ARTICLE AD

Solana’s (SOL) market value has surged to new yearly highs, gaining 13.7% in the last 24 hours, as its price rose from $108 to $123.80 amidst a wider cryptocurrency market rally.

The latest surge is attributed to a wave of purchases of the dogwifhat (WIF) memecoin, a digital asset based on the Solana blockchain.

The memecoin, featuring an image of a developer’s dog with a knitted hat, has risen by over 55% in value from $0.52 on Feb. 27 to $0.88 as per data by CoinMarketCap. Since its launch on Dec. 14 of the previous year, WIF has seen an exponential increase of over 50,000% in its value.

Amidst this cryptocurrency fervor, Coca-Cola HBC has announced its adoption of blockchain technology in collaboration with the Solana-based platform ALL.ART. The partnership aims to enhance the process of verifying internal certificates, allowing for the issuance and exchange of digital certificates as non-fungible tokens (NFTs) on the Solana blockchain. This initiative addresses the issue of forgery and alteration inherent in traditional certificate systems.

SOL 24-hour price chart | Source: CoinMarketCap

SOL 24-hour price chart | Source: CoinMarketCap

While these achievements underscore Solana’s growing influence and adoption, the cryptocurrency is still navigating its way back from a 52% decrease from its all-time high of $259.62, recorded on Nov. 6, 2021. However, market analysts, including Hansolar, suggest that Solana may be on the brink of a bull run, drawing parallels with the Ethereum (ETH) price movements in past bull markets.

When SOL takeoff?

✦ SOL

Assuming SOL is the new ETH this cycle, I think SOL really takes off later than BTC and ETH.

Previously ETH took off when BTC actually broke out into ATHs.

It's then when retail buys into SOL as the high beta catch up play.

Currently SOL is at around… pic.twitter.com/mwyhJ5DO6m

Ethereum, for instance, saw its value escalate from approximately $85 to $4,935 after Bitcoin reached new heights. This pattern suggests a similar fate could await Solana as Bitcoin continues to dominate the market, aiming for new records beyond its November 2021 high of $69,000.

“Previously, ETH took off when BTC actually broke out into ATHs. It’s then when retail buys into SOL as the high beta catch up play,” Hansolar stated, adding:

“Currently SOL is at around 50% from ATHs similarly to how ETH was around the 50% mark as BTC was nearing ATHs in the previous cycle.”

Solana is not alone in experiencing significant growth this year. Other major cryptocurrencies, including Binance’s BNB token and Dogecoin, have also reached their 2024 highs, trading at approximately $427 and $0.132, respectively, shortly before Solana’s surge.

The market momentum is largely driven by Bitcoin, which has seen substantial institutional interest following the approval of spot Bitcoin exchange-traded funds (ETFs) on Jan. 11. These ETFs have since generated a staggering $7.7 billion in volume on Feb. 28 alone, with BlackRock’s iShares Bitcoin ETF attracting an unprecedented $612 million in inflows, marking the largest single-day accumulation for any ETF.

Bitcoin itself has been on an upward trajectory, now trading at $63,400, reflecting a 22% increase over the past week and a 50% uplift over the month. Similarly, Ethereum reached a new 2024 high of $3,492 on Feb. 28, with market analysts eyeing the upcoming spot Ethereum ETF as a potential catalyst for further growth.

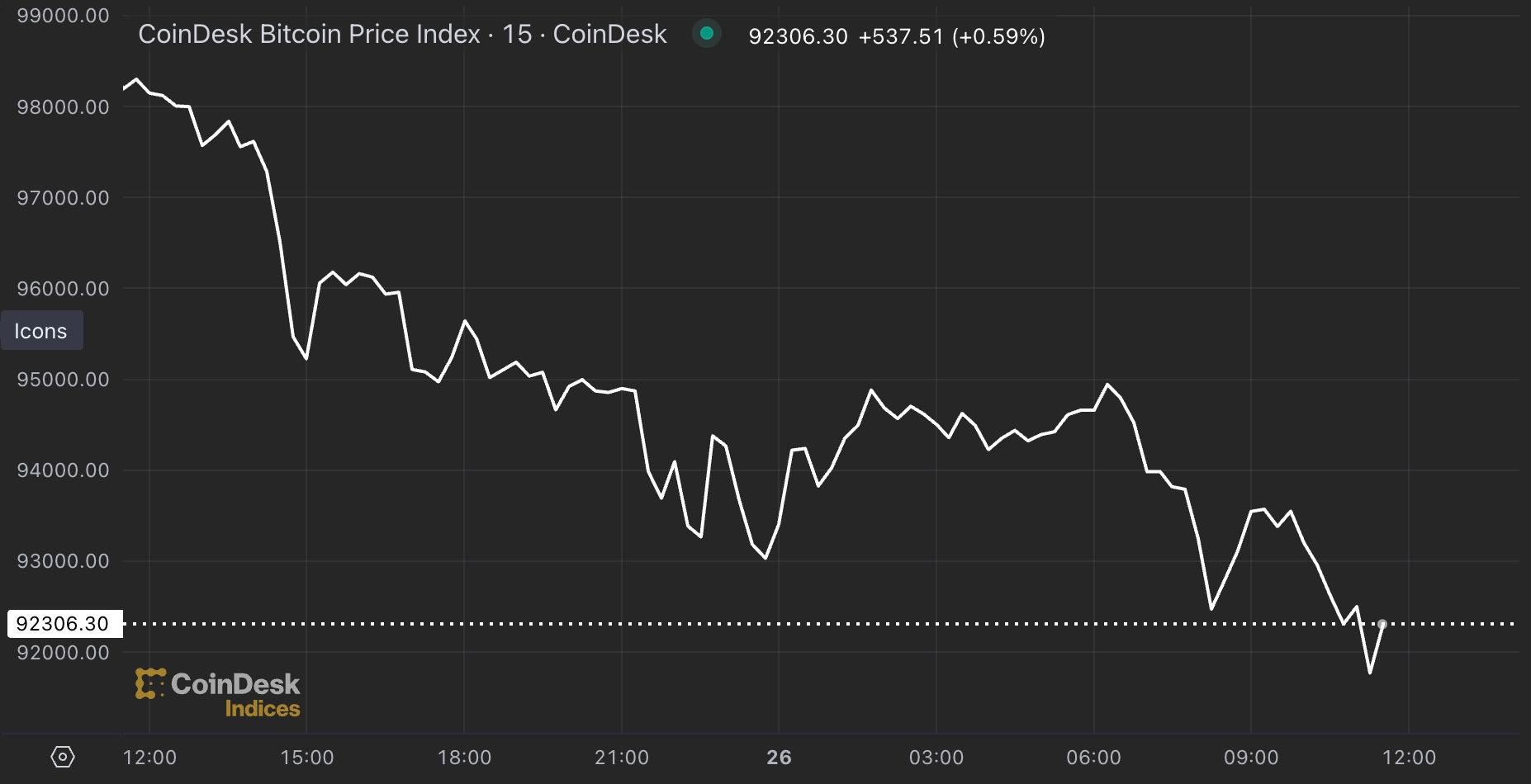

BTC 24-hour price chart | Source: CoinMarketCap

BTC 24-hour price chart | Source: CoinMarketCap

8 months ago

47

8 months ago

47