ARTICLE AD

Eric Jardine, Chainalysis’s Cybercrimes Research Lead, said that as local currencies lose value, people increasingly adopt USD-pegged stablecoins.

Key Notes

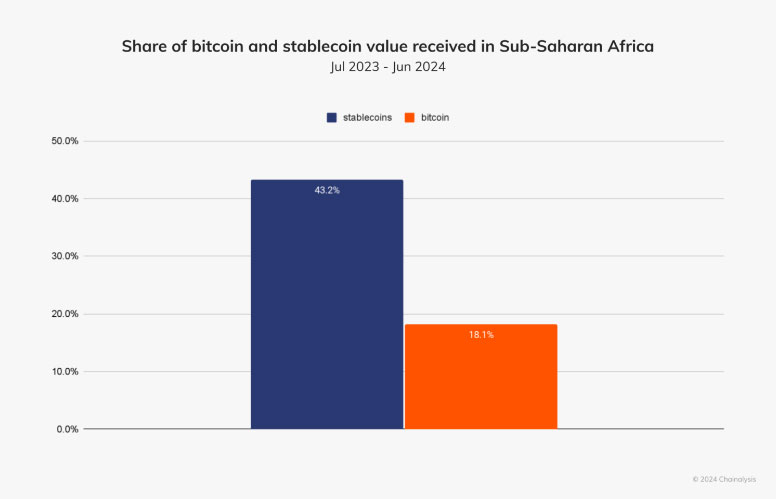

Stablecoins now make up 43% of crypto transactions in Sub-Saharan Africa due to local currency devaluation.Nigeria and Ethiopia report massive growth in stablecoin usage as individuals and businesses seek financial stability.Institutions in South Africa prefer stablecoins over Bitcoin for better liquidity management and reduced currency volatility.Stablecoins are experiencing a major shift, now comprising 43% of crypto transactions in Sub-Saharan Africa. This significant growth is mainly due to the devaluation of local currencies, prompting individuals and businesses to seek more stable financial options. A Chainalysis report from October 2, 2024, indicates that this trend is most evident in areas facing significant economic instability.

Photo: Chainalysis

Frequent currency devaluations drive the transition to stablecoins, which are usually linked to stronger currencies like the US dollar. Eric Jardine, Chainalysis’s Cybercrimes Research Lead, explains that as local currencies lose value, people increasingly adopt USD-pegged stablecoins.

“What this means is that it is reasonable to assume that stablecoin adoption will grow rapidly whenever local currencies lose their value, but that stablecoin use can also grow fast outside of these circumstances,” said Jardine.

Stablecoins Empower Africa’s Economies

Nigeria has become a significant force in global crypto adoption, not just within Africa. From July 2023 to June 2024, the country saw approximately $59 billion in crypto transactions. Most of these transactions were under $1 million, highlighting the prevalence of both individual and professional trades. Notably, the smaller, frequent transactions are increasingly popular, highlighting the everyday usefulness of cryptocurrencies in financial activities.

Photo: Chainalysis

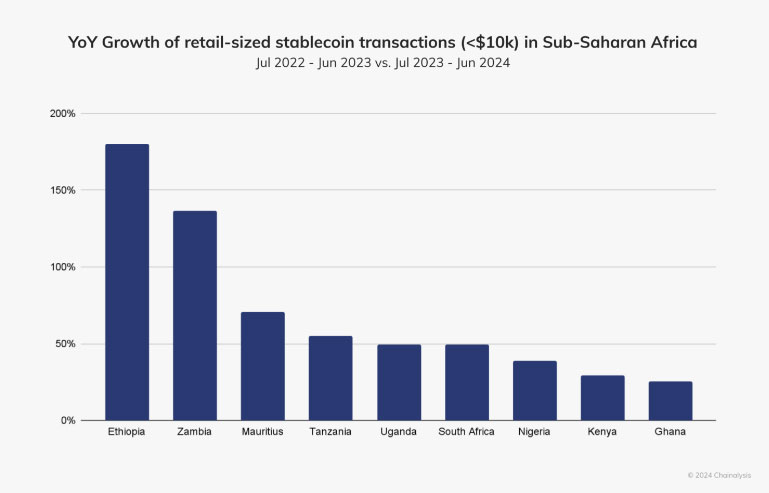

Similarly, Ethiopia is experiencing a swift rise in stablecoin usage, especially among consumers, with a 180% increase compared to the previous year. This growth followed the Ethiopian government’s July decision to ease currency restrictions to obtain support from the International Monetary Fund (IMF). Consequently, the Ethiopian birr (ETB) depreciated by 30%.

Chris Maurice, CEO of the African crypto exchange Yellow Card, emphasizes the importance of stablecoins in overcoming local financial challenges. He explains,

“As the naira depreciates, we can see a rise in stablecoin inflows for transactions under $1 million, with more pronounced activity during periods of significant currency devaluation.”

Institutional Shift from Bitcoin to Stablecoins

The shift towards stablecoins is also evident among institutional clients in South Africa, as noted by Rob Downes of Absa Group. He remarks on the pivotal role of stablecoins in liquidity management and reducing exposure to currency volatility, calling them a “game changer”. This shift aligns with the fact that stablecoins have now surpassed Bitcoin as the most commonly received cryptocurrency in the country.

The adoption patterns in Africa offer valuable insights into the practical applications of cryptocurrencies globally. Africa’s experiences with real-world crypto use cases could position the continent as a leader in the global crypto landscape, suggesting that the lessons learned here could be instrumental for broader global adoption.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Altcoin News, Cryptocurrency News, News

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

1 month ago

16

1 month ago

16