ARTICLE AD

With a 40% gain over the last month, profit-taking and waning buying pressure suggest a possible pullback for Solana price below the $200 mark.

Key Notes

A negative Balance of Power (BoP) of -0.43 and a rising funding rate indicate that Solana sellers are in control.SOL price could decline further if the support at $193.92 is breached.If Solana price manages to hold above key support levels, a rebound is possible, with the potential for the uptrend to retest its three-year high of $225.21.Over the past month, Solana price SOL $214.5 24h volatility: 3.6% Market cap: $101.41 B Vol. 24h: $11.44 B outperformed several cryptocurrencies surging past the crucial resistance of $200 and hitting a three-year high of $225. However, with nearly 40% gains on the monthly chart, the SOL price rally could halt amid the current profit-taking and waning buying pressure. Some on-chain metrics suggest that there’s a possibility of the pullback under $200 again.

As of press time, Solana (SOL) price is trading at $207 with a market cap of $97.6 billion, showing a 5% drop in the last 24 hours. However, during the same period, its trading volume has dropped by 22% to $9.38 billion.

This shows that the bullish sentiment for the fourth-largest has been waning in comparison to the previous week. As a result, the bears could charge in further weakening the SOL rally ahead.

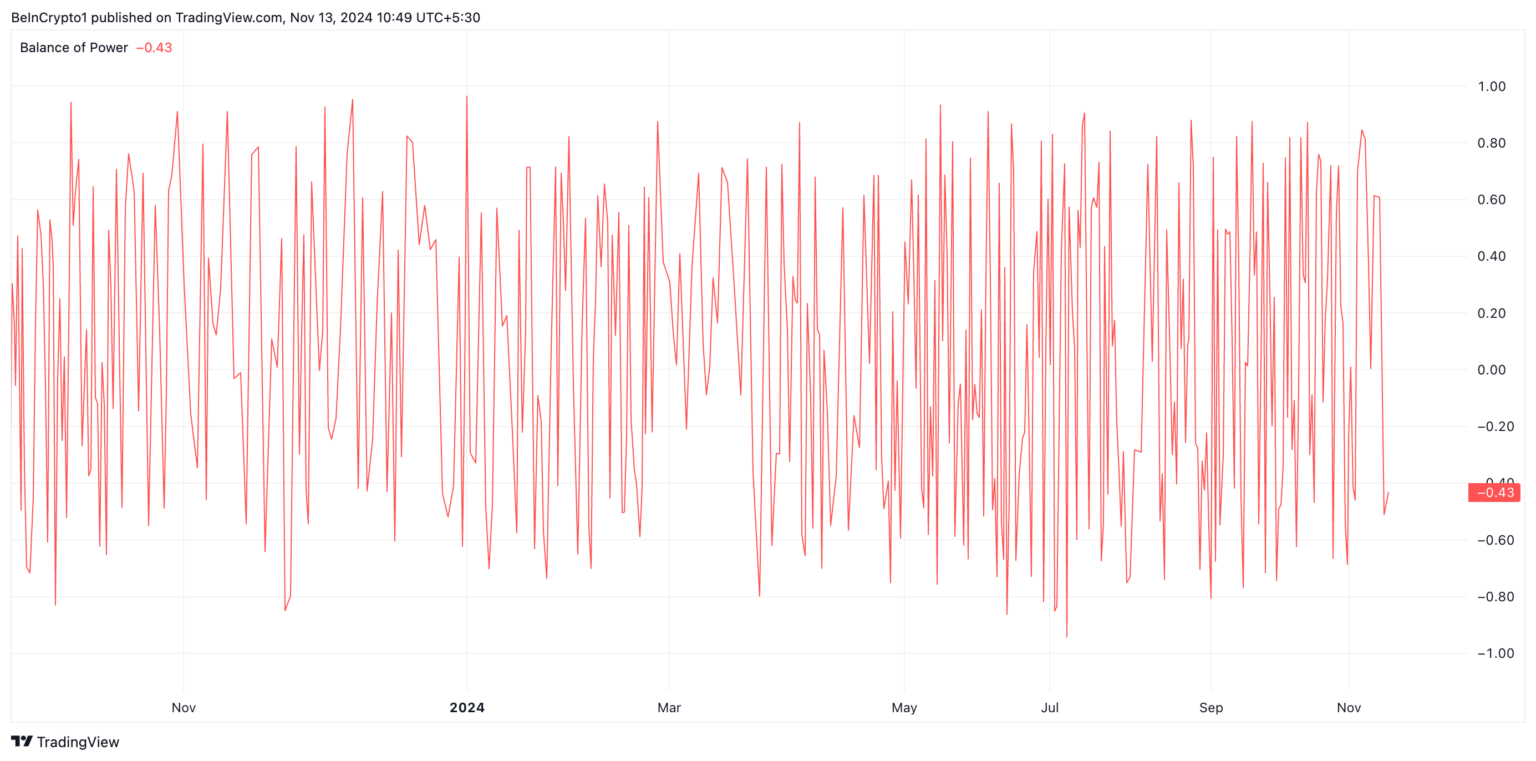

Additionally, Solana’s negative Balance of Power (BoP) aligns with the bearish outlook. Currently, at -0.43, this indicator gauges the strength of buyers versus sellers. A negative BoP indicates that sellers are in control and likely driving the asset’s price lower.

Courtesy: TradingView

Where Is Solana Price Heading Next?

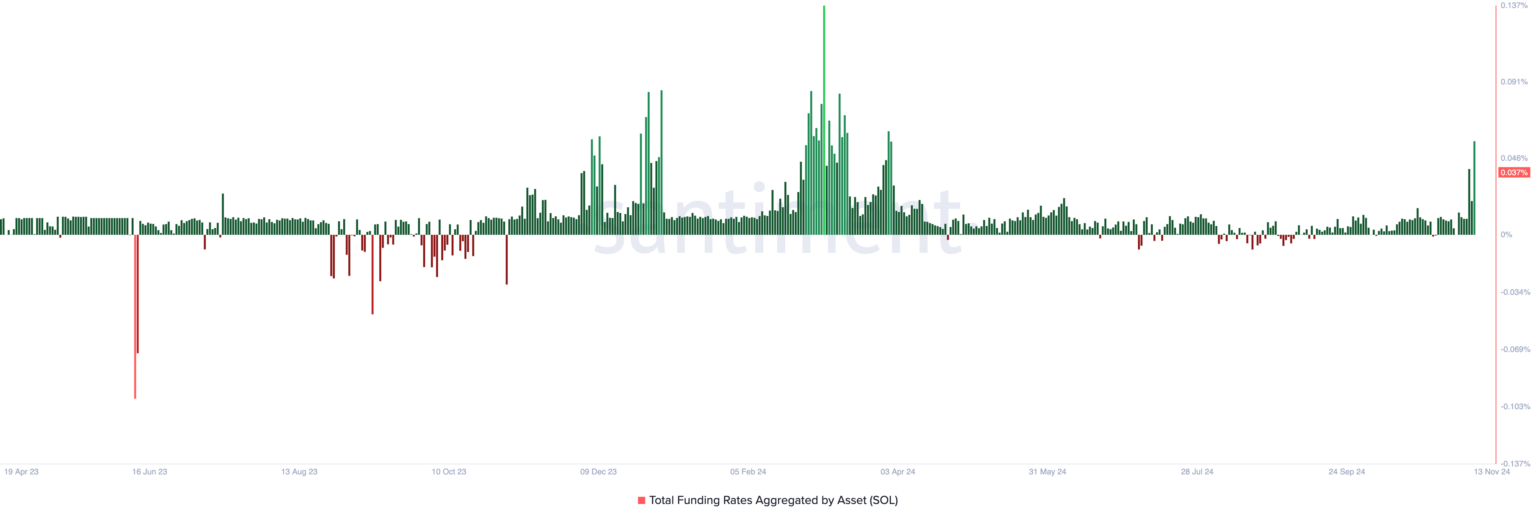

The Solana funding rate also suggests the chances of a continued pullback taking the SOL price under the $200 mark. Currently, the SOL funding rate has touched its eight-month high of 0.037%.

Courtesy: Santiment

The funding rate is a tool in perpetual futures contracts designed to maintain alignment between the contract price and the spot price of the underlying asset. A sharp spike in the funding rate typically signals a significant market imbalance, usually with buyers dominating. This is considered a bearish indicator, suggesting a potential price pullback is imminent.

At the time of writing, SOL is priced at $202.51, remaining slightly above its support level of $193.92. Rising selling pressure could push the price to test this key support. If the bulls fail to defend this level, it would confirm the downtrend, potentially driving SOL further down toward $169.36.

Courtesy: TradingView

Conversely, a robust defense of this support level could trigger a rebound, sparking a renewed rally in Solana’s price. If successful, SOL’s uptrend could gain enough momentum to challenge its three-year high of $225.21.

On the other hand, the Solana blockchain has been hitting important milestones recently. Recently, Solana overtook Ethereum over DEX trading volumes, which hit a record high after mid-April.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Solana (SOL) News, Altcoin News, Cryptocurrency News, News

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

1 week ago

8

1 week ago

8