ARTICLE AD

Recently, the crypto community saw the surge of a new memecoin frenzy with celebrity-endorsed cryptocurrencies. The Solana-based tokens registered massive gains but became pump-and-dump scams in most cases.

Nearly two months later, most of these tokens’ prices decreased significantly from their all-time high days. However, the MOTHER community, one of the best-performing celebrity memecoins, defended their crypto champion against the criticism.

The Rise Of Solana-Based Celebrity Memecoins

In late May, Olympian and reality TV star Caitlyn Jenner launched her Solana-based JENNER token. The news surprised the crypto community, which initially suspected the gold medalist had been hacked.

Jenner was later joined by rapper Rich The Kid and his RICH token. Both memecoins were received with suspicion by the community and were immediately investigated.

Users quickly pointed out that the orchestrator behind the memecoins was a “crypto influencer” named Sahil Arora. Arora was known to be an alleged serial scammer who had previously launched several tokens, including influencer memecoins.

Per the reports, these tokens resulted in a pump-and-dump scam that left most investors empty-handed. Jenner initially confirmed working with the alleged scammer but eventually cut all associations.

After Jenner, several other celebrities launched tokens with Arora’s help, including Lil Pump, Davido, Trippie Red, and MoneyBagg Yo. Australian rapper Iggy Azalea was also linked to Arora’s scam during the launch of her Mother Iggy (MOTHER) token.

Despite the allegations, Azalea assured her followers that she joined the crypto community and launched MOTHER to prevent Arora’s attempts to use her likeness to scam people.

Since then, the industry has seen many more celebrity token launches, some linked to Arora and some being alleged hacks. The list includes the likes of Metallica, Andrew Tate, Hulk Hogan, 50 Cent, and more.

Many celebrity tokens launched in the last two months registered massive price increases. JENNER saw a 51,000% surge to its ATH, while MOTHER increased by 5,552%.

MOTHER’s performance in the weekly chart. Source: MOTHERUSDT on TradingView

MOTHER’s performance in the weekly chart. Source: MOTHERUSDT on TradingView

The Fall Of Celebrity Tokens

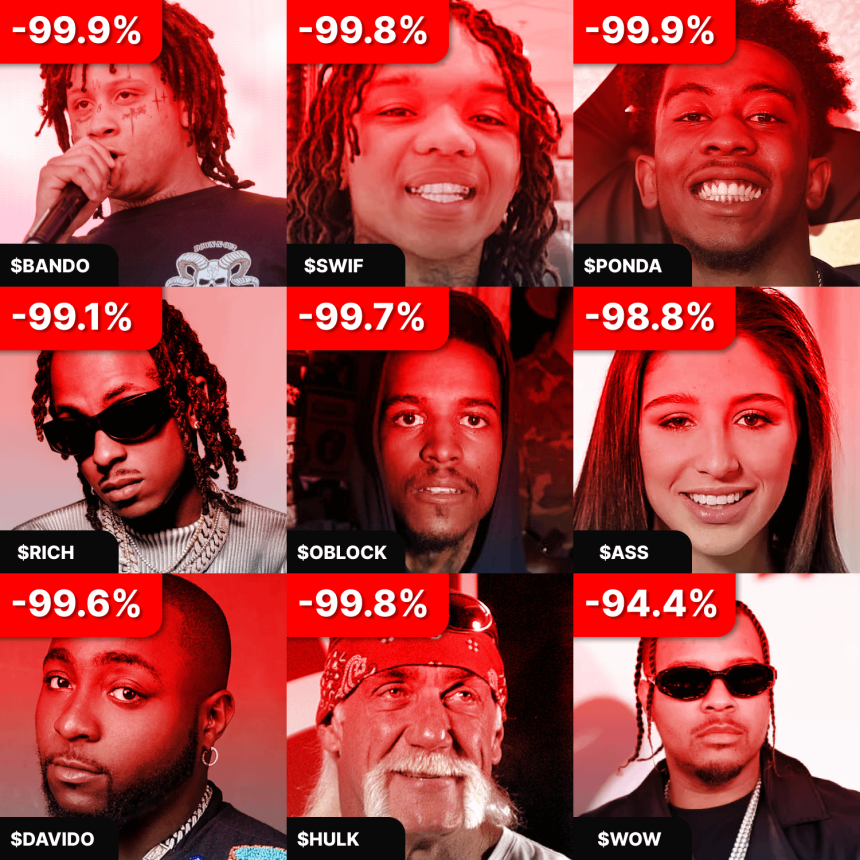

Online reports revealed that the 30 Solana celebrity memecoins launched since May dropped by an average of 94%. According to Web3 strategist Slorg, even the best-performing celebrity tokens “are down more than 70%” from their ATH prices.

Andrew Tate-inspired DADDY crowns itself as the smallest loser among the tokens, with a 73.2% decrease. Meanwhile, JENNER and MOTHER follow closely with a 75% and 78.7% drop.

Just a month into their lifespan, “exactly half are down over 99%, with 7 others being down more than 90%.” Additionally, 22 of the 30 tokens have a market capitalization under the $1 million mark, and only 4 have a market cap above $10 million.

Celebrity tokens are down 94% a month after launching. Source: Slorg on X

Celebrity tokens are down 94% a month after launching. Source: Slorg on X

While most of the tokens have been abandoned, some celebrities still endorse their tokens, occasionally posting about them. But with “only 40% tweeting about the token at least once in the last week, most have followed the same trajectory of an initial pump, and then nothing.”

Some community members called the celebrity meta “pure exploitation, engagement farming their fan base.” However, the MOTHER community defended the token after the report.

An X user stated that “Iggy should be included in this group” as she seems to be “working her ass off, hasn’t sold a single token, spends hours communicating with holders.” Another user considers MOTHER’s launch “an example of what we would hope for from a celebrity.” They asserted that the token “would be a great blueprint to follow.”

As of this writing, MOTHER has seen a 23.1% drop in the last 24 hours, trading at $0.059. Its current price, however, represents a 103.6% increase in the weekly timeframe.

Featured Image from Wikipedia.com, Chart from TradingView.com

4 months ago

30

4 months ago

30