ARTICLE AD

According to local media reports in Japan, Sony Bank announced its foray into the stablecoin world, launching a trial to issue its fiat-linked digital currency. In collaboration with blockchain company SettleMint, one of the most notable aspects of the pilot program is that the trial will take place on the Polygon blockchain.

Sony Bank’s Strategic Move

Sony Bank’s move to explore stablecoin issuance highlights the company’s strategic focus on leveraging blockchain technology and digital assets to increase its financial services offerings.

By pegging the stablecoin to traditional fiat currencies such as the Japanese yen, Sony Bank aims to reduce transaction fees and facilitate instant payments and remittances for individuals and businesses.

Jun Watanabe, president and representative director of Sony Network and founder of the Web3 platform Astar Network, expressed the company’s ambitious plans, stating:

Sony Bank plans to launch a stablecoin, and Sony plans to launch a blockchain with us. It is getting ready.

Furthermore, Watanabe emphasized the potential of leveraging existing assets and services, rather than starting from scratch, as the most effective means of bringing billions of users into the Web3 ecosystem.

This latest development aligns with Sony’s ongoing efforts to embrace blockchain technology and Web3 applications. Last year, Bitcoinist reported that Sony Network Communications partnered with Japanese Web3 technology company Startale Labs to support the advancement of Startale’s services and product development.

The partnership focused on developing all-in-one solutions for Web3 development and prioritizing integrating real-world assets into the decentralized ecosystem.

While Polygon has refrained from making detailed statements about the partnership as of this writing, the project’s reposting of the collaboration announcement on social media site X (formerly Twitter) reaffirms its support for the initiative.

Polygon’s Stablecoin Market Cap Surpasses $1.5 Billion

As of the latest data from DefiLlama, the Polygon blockchain has established a stablecoin market capitalization of $1.511 billion. Over the past week, however, there has been a slight decline of 1.44% in the market capitalization.

On the other hand, Tether’s USDT stablecoin continues to dominate the stablecoin market with a commanding 52.16% market share.

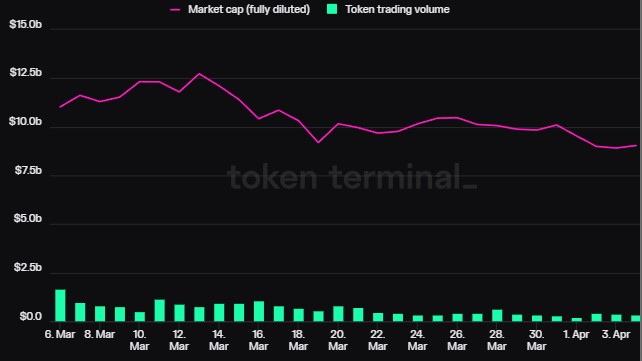

Token Terminal data also reveals additional metrics highlighting Polygon’s performance. The fully diluted market capitalization, representing the maximum potential value of the tokens in circulation, stands at $9.04 billion, reflecting a 13.0% decrease over the past 30 days.

Polygon’s market cap and token trading volume performance over the past month. Source: Token Terminal

Polygon’s market cap and token trading volume performance over the past month. Source: Token Terminal

Meanwhile, the circulating market capitalization, which considers the active circulation tokens, is valued at $8.93 billion, showing the same 13.0% decrease.

On the trading front, Polygon’s native token MATIC has seen a positive trend in token trading volume over the past 30 days. The trading volume during this period amounted to $19.66 billion, marking a notable increase of 13.1%.

MATIC is experiencing a lack of bullish momentum, coinciding with the overall market’s price correction. The cryptocurrency trades at $0.8824, representing a 3.5% price decline in the past 24 hours.

Notably, MATIC stands among the few largest cryptocurrencies that have witnessed year-to-date negative figures, with a 22.8% price decline over this period, according to CoinGecko data.

Featured image from Shutterstock, chart from TradingView.com

9 months ago

55

9 months ago

55