ARTICLE AD

Bitcoin halving and prospect of ETF approvals position crypto for gains in Q2.

The crypto market is holding steady despite recent liquidity issues stemming from US holidays and corporate rebalancing at month’s and quarter’s end, according to a Coinbase report. Speculation around the Bitcoin halving and potential spot Bitcoin exchange-traded funds (ETF) approvals in the US may support performance in the second quarter.

“Moreover, we think speculators playing the short MicroStrategy (MSTR) vs long Bitcoin trade may be contributing to some of the recent market volatility,” the report says.

The report also suggests headwinds from earlier this month are fading, and positive catalysts likely won’t materialize until mid-April. The upcoming Bitcoin halving, estimated to occur between April 16-20, is seen as a key event.

“But on the demand side, the 90-day review period that many wirehouses employ when conducting due diligence on new financial offerings – like spot Bitcoin ETFs – could conclude as early as April 10,” the report said.

Wealth management platforms both within and outside major financial conglomerates are gatekeepers to significant capital that could flow into US spot bitcoin ETFs over the medium term, it added.

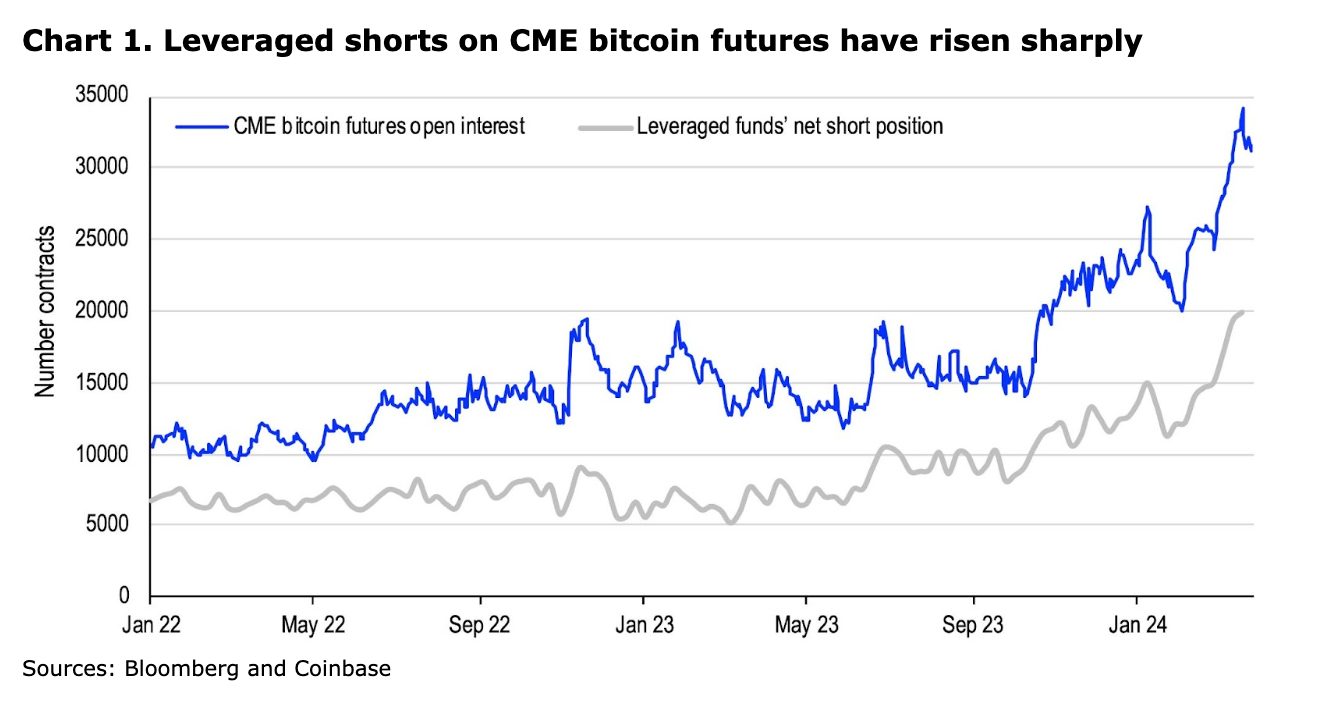

Institutional interest also appears elevated based on a record high of 19,917 leveraged short positions in CME Bitcoin futures as of Mar. 19, suggesting ongoing basis trading activity.

On-chain derivatives on the rise

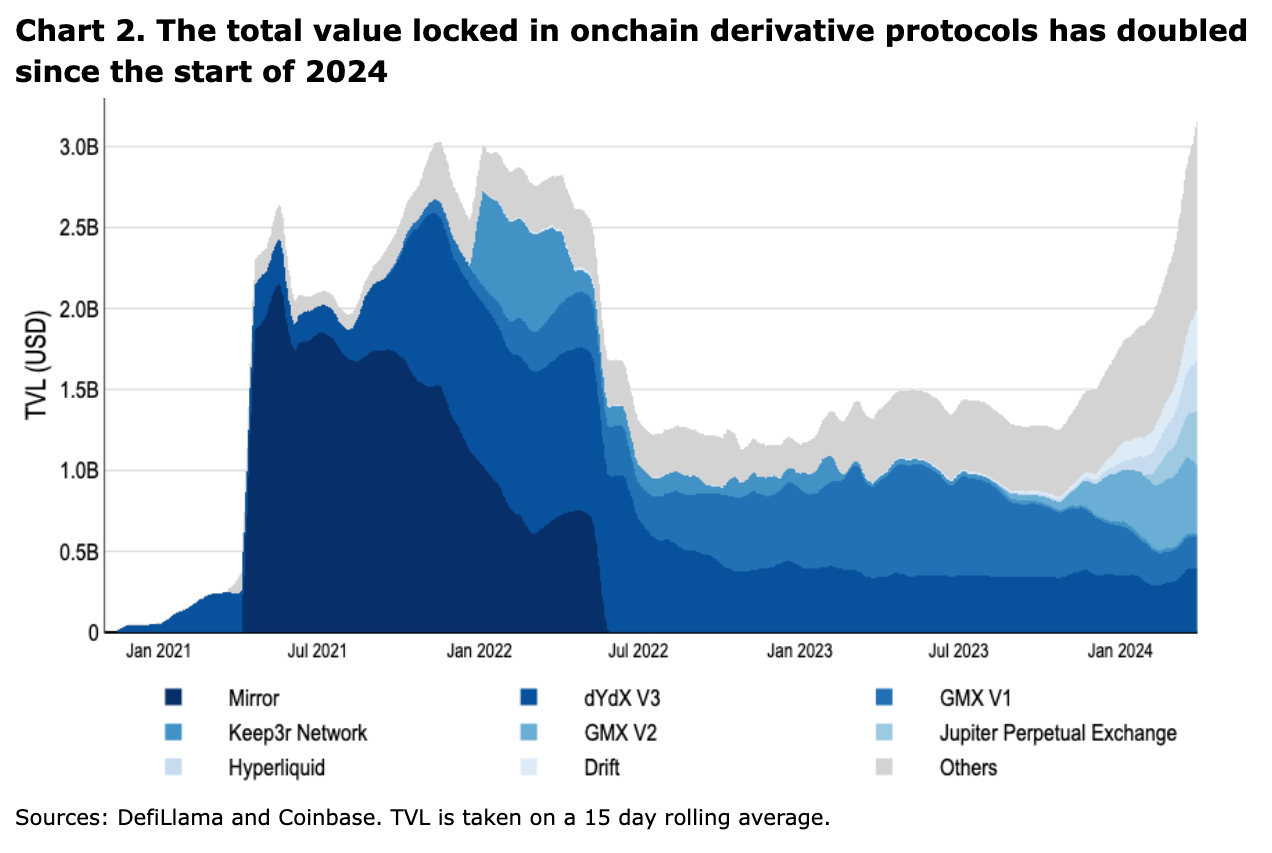

Coinbase’s report also points out that the on-chain derivatives sector surged to new heights, achieving an all-time high in Total Value Locked (TVL) of $3.4 billion. This milestone is particularly significant as it comes at a time when the broader decentralized finance (DeFi) ecosystem is still grappling with a slowdown, with TVL across the board remaining about 50% below its previous cycle highs.

The increased availability of high throughput and low-cost blockspace has paved the way for innovative on-chain products, the report adds, such as Central Limit Order Books (CLOBs). This development has allowed for the rapid creation and cancellation of orders, facilitating liquid exchanges through more traditional market-making strategies. Decentralized exchanges such as dYdX and GMX were mentioned as good examples of these changes.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

43

7 months ago

43