ARTICLE AD

Joe McCann, the CEO and CIO of the crypto hedge fund Asymmetric, recently made a bold statement on X (formerly Twitter), forecasting a $1 trillion market cap for Solana. McCann’s argument hinges on several key points that detail why he believes Solana has achieved product-market fit (PMF) as “The Chain for Retail,” juxtaposing it against Ethereum’s challenges and perceived shortcomings for retail users.

Solana Beats Ethereum

McCann critiques Ethereum for not being designed with retail in mind, pointing out its slow and expensive Layer 1 (L1) transactions, alongside the user experience (UX) nightmare posed by its numerous Layer 2 (L2) solutions. He states, “Ethereum is not a chain designed for retail – the L1 is too slow and expensive and the L2s are (currently) a UX nightmare.”

The friction for new users, fragmented liquidity across over “40 L2s”, and the complications with bridging are highlighted as significant barriers to Ethereum’s adoption by a broader retail audience.

Turning his attention to corporate-backed open-source projects like Coinbase’s L2 solution, Base, McCann acknowledges their potential to solve some UX issues. However, he also notes the inherent priority of such projects to serve corporate interests, often at the expense of broader community needs.

Despite his critique, he admits, “Most corporate open source ultimately ends up serving corporate priorities…and it should!” This acknowledgment underscores the complexity of balancing corporate involvement in blockchain development with the ecosystem’s decentralized ethos.

McCann attributes Solana’s rise to its ability to serve the retail segment effectively, particularly through its association with memecoins and speculative trading. Describing Solana as originally being “Blockchain at Nasdaq speed” for its high throughput and low latency, he notes a pivotal shift in its narrative towards retail.

He observes, “Not once has the concept of being The Chain for Retail™️ ever surfaced. Until now.” This shift is largely credited to Solana’s embrace by the memecoin community and the speculative trading that follows, marking a clear PMF with retail users.

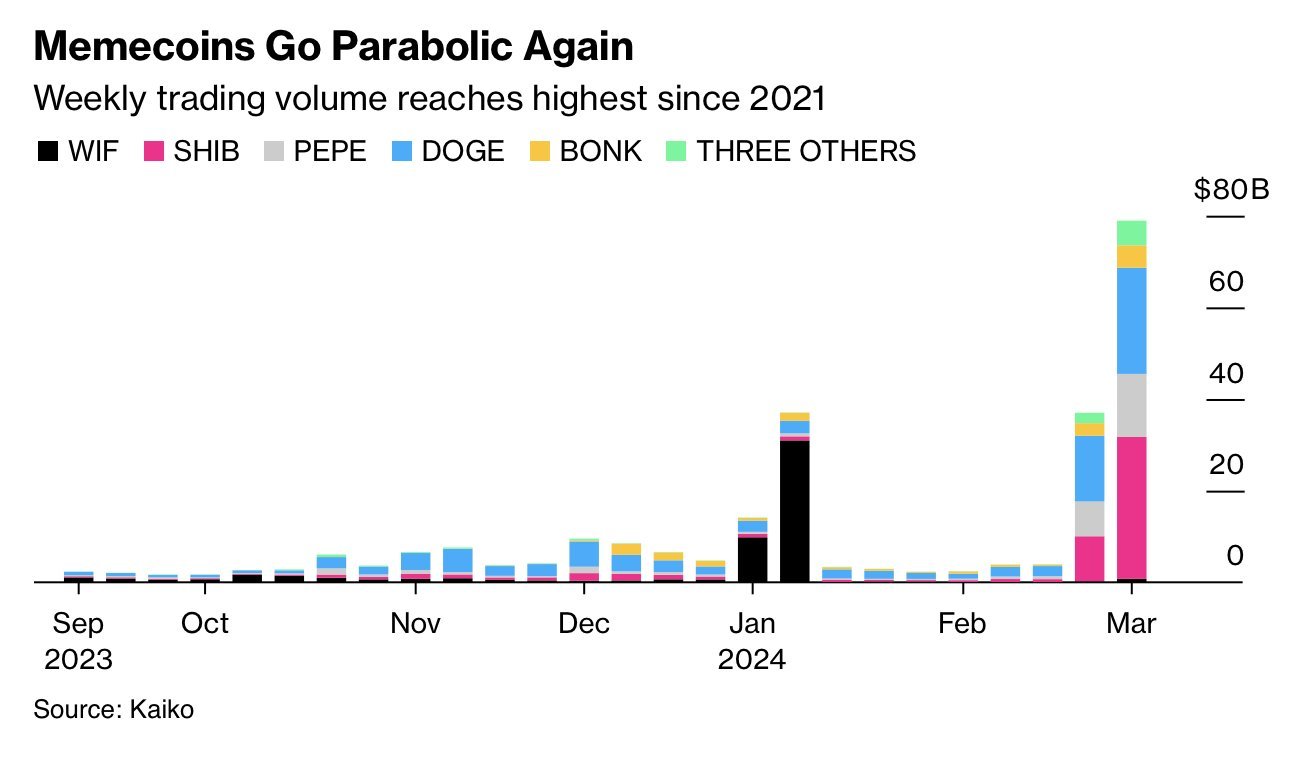

Highlighting the explosion of memecoin speculation on Solana, especially post-NFL season, McCann points out, “Since the NFL season ended, speculation on memecoins has exploded…BONK and WIF are on Solana. […] Thousands of them are being created everyday and trading volumes are exploding.”

Memecoins go parabolic | Source: X @joemccann

Memecoins go parabolic | Source: X @joemccann

The extensive creation and trading volumes of these coins on Solana are seen as a testament to its appeal and utility for retail speculators. Notably, the majority of memecoins is on Solana, not Ethereum.

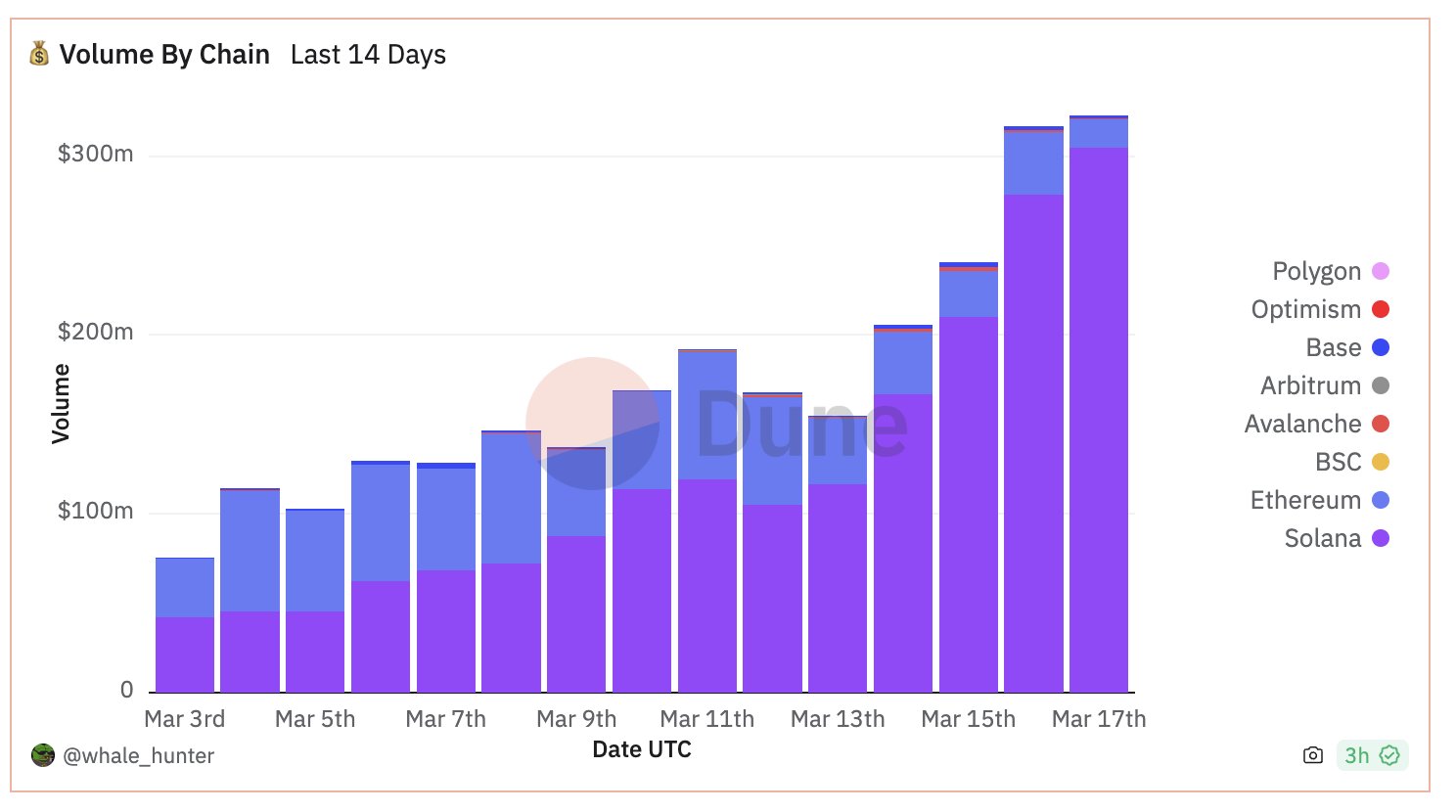

”Trading Bots aka the ‘Robinhood-ification of crypto’ has been driving the majority of the trading due to its…great UX. […] And the majority of those bots are trading memecoins on Solana. Solana is now consistently flipping Ethereum in DEX volumes yet for some reason, SOL is still 1/4th the value of Ethereum, it was 1/8th just a few days ago,” McCann noted.

Trading bots: volume by chain | Source: X @joemccann

Trading bots: volume by chain | Source: X @joemccann

He contrasts Solana’s market cap with Ethereum’s, using their relative valuations to argue for Solana’s growth potential. With Ethereum valued at just under $500 billion and Solana at about $115 billion, he suggests that Solana’s path to a $1 trillion market cap represents a nearly 10x growth opportunity, far outpacing the potential for Ethereum.

“ETH to $1T is a double. SOL to $1T is nearly a 10x. Which horse are you gonna bet on? The fastest one, obviously,” McCann concludes, encapsulating his bullish outlook for Solana based on its retail-friendly ecosystem and the vibrant activity around memecoins.

At press time, Solana traded at $201.27.

SOL price, 1-week chart | Source: SOLUSD on TradingView.com

SOL price, 1-week chart | Source: SOLUSD on TradingView.com

Featured image from Euronews, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

8 months ago

31

8 months ago

31