ARTICLE AD

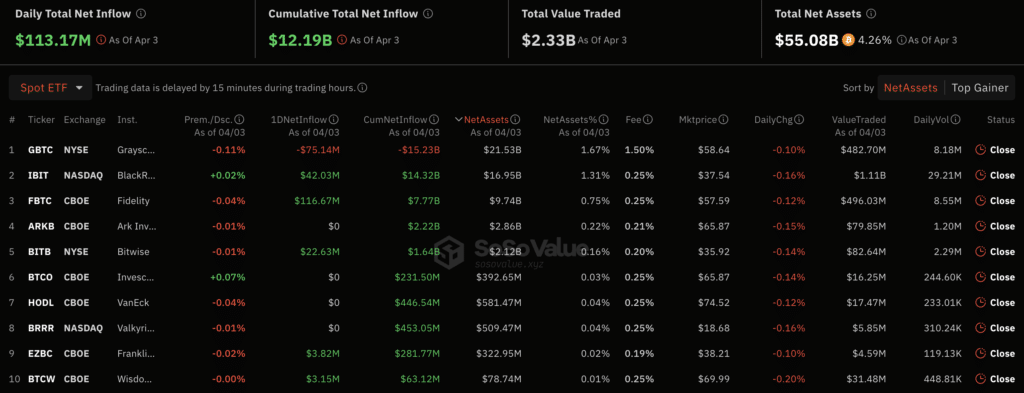

On April 3, net daily capital inflows in the spot Bitcoin ETF sector reached over $113 million.

According to SoSo Value, capital inflows have picked up significantly after falling into the red zone. The leader in the influx of funds is Fidelity’s spot Bitcoin ETF (FBTC), which ended at $116.6 million. Following Fidelity’s offering is iShares Bitcoin Trust (IBIT), which logged $42 million.

Source: SoSo Value

Source: SoSo Value

Capital outflows from the Grayscale Bitcoin Trust ETF (GBTC) reached $75.1 million, a new low from the end of February.

On April 2, net outflows from the ARK Invest (ARKB) Bitcoin ETF reached $87.5 million, surpassing GBTC for the first time. The total net inflow into spot Bitcoin ETFs amounted to $40.3 million. Most of the inflow came from the BlackRock fund, which received another $150 million. In second place was Fidelity, which notched $44 million.

Negative dynamics were observed in GBTC, as the fund has led outflows since the launch of spot BTC ETFs in the American market in January of this year. The total figure has since already broken the $15 billion mark.

Seeing some of CT up in arms over $ARKB having an outflow day, which really shows the greedy and short-sighted nature of some of the folks in this space tbh. Pls let me offer some perspective:

1. ETFs see outflows, even Vanguard's, it's part of life, but overall they tend to be… https://t.co/hnFQUy3BaY

However, the dynamics of outflows in the spot Bitcoin ETF market began to change. According to the day’s results, $87.5 million flowed out of ARKB, while $81.9 million flowed out of GBTC.

The rash of outflows began on the first day of April when investors withdrew around $300,000 from the ARK Invest fund.

7 months ago

47

7 months ago

47