ARTICLE AD

Large players in the BTC options market expected wild price swings in either direction, but there was an overwhelming bullish bias.

Key Notes

QCP Capital projected that BTC could eye $100K-$120K price targets.But increased profit-taking from the ‘Trump trade’ could stall BTC price in the short-term.QCP Capital, one of the largest digital asset trading firms and options desks, projected that Bitcoin BTC $88 120 24h volatility: 2.7% Market cap: $1.74 T Vol. 24h: $85.38 B could eye $100K-$120K. The firm cited strong price action post-US election and the potential establishment of a US Bitcoin Strategic Reserve as key reasons for the outlook.

“In view of Bitcoin’s impressive rally since the US election, our view is that $100,000–$120,000 may not be too far off,” wrote QCP Capital in its daily market update.

BTC Short-Term Risks

However, the trading firm highlighted increased selling of call options (bullish bets) and buying of puts (bearish bets) by large players as a risk. It meant that large players were cashing out from their ‘Trump Trade’ bets and buying protective puts to hedge against a potential price pullback.

“Implied volatility has been falling on the move up as many large players were positioned for it and sold calls into the rally. With each new high, our desk observed market is selling calls and buying puts to hedge their downside risk,” added QCP Capital.

This partly explained the recent price stalling above $93K and the ensuing pullback. At the time of writing, BTC was valued at $88K, about a 6% decline from the latest all-time high (ATH).

Source: BTCUSDT, TradingView

Presto Research, a crypto-focused research firm, echoed a sentiment similar to that of QCP Capital. The analysts noted slow demand from TradFi, citing a decline in MicroStrategy’s MSTR and Coinbase’s COIN as indications of the unwinding of the ‘Trump trade.’

“We’re at an all-time high, and some are unwinding the ‘Trump trade,’ which includes long $BTC positions…ETF inflows also show signs of a slowdown, although whether it’s a blip or a lasting trend remains to be seen,” the research firm wrote.

According to Soso Value data, the US spot BTC ETFs saw a daily net outflow of $400.67 million on Thursday.

Insights from BTC Options Market

That said, large players in the BTC options market expected wild price swings on either side, but there was an overwhelming bullish bias.

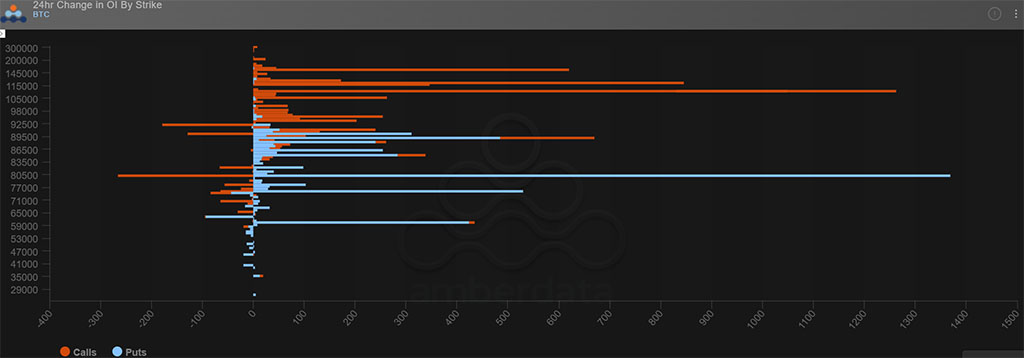

Source: Amberdata

In the past 24 hours, the changes in OI (Open Interest) rates or money inflows in call options were concentrated at $95K, $105K, $110K, and $120K targets. This indicated the levels as potential and immediate upside targets.

However, there was also significant OI in puts (downside bets) at $80K and $75K. In short, these levels could act as support in case of an extended pullback.

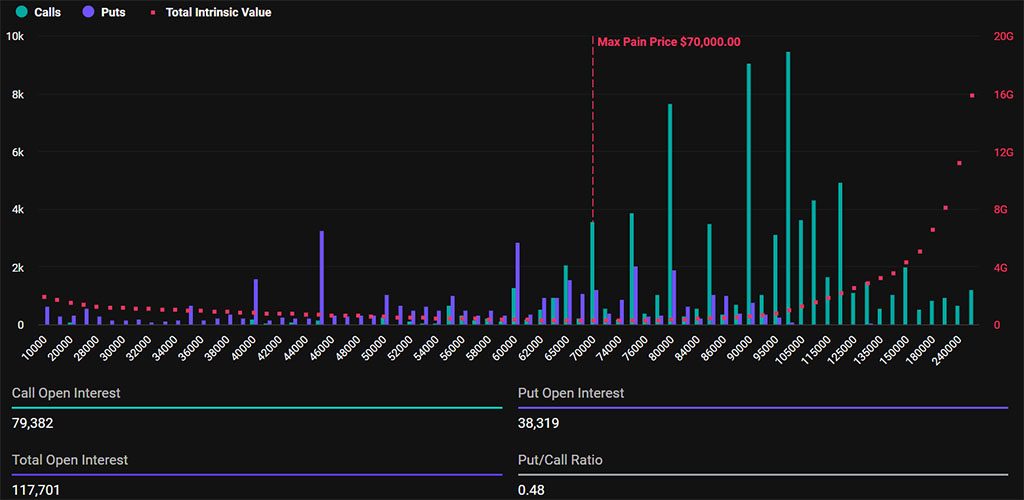

Source: Deribit

But the end-November and December options expiries remained arguably bullish. For example, Deribit options for the December 27 expiry had a Put/Call ratio of 0.48, which was less than 1 and meant more calls (bullish bets) than puts (bearish bets), a bullish cue.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bitcoin News, Cryptocurrency News, News

Benjamin is a Telecommunication Engineering graduate who is passionate about crypto-markets and unraveling market trends. Armed with data, charts and patterns, he's interested in making the intricate, complex landscape of digital assets easier for every user.

2 months ago

21

2 months ago

21