ARTICLE AD

In enterprise software-as-a-service (SaaS), usage-based pricing, a pricing model in which customers are charged only when they use a product or service, is gaining ground. According to a report from VC firm OpenView, ~60% of SaaS businesses offer some form of usage-based pricing today. Recently, Apigee, Google Cloud’s API management platform, made the shift, as did vertical software giant Autodesk.

But while usage-based pricing has its advantages, it can be tougher to keep tabs on from a billing perspective. Often, companies paying for usage-based-priced products struggle to figure out what to bill their own customers for said products.

“This is a new challenge for engineers, as they need to build a real-time infrastructure to put cost control in place and integrate usage data with product and revenue teams,” Peter Marton, co-founder and CEO of OpenMeter, told TechCrunch in an interview. “Real-time data is a challenge from the consumer side, too. A tight feedback loop between customers interacting with usage-based products and the consumption reflected on their billing and usage dashboards is essential for controlling spending.”

Marton experienced issues with “metering,” as he calls it, firsthand while working at Stripe as a staff software engineer. There, he ran into blockers collecting usage-based pricing data from different providers and infrastructure and aggregating and analyzing this usage together.

In search of a solution, Marton teamed up with András Tóth, an ex-Cisco software engineer and Marton’s former colleague at RisingStack, a software dev firm, to launch OpenMeter, which meters customer usage of apps.

As Marton explains, OpenMeter — built on Apache Kafka, an open source toolkit for handling real-time data feeds — processes “usage events” across a company’s tech stack. It then turns the events into human-readable consumption metrics, which it funnels to billing and finance dashboards as well as customer relationship management databases for product and revenue teams to review.

OpenMeter can also enforce usage and rate limits. And it can execute usage-based or hybrid pricing, allowing companies to more transparently bill (at least in theory) their customers.

“OpenMeter is … built for engineers, and offers a composable architecture to process real-time usage data and control cost,” Marton said. “Enterprise companies choose OpenMeter for its composability. It’s hard to replace decades of monetization infrastructure at once, so we built a solution that engineering teams can incrementally adopt.”

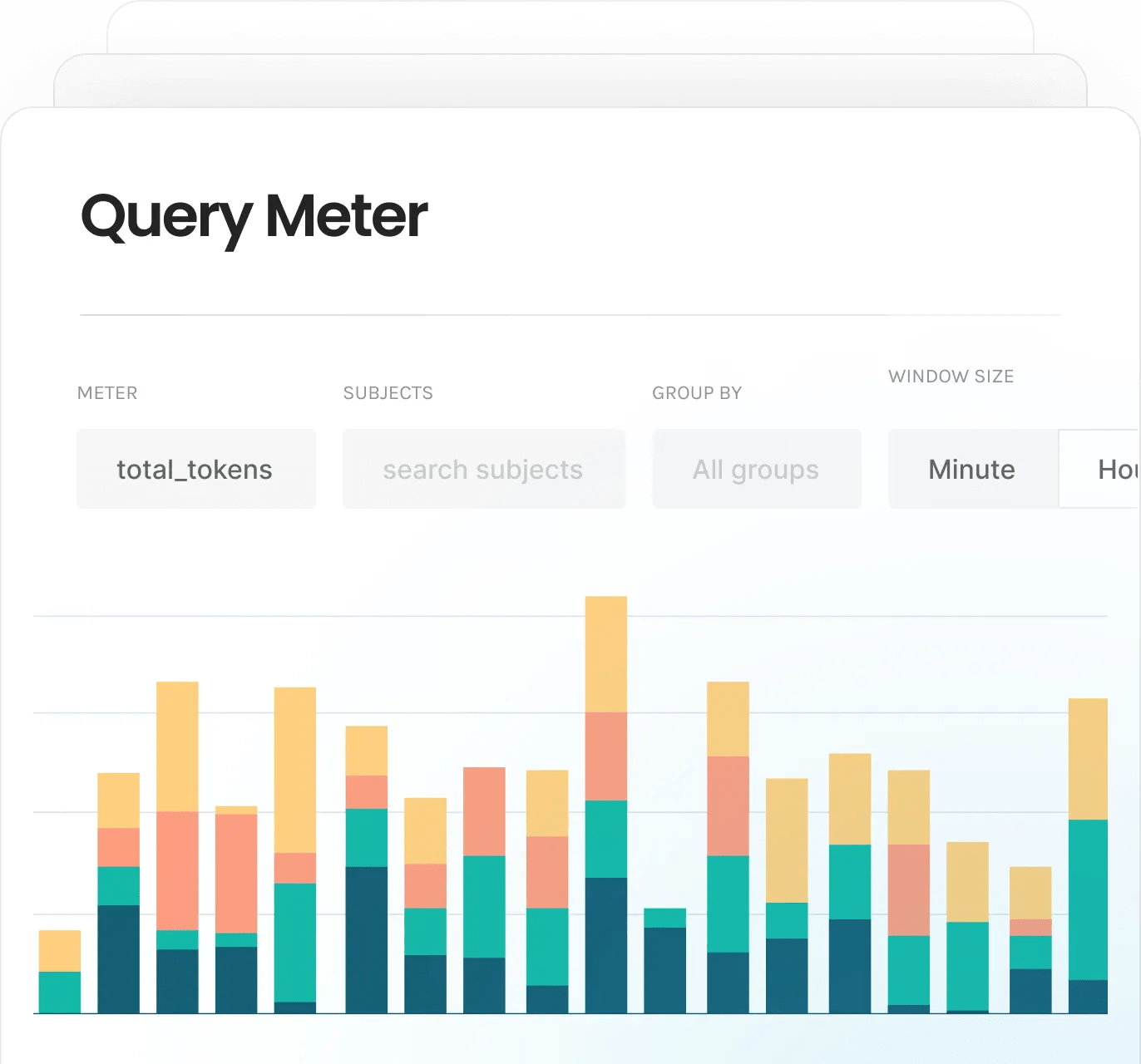

One of OpenMeter’s tracking dashboards.

Now, OpenMeter isn’t the only game in town when it comes to vendors addressing metering dilemmas.

There’s Metronome, which recently raised $43 million for its software that helps companies offer usage-based billing, and Amberflo, which is building tool sets to transform SaaS pricing with metered usage. Elsewhere, M3ter furnishes SaaS businesses with usage-based pricing solutions.

So what sets OpenMeter apart? Well, for one, it’s open source. OpenMeter’s software is freely available to use, with paid options for enterprises who prefer managed plans.

Marton implies that it’s also cheaper than the competition — though he acknowledges that exact pricing is still be worked out.

“Competitors in the usage-based space only cater to the revenue teams with a closed-source, billing-first approach,” he said. “OpenMeter focuses on the new generation of AI companies.”

In any case, OpenMeter has managed to achieve a measure of early success, raking in $3 million from Y Combinator (which incubated it), Haystack and Sunflower Capital. Marton says that the company, which has four employees at present based out of its San Francisco office, has “multiple” market-leader AI companies as customers — but wasn’t willing to share their names.

“The economic downturn prompted companies to have tighter control around spending, necessitating understanding per-user cost and enforcing usage quotas, while revenue teams need to find actionable insights in usage data to find new revenue streams,” Marton said. “It’s a tailwind for OpenMeter.”

8 months ago

60

8 months ago

60