ARTICLE AD

RippleX, the developer arm of Ripple, is partnering with OpenEden Labs to introduce tokenized US Treasury bills (T-bills) to the XRP Ledger (XRPL), according to an official press release from August 1. OpenEden Labs is a tokenization platform and announced the launch of its TBILL tokens, which are backed by short-dated US T-bills and reverse repurchase agreements collateralized by US Treasuries.

Ripple Further Expands Its Range Of Products

The introduction of these tokenized assets on the XRPL aligns with a broader trend of integrating real-world assets (RWAs) into blockchain networks. In an effort to bolster the adoption and liquidity of OpenEden’s tokenized T-bills, Ripple has committed to investing $10 million into TBILL tokens.

Via X, Ripple X shared: “News alert – tokenization platform OpenEden Labs is bringing tokenized US Treasury bills (T-bills) to the XRPL! What’s more, Ripple is creating a fund to invest in tokenized T-bills, and will allocate USD$10M to OpenEden’s TBILL tokens as part of it.”

Markus Infanger, Senior Vice President at RippleX, emphasized the significance of this integration: “OpenEden’s tokenized US Treasury bills represent another exciting example of how all types of real-world assets are being tokenized to drive utility and new opportunities,” he stated. “Institutions are increasingly looking at where to tokenize their real-world assets and the arrival of T-bills on the XRPL powered by OpenEden reinforces the decentralized Layer 1 blockchain as one of the leading blockchains for real-world asset tokenization.”

Notably, OpenEden has already amassed over $75 million in Total Value Locked (TVL) for its tokenized US T-bills, indicating strong market confidence in its model. The platform has also received an investment-grade “A” rating from Moody’s, further validating its financial stability and appeal to institutional investors.

Jeremy Ng, Co-Founder of OpenEden, noted the diverse interest in their offerings: “OpenEden has attracted a wide range of institutional clients, including foundations, corporate treasuries, and buy-side funds, contributing to a stable and diversified user base,” he said. “Bringing tokenized T-bills to the XRP Ledger is the next step in our exciting journey. Purchasers will be able to mint our TBILL tokens via stablecoins, including Ripple USD when it launches later this year.”

Notably, this is not the first step by Ripple in the RWA sector. In June, the company expanded its partnership with Archax, a UK based Financial Conduct Authority regulated digital asset exchange, broker, and custodian. This collaboration aims to introduce “hundreds of millions of dollars of tokenized RWAs” to the XRP Ledger in the near future.

According to Ripple, the XRPL has facilitated over 2.8 billion transactions since its inception in 2012 and now supports more than 5 million active wallets, boasting a network of over 120 validators without a single failure or security breach.

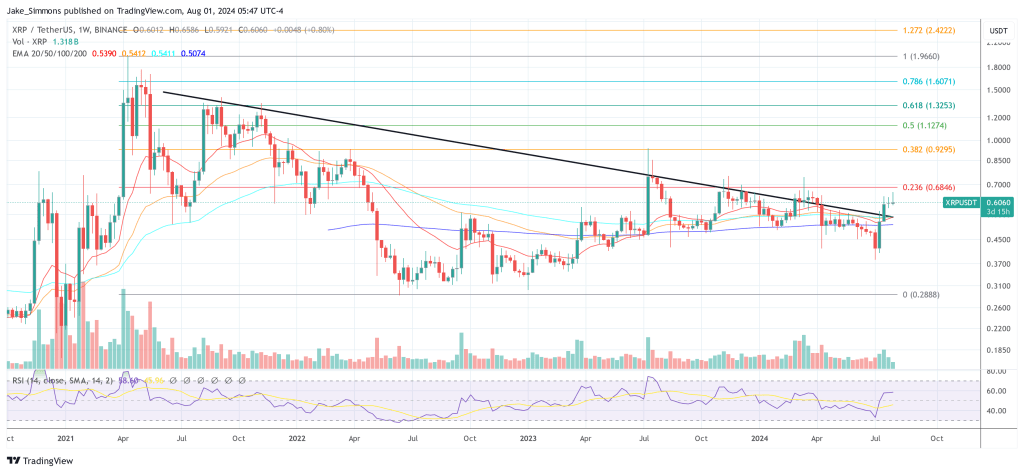

At press time, XRP traded at $0.606.

XRP faces key resistance at the 0.23 Fib, 1-week chart | Source: XRPUSDT on TradingView.com

XRP faces key resistance at the 0.23 Fib, 1-week chart | Source: XRPUSDT on TradingView.com

Featured image created with DALL.E, chart from TradingView.com

3 months ago

26

3 months ago

26