ARTICLE AD

Meme coin marketplace Pump.fun was attacked by a former team member yesterday, resulting in halted trading, users unable to liquidate their tokens, and the platform losing $1.9 million, according to a May 16 post-mortem. Despite this episode, the meme coin sector on Solana stood firmly in the last 24 hours, with tokens making two-digit leaps.

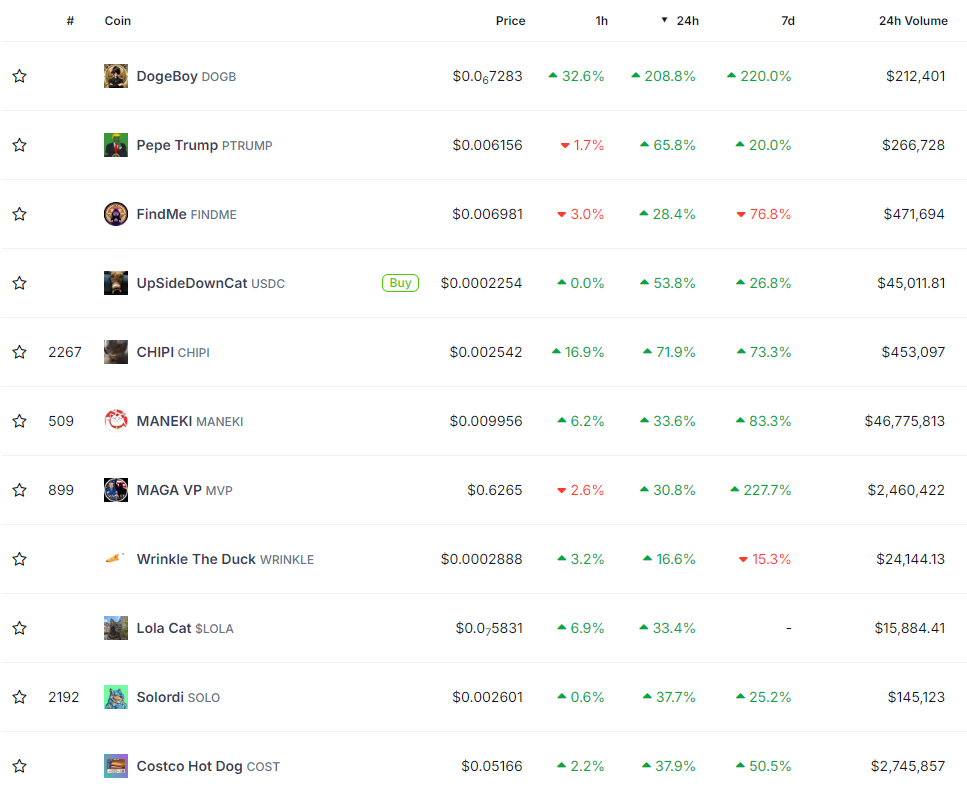

The best performance in the period was registered by DogeBoy (DOGB), with a nearly 210% upside, while Pepe Trump (PTRUMP) also saw significant positive movement of 67.5%. Maga VP (MVP), another Trump-themed token, is also among the biggest winners in the period, presenting almost a 31% price advance.

On the cat-coins front, MANEKI has shown 34% growth in the past 24 hours at the time of writing, a movement that made its market cap surpass $91 million. UpSideDownCat (USDC) surged almost 54% in the same period, and the cat Chipi (CHIPI) showed a 72% upside.

Solana meme coins with the best performances in the last 24 hours. Image: CoinGecko

Solana meme coins with the best performances in the last 24 hours. Image: CoinGeckoThe Costco Hot Dog (COST), a meme coin that backpacked the meme of hot dogs sold at Costco markets never rising in value, has risen 38% at the time of writing. The meme coin FindMe shown in the image above was, in fact, a honey pot attack.

Honey pots are smart contracts programmed to forbid tokens from being sold, while the contract deployer drains all the liquidity. Currently, the only FindMe pool available has $231 in liquidity, which highlights the risks of trading meme coins.

Moreover, despite showing a 33% growth in the last 24 hours, the token Lola Cat (LOLA) is still relatively new to the meme coin market. Hence, the asset still doesn’t have a seven-day track record.

Solordi (SOLO) represents the dog-themed coins on the meme coins with the most substantial growth in the last 24 hours after leaping 37.7%.

Pump.fun explains the ‘exploit’

As reported by Crypto Briefing, a user used flash loans to manipulate token prices on Pump.fun, borrowing SOL from the money market Drift. However, the exploiter was able to move liquidity from Pump.fun’s pools, which would be possible only by using an authorized wallet.

Wintermute’s head of research Igor Igamberdiev identified that the wallet commonly used to move liquidity from Pump.fun to decentralized exchange Raydium was being controlled by the exploiter, suggesting a private key compromise or an inside job.

In their post-mortem, the meme coin marketplace revealed that a former employee was responsible for the attack, and misappropriated nearly 12,300 SOL. Pump.fun tackled the issue by deploying their smart contracts again, launching pools with the whole they met in the bonding curve during the incident, and removing the platform fees for the next seven days.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

4 months ago

27

4 months ago

27