ARTICLE AD

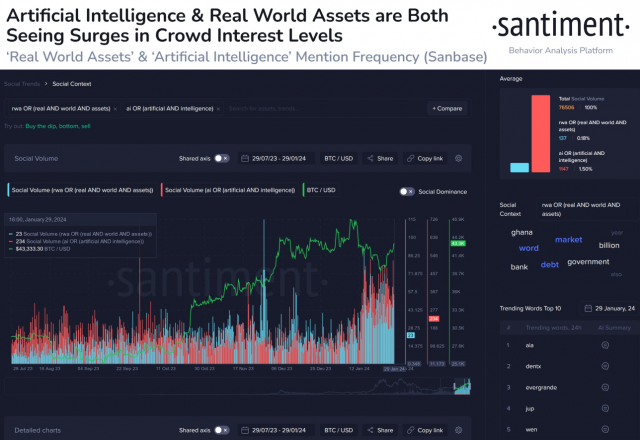

Real-world assets (RWA) and artificial intelligence (AI) are two sectors in crypto that might be drivers in the next bull run, according to a Jan. 30 post on X published by on-chain analysis firm Santiment. For the past six months, a growth in crowd interest can be seen around those two topics, Santiment points out.

RWA registered an average participation of 0.2% in social volume, while AI’s average stands at 1,5%. Although those numbers might seem thin, they are disputing social volume with all the relevant terms related to crypto.

Image: Santiment

Image: SantimentSantiment also highlights that RWA and AI tokens are benefiting from market decouplings, which is when some crypto assets don’t follow Bitcoin movements. A few examples of RWA tokens mentioned in the post that shine when diverting from the market’s major movements are AVAX, LINK, ICP, MKR, and SNX.

For the AI sector, the on-chain analysis firm mentions GRT, FET, AGIX, OCEAN, and TAO as tokens with significant movements in the past six months.

Bullish themes

The rise in interest in RWA and AI is also shown in industry reports about hot thesis in crypto for 2024. Binance’s report “Full-Year 2023 & Themes for 2024” mentions both areas as “key themes that are particularly exciting”.

The report emphasizes the tokenized US Treasuries use case in RWA, which can be used to “take advantage of real-world yields by investing in tokenized treasuries without leaving the blockchain”. According to data presented by analytics company rwa.xyz, the tokenization of US government bonds, treasuries, and cash equivalents is an $865 million industry with 657% yearly growth.

Binance predicts a continued expansion for the RWA industry, propelled by elevated rate hikes in the US, institutional adoption, developments in related infrastructures, such as decentralized identity and oracles, and interoperability solutions.

The integration of AI and crypto is also an area poised for growth per the report, opening up a “realm of possibilities” in terms of use cases and alternatives to existing solutions. Some use case examples mentioned by Binance are trade automation, predictive analytics, generative art, data analytics, and DAO operations.

Moreover, utilizing decentralized storage for data management in AI training is another use case which, this time, uses crypto as a leverage for AI. This allows broader participation, resulting in a potential surge in innovation and development in the field.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

10 months ago

67

10 months ago

67