ARTICLE AD

Amid Bitcoin’s (BTC) rally, experts at QCP Capital wondered whether BTC could hit all-time highs sooner than the end of March.

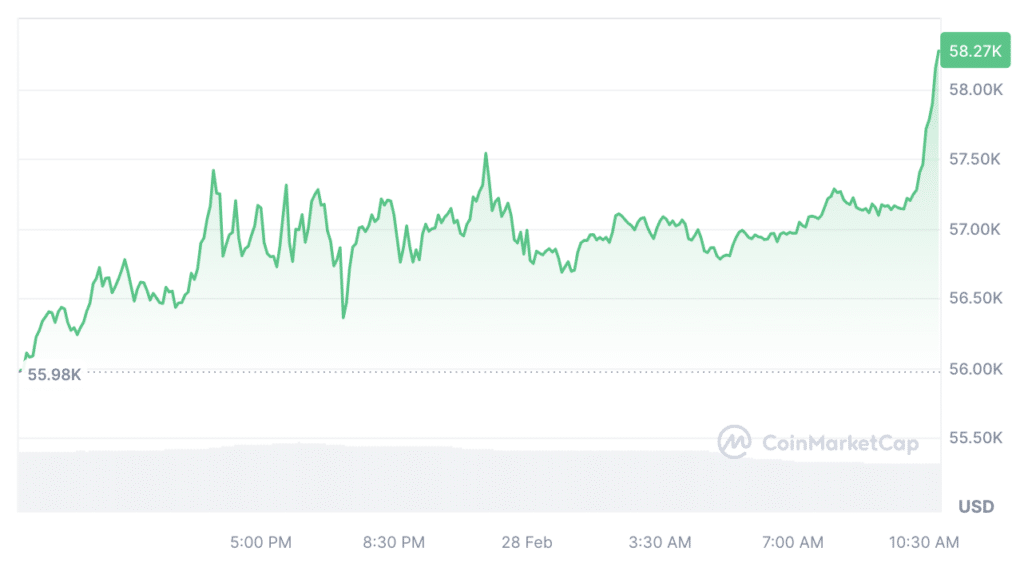

At the time of writing, BTC is trading at $58,300, up 4% in 24 hours and 13% in the last seven days, according to CoinMarketCap data. Following the rapid growth of the first cryptocurrency, analysts at QCP Capital wondered whether BTC would reach all-time high earlier than the end of March 2024.

Source: CoinMarketCap

Source: CoinMarketCap

In their latest analysis, experts presented bullish and bearish scenarios for Bitcoin. The first is that ongoing large capital inflows into spot Bitcoin ETFs will continue the uptrend as halving is expected soon.

Thus, the volumes of spot ETFs exceeded $3.2 billion, and the net inflow amounted to $520 million, analysts note. The rapid price surge triggered short liquidation and a speculative buying frenzy, with funding rates on local exchanges skyrocketing and even longer-dated futures trading at up to +16% over the spot market.

“Demand for vols has picked up, but vol spikes have been quickly sold into. Despite the size of the move, its one-way nature means that the realized volume remains close to 40%. We see the large 60k strike as a natural target for March expiry.”

QCP Capital expertsAccording to the second forecast, volatile funding rates may limit speculative fervor, and the crypto industry may see some reduction in leverage in the short term and possibly a pullback towards the $50,000 level.

Since the beginning of this year, Bitcoin has risen in price by 35%, and since the beginning of last year, by almost 250%. It is now 16% away from its all-time high of $69,000 set in November 2021. Amid the BTC rally, the rest of the top 10 cryptocurrencies by market capitalization are also showing significant growth.

Source: CoinMarketCap

Source: CoinMarketCap

Crypto market participants highlight several reasons for the rally. Thus, there is growth in the inflow of funds into crypto funds, the approach of halving, and expectations of the Federal Reserve System (FRS) switching to lowering the key interest rate.

8 months ago

47

8 months ago

47