ARTICLE AD

Social media apps can rise quickly and burn out just as fast, but taking a step back and looking at those trends on a longer timeline offers a better glimpse at the big picture.

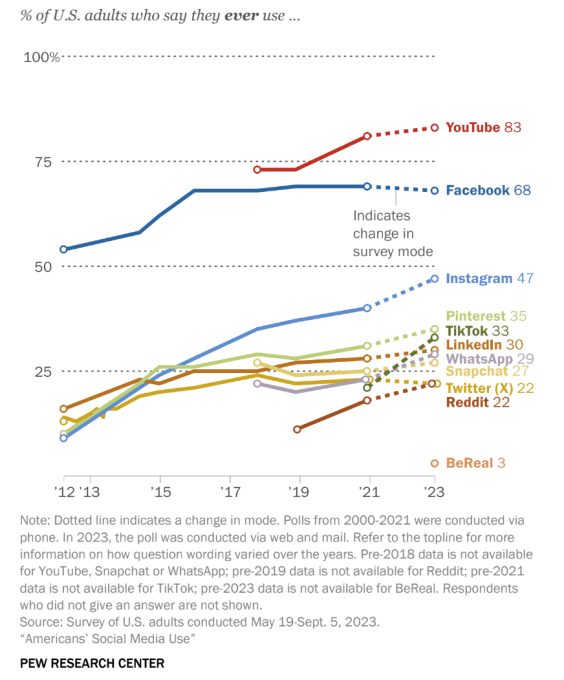

The Pew Research Center’s latest report on Americans’ social media habits is out, rounding up social media usage trends among U.S. users over the last two years. While there may be a few small tweaks with each survey, Pew mostly asks the same questions every couple of years, making it possible to track meaningful changes over time.

This year’s report surveyed 5,733 U.S. adults, capturing the data from May to September 2023. Most of the findings are intuitive, showing the slow migrations between social platforms, but there are a few interesting moments in the survey worth highlighting.

“I think one of the really interesting things that we saw this year is the amount of stability that we saw on many of the platforms that we’re studying,” Pew Research Center Associate Director of Research Jeff Gottfried told TechCrunch.

While many social media stalwarts mostly hovered near their previous numbers from 2021 — including X, formerly Twitter, surprisingly — TikTok saw relatively explosive growth over the two year timeframe. In 2021, 21% of adults said they “ever use” TikTok, but by last year that proportion was up to 33%. TikTok’s growth among U.S. users didn’t appear to stop Instagram from picking up more adoption as well, and the Meta-owned app went from 40% to 47% in the same time frame.

Image Credits: Pew Research Center

“Something that we really do see especially with TikTok and a couple of the other sites is just how prominent it is among certain [groups] in the population,” Gottfried said.

Two platforms that didn’t see much change over the last two years were YouTube and Facebook — the two most dominant social apps captured by Pew’s survey data. In 2023, 83% of respondents reported ever using YouTube, while 68% said they use Facebook. The latter number is robust considering popular perception that Facebook’s star is falling, but within the constraints of this particular study that doesn’t appear to be the case.

“A majority of all age groups are using those two platforms, something that really stood out in our data as well,” Gottfried said.

The data revealed some intuitive but still noteworthy age gaps for social app usage. While only 15% of people 65 and older use Instagram, that number is 78% for 18 to 29-year-olds. Snap and TikTok showed similar age divides, though a notable 10% of adults 65 and up reported using TikTok. In the survey, 40% of women overall said they use the platform compared to 25% of men.

Pew also collected some demographic information on race, allowing the survey to get a bit more granular on how different communities engage with social apps. A few differences emerged, including that nearly 60% of Hispanic and Asian adults said they use Instagram compared to only 46% of Black adults and 43% of white adults. Hispanic adults had the highest rates of TikTok usage (49%) compared to Black adults (39%), Asian (29%) and white adults (28%).

Pew’s numbers are interesting, but its straightforward approach doesn’t offer much in the way of insight for why these numbers are what they are. The race and gender differences in particular would lend themselves to deeper research.

While the 2021 Pew survey measured Nextdoor usage along with a slate of more traditional social media apps, the 2023 version swapped in BeReal instead (only 3% of Americans surveyed said they ever use it). The app’s inclusion was exploratory, according to Gottfried, and we’ll be curious to see what makes the cut in 2025 — maybe Threads or something we haven’t even heard of yet.

“It was just one of those ones that was starting to really [become] part of the conversation and we wanted to make sure we started to get a baseline measurement,” Gottfried said.

9 months ago

28

9 months ago

28