ARTICLE AD

Solana (SOL) has gained bullish momentum as the Zeus Network plans to connect it with the Bitcoin blockchain.

SOL is up by 4% in the past 24 hours and is trading at $129.9 at the time of writing. The asset’s market cap surpassed the $58 billion mark with a daily train volume of $4.1 billion.

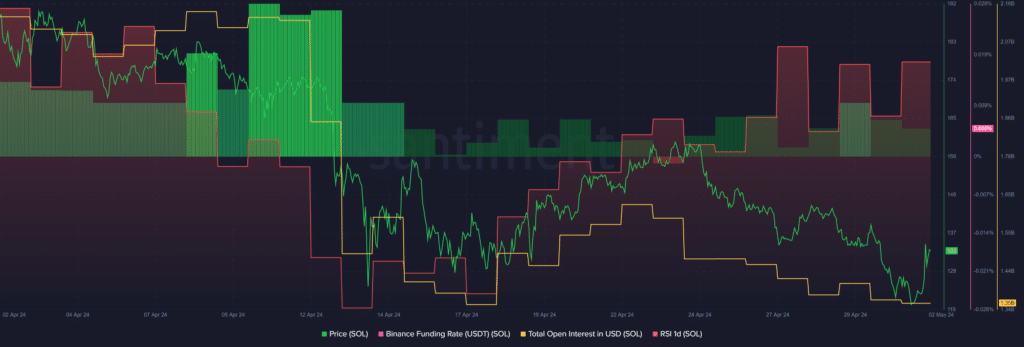

SOL price, Binance funding rate, open interest and RSI – May 2 | Source: Santiment

SOL price, Binance funding rate, open interest and RSI – May 2 | Source: Santiment

According to data provided by Santiment, the SOL total open interest has been consistently declining over the past 10 days — falling from $1.63 billion on April 22 to $1.35 billion at the reporting time.

The declining open interest could potentially indicate less price volatility and liquidations.

Moreover, data from the market intelligence platform shows that the ratio of long to short trading positions on Binance has been cut in half since April 29 as the SOL price continued its downward momentum. This shows more trading contracts have been betting against a price hike.

Per Santiment, the SOL Relative Strength Index (RSI) surged from 43 to 50 over the past 24 hours. The indicator suggests that the asset is neither undervalued nor overvalued at this price point due to the bearish market conditions.

For SOL to stay in the bullish zone, its RSI would need to remain below the 50 mark. An RSI of over 50 could also suggest higher price volatility and even whale manipulation.

The bullish sentiment toward SOL comes after Zeus Network announced to potentially make Solana “the Layer 2 solution for all blockchains” with ZPL (Zeus Program Library) and assets powered by the so-called permissionless communication layer.

In simple terms, users could convert assets like BTC into a ZPL-Asset, zBTC for example, and gain access to the Solana ecosystem, per the announcement.

8 months ago

18

8 months ago

18