ARTICLE AD

Recently, a popular crypto trader and YouTuber has predicted a substantial surge in Solana price, forecasting it could reach as high as $360 soon.

This prediction is underpinned by a technical pattern on Solana’s chart—a bullish signal suggesting a potential reversal from bearish to bullish momentum.

Technical Insights Into SOL Potential $360 Rise

According to the trader, CryptoJack on X, SOL has developed a “rounding bottom pattern” over an extended period, indicating it is on the brink of a significant breakout.

Notably, the ’rounding bottom’ pattern, characterized by a gradual decline followed by a stabilizing trend and an upward breakout, is a classic bullish indicator in technical analysis.

CryptoJack’s analysis points out that Solana is setting up for a significant uptick, aiming for a price target double its current value of approximately $146.

Solana formed a rounding bottom pattern over many weeks and is primed for an explosion any moment now.

I entered a Long position on $SOL and expect it to break ATHs this year! #Solana pic.twitter.com/ApUazaXXz5

— CryptoJack (@cryptojack) May 8, 2024

Not only does CryptoJack see a bright future for Solana, but other analysts, such as Altcoin Sherpa, also maintain a bullish stance, with projections of the token potentially surpassing $500 this year.

This would represent a 300% increase from its current level, adding to the 589% growth it has already achieved year-to-date.

Solana Challenges Ethereum

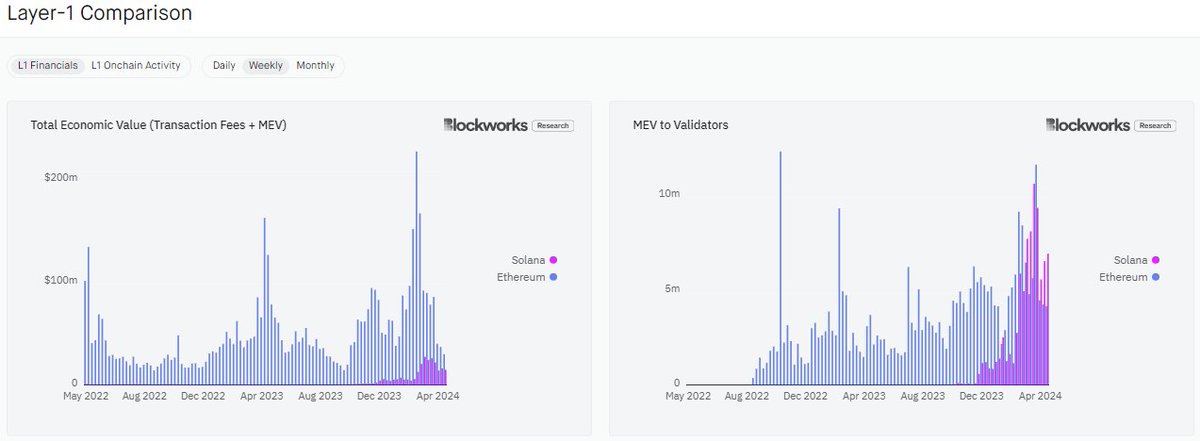

While Solana has shown notable growth, some of its key metrics are also beginning to keep up the pace. Dan Smith, a senior research analyst at Blockworks, suggests that Solana could soon surpass Ethereum regarding transaction fees and capture Maximal Extractable Value (MEV).

Smith’s analysis of X highlights that Solana’s total economic value is nearing Ethereum’s, indicating its increasing relevance in the blockchain space.

Solana will flip Ethereum in transaction fees + captured MEV this month, maybe even this week

— Dan Smith (@smyyguy) May 7, 2024

Despite this competition, Ethereum maintains a significant lead in daily transaction fees and total value locked (TVL). In the last 24 hours, Ethereum generated over $2.75 million in fees, compared to Solana’s $1.49 million.

Solana vs Ethereum transaction fees. | Source: Dan Smith on X

Solana vs Ethereum transaction fees. | Source: Dan Smith on X

Moreover, according to data from DeFillama, Ethereum’s TVL of over $53 billion dwarfs Solana’s $3.96 billion, representing just about 7.2% of Ethereum’s scale.

Meanwhile, Ethereum does not come close to Solana in terms of market performance. Solana has seen quite outstanding growth in the past year, surging by over 500%. On the other hand, Ethereum has only seen a 66% surge over the same period.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

8 months ago

42

8 months ago

42