ARTICLE AD

In an attempt to reverse its fortunes, Grayscale revealed its plan to launch an innovative low-cost version of its GBTC fund named “Grayscale Bitcoin Mini Trust” with just 0.15% fees.

Despite a volatile pre-halving week, spot-traded Bitcoin exchange-traded funds (ETFs) in the United States seem to be regaining investors’ trust. Data from SoSoValue indicates that, after five consecutive days of net outflow, these ETFs recorded net inflows again on Monday, April 22nd, 2024.

Spot Bitcoin ETFs saw just a $62 million inflow on Monday. The Fidelity Wise Origin Bitcoin Fund (FBTC) attracted the highest single-day net inflow of $34.83 million. Other prominent funds like ARK 21Shares Bitcoin ETF saw over $22.5 million in inflows. The iShares Bitcoin Trust experienced a solid $19.65 million inflow.

While most of the spot Bitcoin ETFs experienced inflows, Grayscale Bitcoin Trust ETF (GBTC), known for significant withdrawals previously, continued this pattern with a net outflow of around $35 million. However, it’s crucial to acknowledge that despite Grayscale’s outflow, the overall net inflow for spot Bitcoin ETFs remains positive.

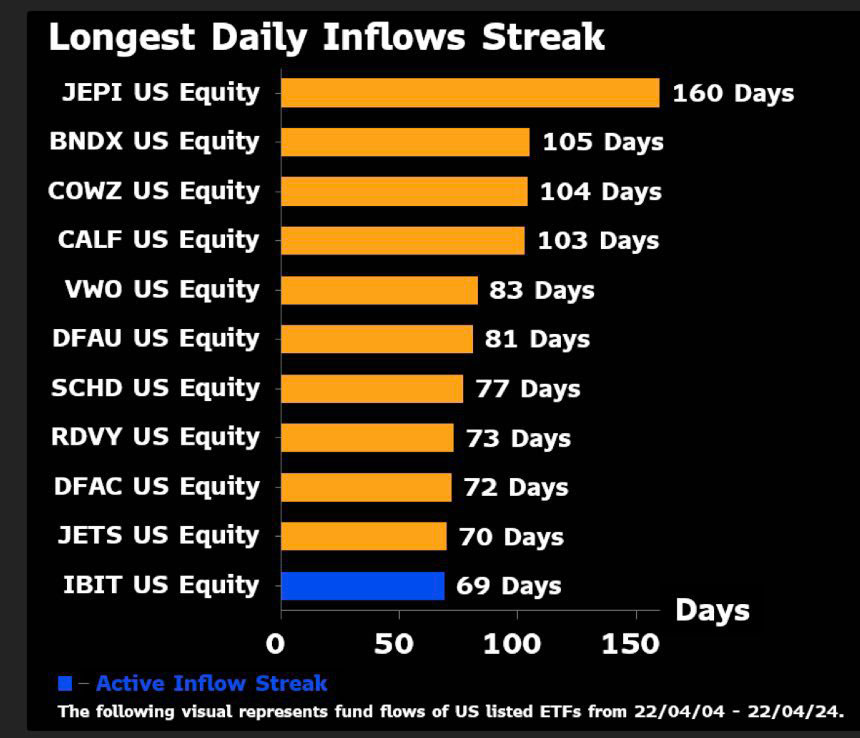

BlackRock’s IBIT Maintains 69-Day Inflow Streak

BlackRock’s iShares Bitcoin Trust ETF (IBIT) has consistently captured investors’ attention, drawing an impressive streak of 69 consecutive days of net inflows as of April 23, 2024. This remarkable streak positions IBIT on the verge of securing a place among the top 10 Exchange-Traded Funds with the lengthiest daily inflow periods.

Photo: Bloomberg

In April, IBIT experienced a noteworthy daily average inflow of $223.4 million. Remarkably, the maximum inflow reached a substantial $849 million, while the minimum stood at $18 million. This range shows a commendable level of investor engagement.

Fidelity’s FBTC does not perform as well as IBIT but still reflects a positive investor outlook. The fund attracted an average inflow of $118 million in April, with a peak inflow of $473 million. However, it’s important to note that FBTC had zero inflows on three separate days in April.

Grayscale Bitcoin Trust’s struggles persist, marking an opposite trajectory from BlackRock’s IBIT. The past quarter saw massive Bitcoin outflows from GBTC, totaling nearly 300,000 coins. April alone witnessed outflows exceeding $1.6 billion – a stark contrast to IBIT’s inflows during that time.

Grayscale Seeks Redemption with “Mini Bitcoin ETF”

In an attempt to reverse its fortunes, Grayscale revealed its plan to launch an innovative low-cost product titled “Grayscale Bitcoin Mini Trust”. This fresh offering stands out with its minimal expense ratio of merely 0.15%, potentially positioning it as the cheapest Bitcoin ETF focused on spot market exposure.

GBTC’s substantial 1.5% fee likely discouraged investors, especially when compared to more affordable options from BlackRock and Fidelity. Therefore, the low-cost “Grayscale Bitcoin Mini Trust”. With a 0.15% fee, addresses Grayscale’s difficulties by enhancing competitiveness through revised product offerings.

The launch of the Bitcoin Mini Trust, with its disruptive fee structure, signifies Grayscale’s determination to regain its market share and attract new inflows. However, only time will tell if this strategy proves successful in the face of strong competition from established players in the Bitcoin ETF landscape.

7 months ago

33

7 months ago

33