ARTICLE AD

Teachers’ Venture Growth, the late-stage venture and growth investment arm of Ontario Teachers’ Pension Plan, is investing $80 million in Perfios, an Indian fintech that provides real-time credit underwriting solutions to banks and other financial institutions. The new investment values Perfios at a valuation of over $1 billion.

15-year-old Perfios, which raised a $229 million funding round in September, said it will use the fresh capital for international expansion and to explore inorganic growth opportunities (read acquisitions.) The startup, which has raised $464 million in primary and secondary transactions to date, plans to go public by next year, it said earlier.

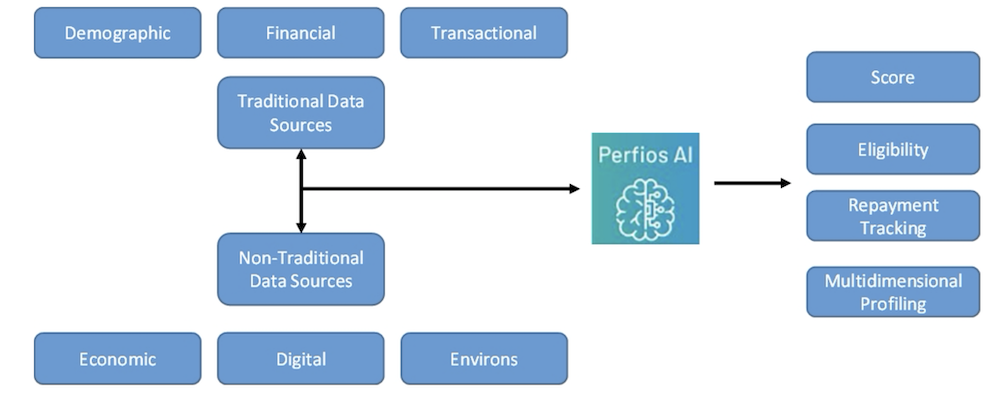

Bengaluru-based Perfios users AI to help businesses automate loan decisions and assess customer creditworthiness. Its system is designed to adapt and learn autonomously, enabling it to forecast trends even in new markets. The digital scoring feature provides overall scores, detailed breakdowns, and various metrics to evaluate credit risk for a range of financial products.

The platform adapts and learns on its own, and can forecast trends in new markets or areas. With its digital scoring, Perfios AI gives overall scores, detailed breakdowns and features to evaluate credit risk efficiently, Bernstein analysts said in a note.

Perfios’ credit decisioning tools. Image Credits: AllianceBernstein

Perfios said delivers 8.2 billion data points to banks and other financial institutions every year to facilitate faster decisioning, and processes 1.7 billion transactions a year with an AUM of $36 billion. Perfios is the second unicorn from India this year.

“We are excited about the growing opportunities within the B2B enterprise tech space in India, and we believe Perfios is a best-in-class fintech-focused SaaS player,” said Kelvin Yu, Senior Managing Director and Head of Teachers’ Venture Growth in Asia, in a statement.

Ontario Teachers’ Pension Plan, one of Canada’s largest pension funds, has ramped up its interest in India in recent years. The fund, which also backed logistics unicorn Xpressbees last year, has invested more than $3 billion in India and plans to deploy a significant amount in the country by 2030 as part of its broader goal to deploy $300 billion in certain key markets.

9 months ago

62

9 months ago

62