ARTICLE AD

Solana’s Decentralized Physical Infrastructure Network (DePIN) ecosystem is experiencing significant growth, driven by its high-speed transactions, low costs, and robust infrastructure, according to the “Solana DePIN Snapshot: H1 2024” report by on-chain data firm Flipside. The report explored different sectors within the DePIN narrative by analyzing their key projects.

Render Network was used as a benchmark for the decentralized compute sector. Decentralized compute networks provide scalable and cost-effective computing power by leveraging a network of decentralized nodes.

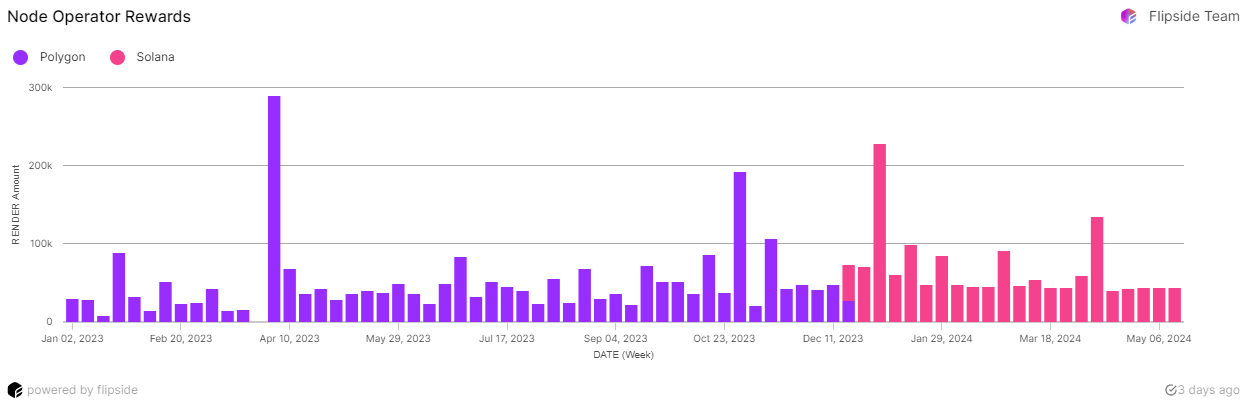

Render has successfully rendered approximately 33 million frames, equivalent to 33,000 GPU hours using NVIDIA RTX 3090 GPUs. Weekly active node operators peaked at 1,900 in January 2024, a 66.3% increase since migrating to Solana. Node operator rewards increased by 34.3% post-migration, peaking at 228,000 RNDR in early January 2024.

Rewards paid for Render node operators. Image: Flipside

Rewards paid for Render node operators. Image: FlipsideAnother sector from the DePIN narrative is decentralized connectivity, which was represented in the report by Helium. Decentralized wireless networks are based on the idea that, as technology has progressed, physical networks don’t need to be built from a top-down approach.

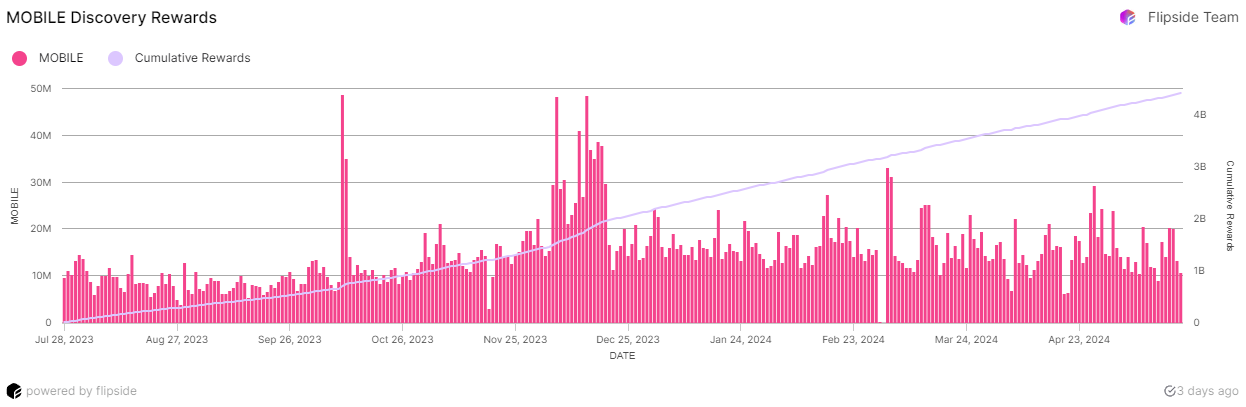

Helium Network’s mobile network token burns vastly outnumber those of the IoT network, driven by the rapid adoption of Helium Mobile services. Helium Mobile subscribers peaked at nearly 90,000 in January 2024, sustained by competitive pricing and MOBILE token incentives. Mobile Discovery Rewards growth has accelerated since December 2023, outpacing new subscriber growth.

Rewards paid for mobile discovery. Image: Flipside

Rewards paid for mobile discovery. Image: FlipsideDecentralized data and sensor networks are also a part of the DePIN industry, and are represented in the report by Hivemapper. The projects within this sector leverage distributed technology to collect, process, and share data from a vast array of sensors, creating a robust, real-time web of information.

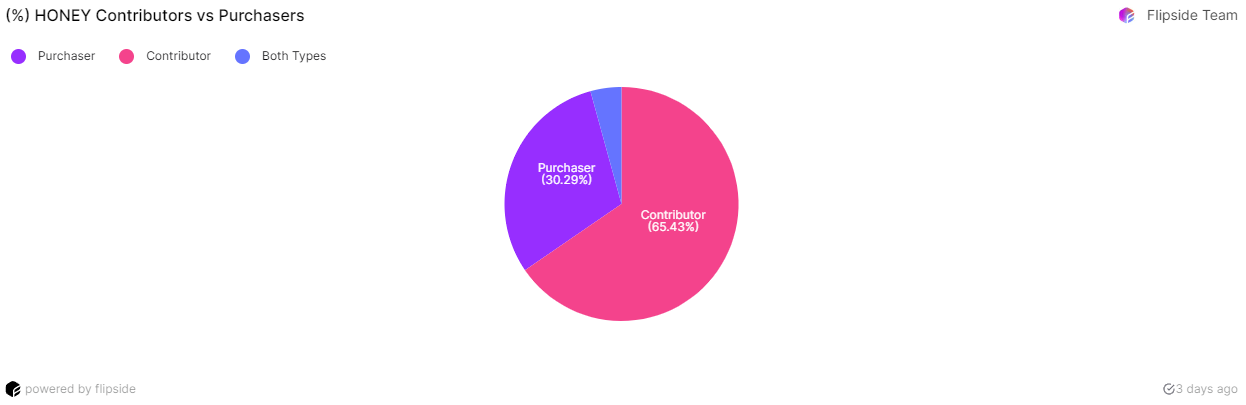

Hivemapper has mapped over 50 million kilometers across 90+ countries, making it the fastest-growing mapping project. There has been a significant rise in net HONEY burns due to increased network activity and enterprise adoption. Nearly one-third of HONEY token owners are active contributors, indicating high community engagement.

Different HONEY holders by percentage. Image: Flipside

Different HONEY holders by percentage. Image: FlipsideFurthermore, another traditional service that has its decentralized version in DePIN is storage solutions. Decentralized storage networks provide secure, scalable, and cost-effective data storage solutions by distributing data across multiple nodes rather than relying on centralized servers.

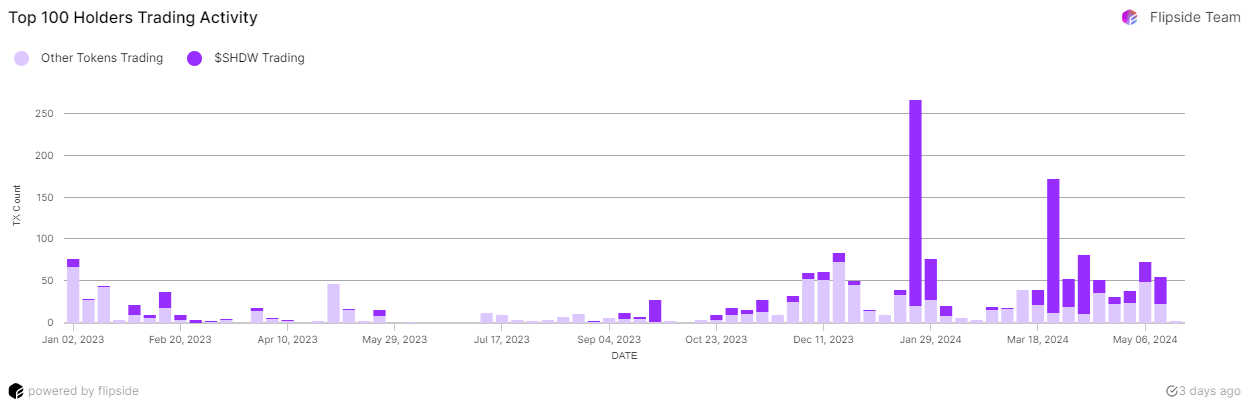

Activity registered by SHDW largest holders. Image: Flipside

Activity registered by SHDW largest holders. Image: FlipsideShdwDrive is the representation of this DePIN niche in Flipside’s report. The project demonstrated impressive performance in Testnet 2, handling up to 38,000 transactions per second during surge scenarios. The number of SHDW token holders peaked at 67,000 in March 2024, with more top wallets accumulating than selling. Staking activity has shifted towards withdrawals since rewards ended, typical for pre-utility phases.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

44

7 months ago

44