ARTICLE AD

Strategy leverages debt markets to bolster its position in Bitcoin despite volatile market conditions.

Key Takeaways

Strategy has acquired a total of 499,096 Bitcoin, representing 2.3% of Bitcoin's total supply cap. The company completed a $2 billion debt offering to fund further Bitcoin acquisitions and corporate purposes. <?xml encoding="UTF-8"?>Michael Saylor’s Strategy announced today it had added 20,356 Bitcoin to its treasury during the week ending Feb. 23, spending roughly $2 billion and driving its total holdings toward 500,000 BTC. The company financed the purchase through a recently closed $2 billion senior convertible note offering.

$MSTR has acquired 20,356 BTC for ~$1.99B at ~$97,514 per bitcoin and has achieved BTC Yield of 6.9% YTD 2025. As of 2/23/2025, @Strategy hodls 499,096 $BTC acquired for ~$33.1 billion at ~$66,357 per bitcoin.https://t.co/mEkdWiotVy

— Strategy (@Strategy) February 24, 2025

The company acquired its total Bitcoin holdings for about $33 billion at an average price of $66,357 per Bitcoin. Strategy reported a Bitcoin yield of 6.9% year-to-date for 2025 as of February 24.

Strategy said earlier today that it had completed a $2 billion offering of 0% convertible senior notes due in 2030. The notes were sold in a private offering to qualified institutional buyers, with an option granted to initial purchasers to buy up to an additional $300 million in notes. The net proceeds from the offering are approximately $1.99 billion after deducting fees and expenses.

Strategy has completed a $2 billion offering of convertible notes at 0% coupon and 35% premium, with an implied strike price of ~$433.43. $MSTRhttps://t.co/ib7G0msycM

— Strategy (@Strategy) February 24, 2025

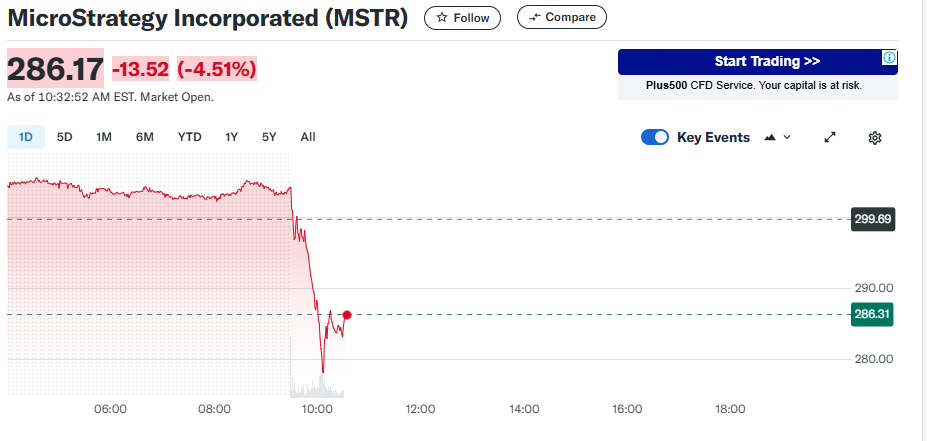

As of the publication of this article, MSTR stock was trading at around $286, reflecting a decline from its previous close of $299. This represents a drop of approximately 4.5%, with an intraday low of 5.5%.

Strategy, formerly known as MicroStrategy, began its Bitcoin accumulation in August 2020 as the first publicly traded company to adopt Bitcoin as a primary treasury reserve asset.

The company has maintained an aggressive acquisition strategy, with notable purchases including 218,887 Bitcoin for $20.5 billion in Q4 2024.

Strategy’s current holdings represent about 2.3% of Bitcoin’s total supply cap of 21 million and approximately 2.5% of the circulating supply of 19,828,478 Bitcoin.

In October 2024, MicroStrategy, led by Michael Saylor, set its sights on becoming the world’s foremost Bitcoin bank with aspirations for a trillion-dollar valuation, grounded in a robust, long-term belief in Bitcoin’s potential.

Disclaimer

2 hours ago

4

2 hours ago

4