ARTICLE AD

The move signals a potential shift in attitude towards digital assets, despite ongoing legal challenges.

Key Takeaways

The SEC is reviewing Grayscale's applications for XRP and Dogecoin ETFs. Grayscale aims to convert its trusts into ETFs, offering investors exposure to digital assets. <?xml encoding="UTF-8"?>The US SEC has initiated its review of proposed rule changes that would enable NYSE Arca to list and trade shares of both the Grayscale XRP Trust and Grayscale Dogecoin Trust.

This development, especially the acknowledgment of the Grayscale XRP Trust application, was highly anticipated, given that Ripple and the SEC are still fighting over XRP’s classification.

While Grayscale’s ETF proposals aren’t a done deal just because the SEC acknowledged them, it’s a positive sign that the regulator might be warming up to crypto investment products, contrasting with previous instances where SEC reluctance led to the withdrawal of similar applications, FOX Business journalist Eleanor Terrett commented.

The securities regulator has opened a 21-day public comment period for applications submitted through NYSE Arca, after which it will decide whether to approve, disapprove, or institute proceedings.

NYSE Arca filed a 19b-4 form with the SEC last month seeking approval to list and trade Grayscale’s XRP Trust. As of January 22, 2025, the fund managed $16.1 million in assets.

For the Grayscale Dogecoin Trust, NYSE Arca submitted its 19b-4 form on January 31, shortly after Grayscale launched the trust product. Both proposed ETFs would allow investors to gain exposure to their respective digital assets without direct ownership. Coinbase Custody Trust Company serves as custodian, while BNY Mellon handles administration and transfer agent responsibilities.

Grayscale is expanding its ETF offerings, pursuing conversions of its trusts into ETFs, including those for XRP, Litecoin, and Solana. The asset manager is also seeking greenlight to launch its Cardano Trust.

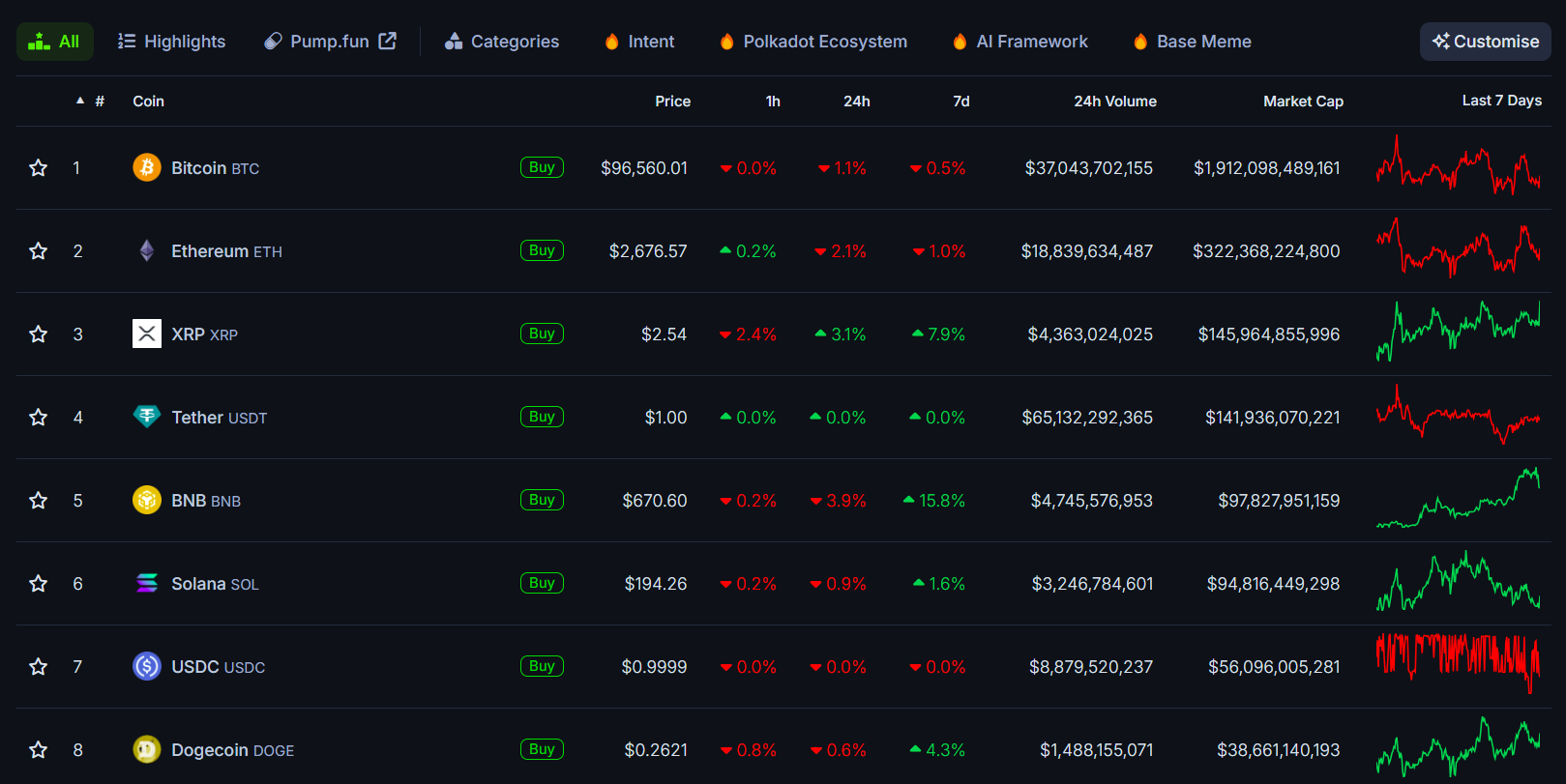

According to CoinGecko data, Dogecoin ranks as the eighth largest digital asset by market cap, originally created as a playful alternative to Bitcoin and gaining substantial support from Elon Musk. XRP holds the position of third-largest digital asset.

Disclaimer

Disclaimer

5 days ago

35

5 days ago

35