ARTICLE AD

Reliance, its media asset Viacom18 and Disney are merging their media businesses in India, creating the largest media conglomerate in the South Asian market.

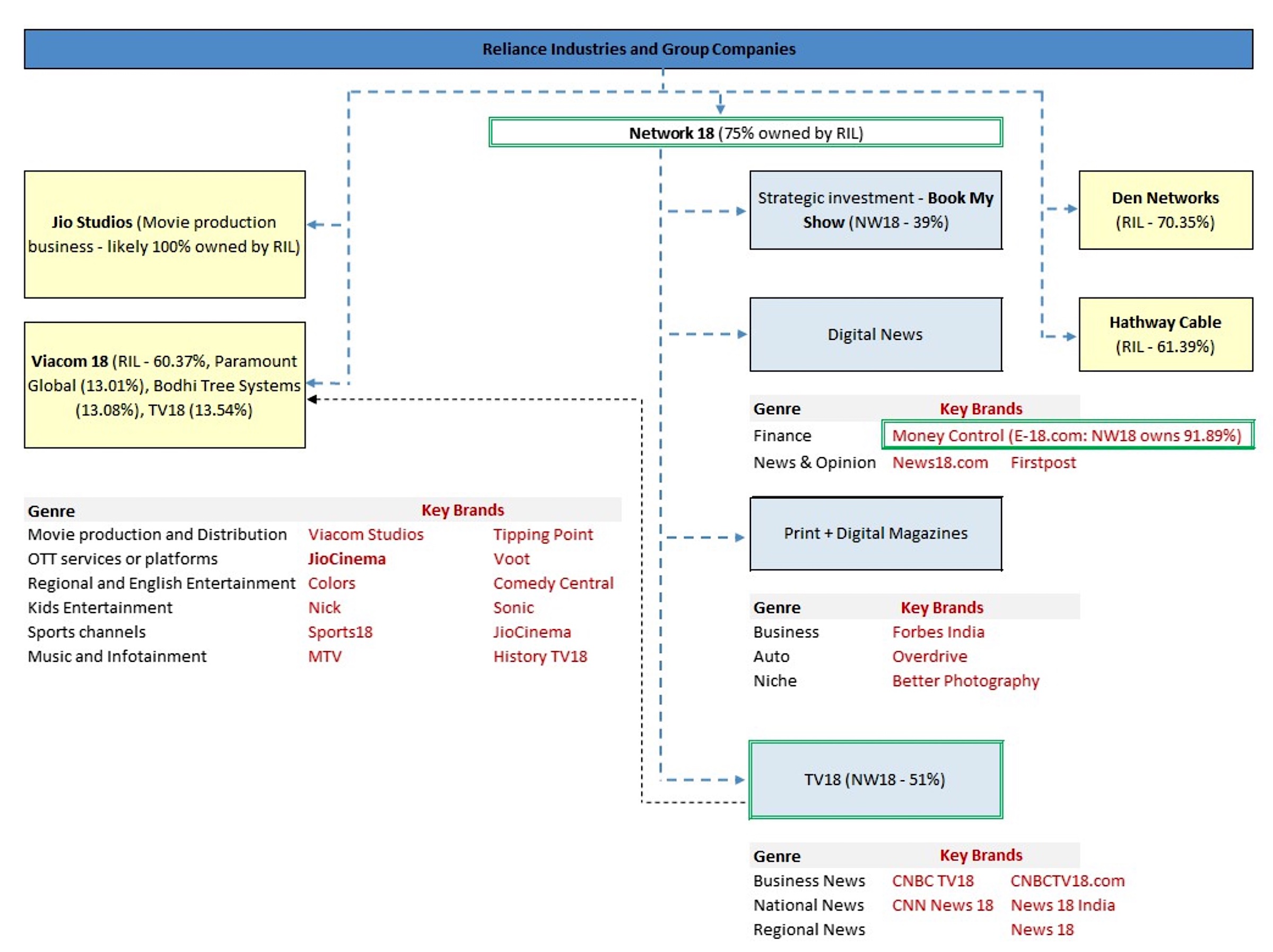

Reliance, which is India’s most valuable firm, said it sees an opportunity to expand and streamline its presence in the Indian fast-growing market by acquiring the majority stake in Disney India. Reliance, which owns more than 60% in Viacom18, values the joint venture at $8.5 billion and plans to invest $1.4 billion into the joint venture for its growth.

The merger of Reliance and Disney India also unites two leading Indian streamers, JioCinema and Disney+Hotstar, and paves way for both to leverage Reliance’s vast telecom network to potentially reach over 450 million subscribers.

The merger would also give Reliance dominance in sports and entertainment, bolstered by Jio’s recent sports rights acquisition from Disney/Star.

The merger comes as Disney’s Hotstar has faced fierce competition from JioCinema, which lured top Disney talent last year to boost its platform. Viacom18 also outbid Disney’s $3 billion for five-year streaming rights to India’s popular cricket tournament, the Indian Premier League, breaking many of Hotstar’s past viewing records in just one year. (Disney paid the same amount for the TV rights.)

The merger reunites former Star India CEO Uday Shankar and James Murdoch with the business they previously built for a decade – Shankar departed Star India after 2020 disputes with Disney, then he and Murdoch launched Bodhi Tree, an India media investment vehicle backed by $1.7 billion from Qatar Investment Authority and Comcast which invested over $500 million in Viacom18. Shankar now returns as vice chair of the merged entity’s board.

The sale enables Disney to address more pressing priorities and eases financial strains in India.

8 months ago

45

8 months ago

45