE AD

The slump might not be related to the perceived value of the token but to an accumulation movement directed at other assets.

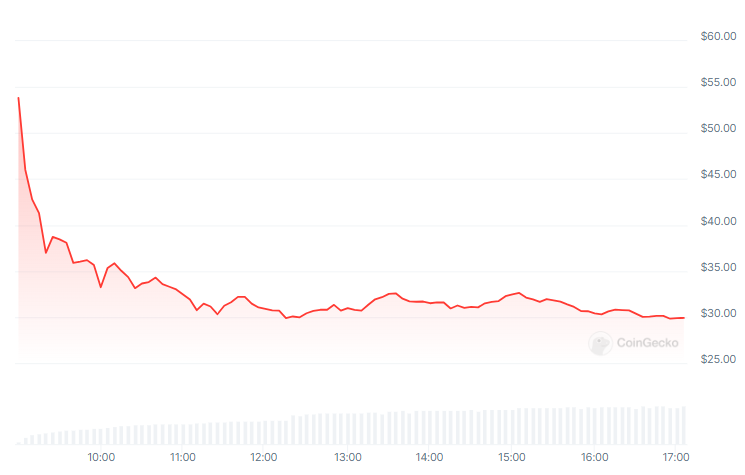

Rollup interoperability infrastructure Omni Network launched its native OMNI token today, and its price crashed 44% at the time of writing, according to data aggregator CoinGecko. Now sitting at $30.03, the OMNI exhibits a fully diluted valuation of over $3 billion and a $318 million market cap. In the last 24 hours, the trading volume for OMNI reached almost $447 million.

OMNI’s price in the last eight hours. Image: CoinGecko

OMNI’s price in the last eight hours. Image: CoinGeckoHowever, the crash might not be tied to the perceived value of the token, instead following the movements of the crypto market as a whole. As Bitcoin (BTC) tumbled over 12% in the last seven days, losing its $60,000 price level briefly today on some centralized exchanges, other tokens followed its pullback. Therefore, major crypto on the market offers new buying opportunities that investors are quick to seize.

As an airdropped token, investors see OMNI as new liquidity through selling and rotating the capital into those major coins. The same fate fell on PRCL, the airdropped token for real-world asset-based derivatives exchange Parcl, which bottomed today at $0.4658 after falling 25%.

Although not guaranteed, those tokens may see a recovery within the next few days, after the market finishes its accumulation movement on other tokens. The trader identified as Rekt Capital shared on X that a pre-halving retracement is on course and that it can be identified in previous halving cycles. The next phase is an accumulation period, followed by a parabolic uptrend started by Bitcoin.

3 Phases of The Bitcoin Halving

1. Final Pre-Halving Retrace

Bitcoin has produced two -18% retraces prior to the Halving in the span of just over a month

In mid-March, BTC pulled back -18% before recovering to $70000 and now in mid-April BTC has retraced -18% again

This… pic.twitter.com/2BKBQXpPOV

— Rekt Capital (@rektcapital) April 17, 2024

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

39

7 months ago

39