ARTICLE AD

Key Notes

Solana has experienced a 373% price increase over the past year, driven by the rise of Solana-based meme coins and DeFi activity.On-chain analyst Titan of Crypto identified a bullish cup-and-handle pattern on Solana's monthly chart with $400 target.Chances of Solana ETF approval increase with potential regulatory changes under the new SEC leadership.Earlier today, Solana price SOL $259.7 24h volatility: 6.9% Market cap: $123.29 B Vol. 24h: $14.82 B surged by another 12% hitting a fresh all-time high of $263.70 while taking its market cap to more than $124.90 billion. This comes as the Cboe Exchange submits four 19b-4 filings of spot Solana ETFs for asset managers VanEck, Bitwise, 21Shares, and Canary Capital.

The FTX collapse in November 2022 led to the SOL price hitting its bottom of $10. From there, Solana has staged a massive recovery to its new all-time high levels. With 373% gains over the last year, SOL has been one of the top-performing altcoins in 2024.

One of the major reasons behind the SOL price rally has been the rise of the Solana-based meme coins in 2024. These meme coins contributed massive trading revenue providing a strong revenue boost to the Solana blockchain.

Additionally, the growth of decentralized finance (DeFi) on Solana has been impressive as well. So far in 2024, the total value locked (TVL) on Solana DeFi has surged by 500%, now at $8.916 billion as per the data from DeFiLlama.

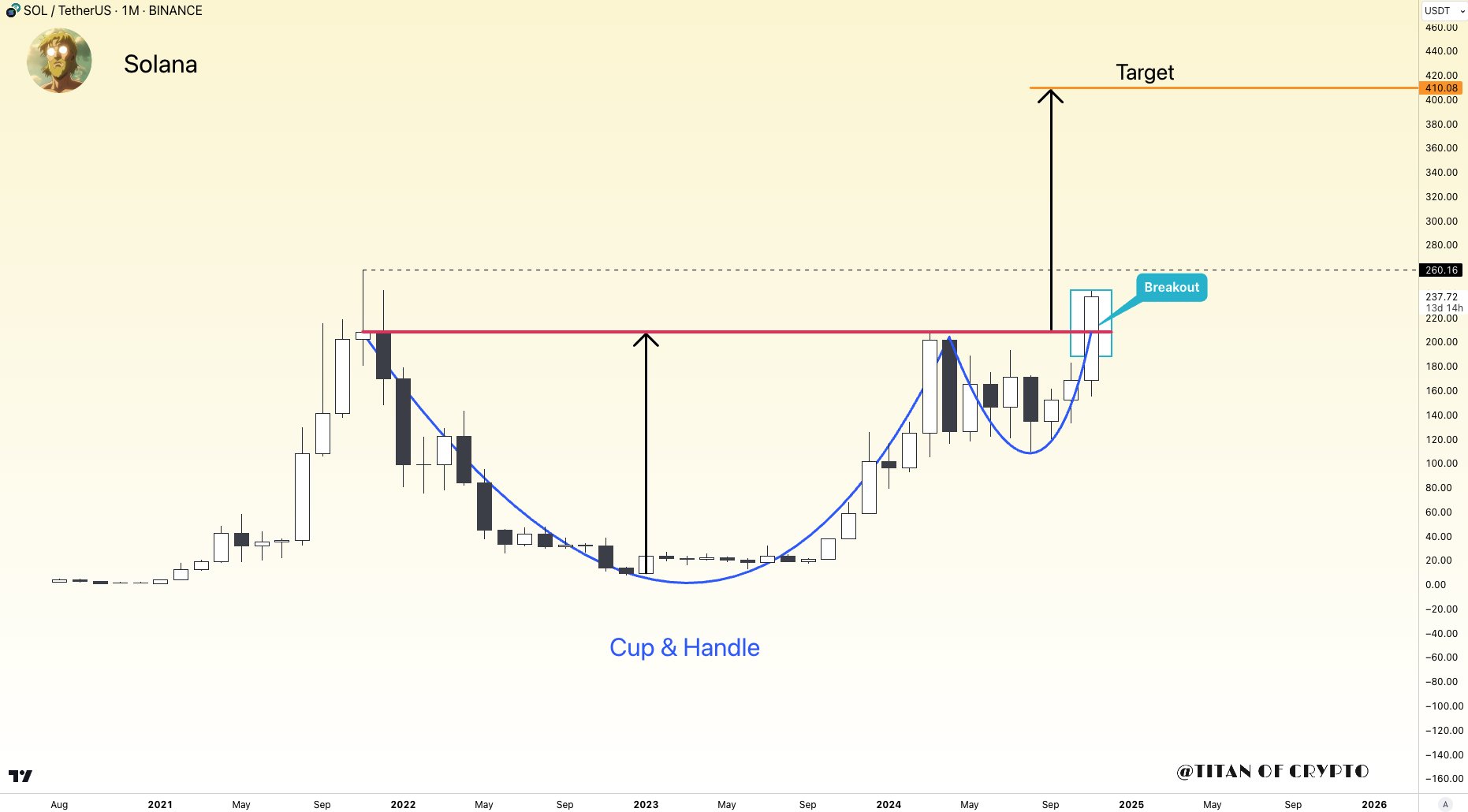

Independent on-chain analyst Titan of Crypto has identified a significant bullish trend on Solana’s monthly chart, noting a breakout in progress. The chart reveals a classic cup-and-handle formation, a pattern known for its high reliability.

Titan of Crypto

Historically, this pattern boasts a 95% success rate and an average profit yield of 54% following a breakout, signaling strong upside potential for Solana. “Once it clears its previous ATH, it could soar straight to $400!” noted the analyst.

Spot Solana ETF Filings Trigger SOL Price Rally

As reported, the Cboe BZX Exchange submitted four 19b-4 filings of spot Solana ETF for asset managers VanEck, Bitwise, 21Shares, and Canary Capital. The development took place on the same day as US SEC Chair Gary Gensler announced his resignation with January 20 being his last day in the office. Fox Business journalist Eleanor Terret stated that the US SEC now has “up to 15 days to acknowledge the filings and publish them to the federal register”.

A 19b-4 filing notifies the SEC of a proposed rule change by a self-regulatory organization, such as a financial regulator or stock exchange. This differs from S-1 registration statements, which VanEck and 21Shares submitted for their Solana ETFs in late June, followed by Canary Capital on October 30.

A day before on November 20, crypto exchange Bitwise submitted its statutory trust in Delaware for the Solana ETF. Later on November 21, the asset manager filed for the S-1.

Industry experts anticipate a more favorable regulatory environment for cryptocurrencies under the Donald Trump administration. This could potentially lead to an increase in crypto ETF filings, similar to those submitted on November 21.

SCOOP: Former SEC commission Paul Atkins is said to be in the lead position to replace @GaryGensler as @SECGov chair, according to a person with direct knowledge of the matter. As with all things in Trump World this could change, of course. Fox Business has previously reported…

— Charles Gasparino (@CGasparino) November 21, 2024

Furthermore, investors are looking up to a new SEC leadership with pro-crypto SEC Commissioner Paul Atkins currently leading for replacing Gary Gensler.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

2 months ago

65

2 months ago

65