ARTICLE AD

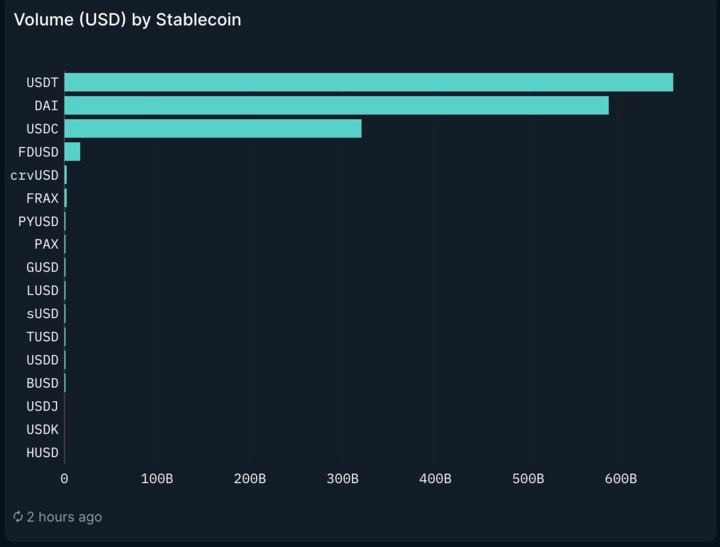

USDT, USDC, and DAI have accumulated over $1.3 trillion over the last 30 days in trading volume on EVM-compatible chains alone.

The three largest stablecoins by market cap have processed over $1.3 trillion in transactions in dollar terms in the past 30 days. According to data from an on-chain specialist at analysis platform Nansen, this is more than Visa’s monthly average in 2023, which was $1.2 trillion.

Tether USD (USDT), the largest stablecoin by market cap, processed $654 billion in transactions in the last 30 days, while over $394 billion was transacted using MakerDAO’s DAI. USD Coin (USDC) got third place, reporting $321 billion in trading volume during the same period.

Image: Nansen

Image: NansenVisa reported $12.3 trillion in payment volume last year, which puts its monthly average at $1.2 trillion. However, Nansen data only tracks stablecoin trading volume for networks compatible with the Ethereum Virtual Machine (EVM). Therefore, the stablecoin trading volume for the past 30 days could be higher, since it doesn’t account for blockchains such as Solana.

The total market cap of the five largest stablecoins on EVM-compatible chains nears $83 billion, with a $1.5 billion increase over the past 30 days. Moreover, investors labeled as “smart money” by Nansen have been growing their stablecoin holdings since April 8, as the proportion of these assets in their wallets grew from 4.1% to 5.3% at the time of writing.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

8 months ago

46

8 months ago

46