ARTICLE AD

The latest crypto high-profile platform to be targeted by the bad guys is Metawin. According to reports, hackers broke into the withdrawal system of the crypto site and stole more than $4 million worth of digital assets.

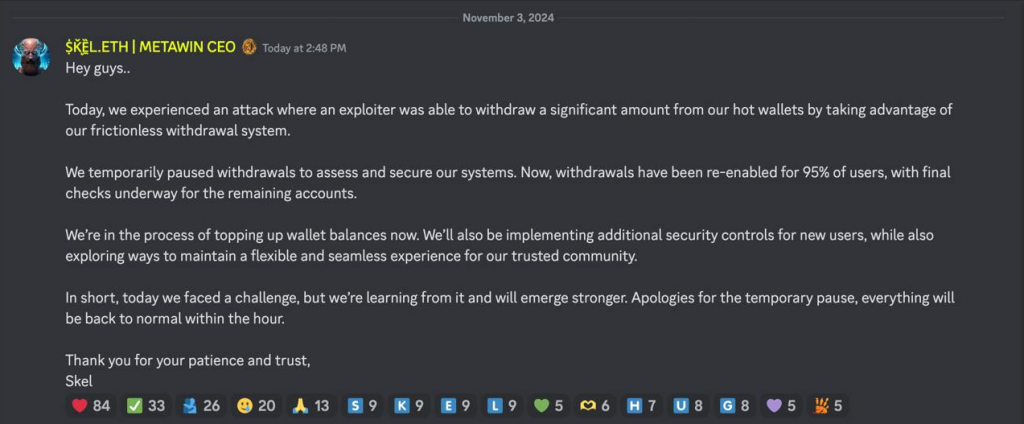

Metawin’s CEO has confirmed the security breach as the casino immediately stopped all its payment requests.

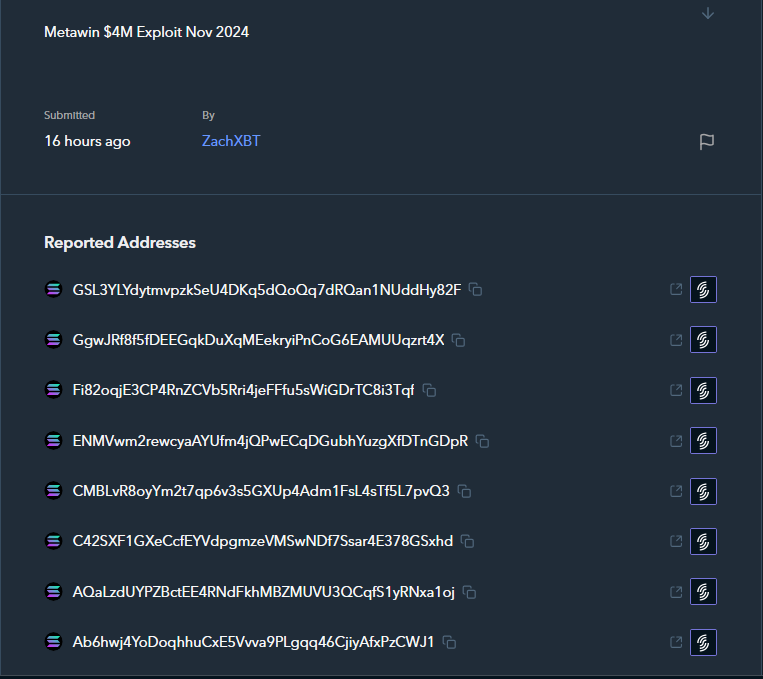

One crypto user reported that the hacker has moved funds to the HitBTC nested service and KuCoin. The user also found out that there are approximately 115 crypto addresses connected with the hacking incident.

Withdrawals are back online after the casino’s latest statement about the hacking incident, where 95% of its users currently access this service.

A Series Of Costly Crypto Hacks This October

The incident was reported on Telegram by on-chain investigator ZachXBT, who wrote, “It appears that the cryptocurrency casino Metawin was exploited for $4M+ on Ether and SOL earlier today.”

🚨 MetaWin Casino Loses $4M in Hack as Crypto Scams Surge

Online casino @metawincom lost around $4 million in a hack on November 3, targeting its hot wallets through a flaw in its withdrawal system, according to CEO Skel.

Withdrawals were halted but have since been restored… pic.twitter.com/KT28cS3UCs

— VERITAS PROTOCOL (@veritas_web3) November 3, 2024

Metawin’s hacking is the latest in high-profile hacking and online thefts targeting the DeFI sector. October is one of the costliest months for cryptocurrency security breaches. The month saw 20 hacks, costing crypto firms around $88 million. These hacking incidents underscore the current security weaknesses of crypto sites, particularly those in DeFI.

Based on industry tracking, Radiant Capital was the worst-hit crypto firm this October.

Last October 17th, hackers exploited the weak points of the platform’s smart contracts, successfully stealing $53 million.

The hackers used cross-chain protocols to transfer the digital assets to Ethereum, making it difficult to trace the assets. Then, we have a US government wallet compromised for $20 million. Interestingly, the “hacker” returned most of the funds, but $700k is still missing.

Another interesting hacking case targeted EigenLayer and The Tapioca Foundation. On October 4th, EigenLayer lost $5.7 million to theft, and The Tapioca Foundation also lost $4.7 million.

Losses Pile Up As More Crypto Sites Suffer Hacks

Many are concerned with hacking as well as security breaches into DeFi. To date this year, hacker activity has caused $1.7 billion in losses. This includes 179 incidents. While there have already been a few breaches that have occurred this year, the numbers are far more significant than what occurred last year. In other words, stakes are much higher for block chain developers as the fees just keep going higher.

Analysts say hacking incidents in the third quarter cost firms around $750 million. Each hack averaged $5.93 million in digital assets. These losses from hacking suggest a growing crypto problem that the industry must address.

Featured image from Dall-E, chart from TradingView

2 weeks ago

8

2 weeks ago

8