ARTICLE AD

Starknet's new staking feature allows for greater community control and network decentralization.

Key Takeaways

Starknet's governance vote passes STRK token staking for late 2024. Staking features include a 21-day withdrawal time-lock and a balance between rewards and inflation. <?xml encoding="UTF-8"?>Starknet token holders have ratified a proposal to implement staking on the Layer 2 network, marking a significant milestone in the platform’s development and governance.

The proposal, dubbed “SNIP 18” and submitted by core developer StarkWare, received overwhelming support in a recent vote conducted on Snapshot’s new decentralized Snapshot X platform. Of the participating voters, 98.94% voted in favor of implementing staking, while 0.45% abstained, and 0.61% voted against it.

Staking mechanism for STRK

The approved staking mechanism will allow STRK token holders with a minimum of 20,000 tokens to become stakers, while others can delegate their tokens. StarkWare CEO Eli Ben-Sasson emphasized the significance of this development, stating that his was a “historic milestone” for the chain’s development towards full decentralization.

“As one of the first Layer 2s to offer this opportunity to its token holders, we are moving closer to having a network that is fully operated and run by the community for the community,” Ben-Sasson shares.

The staking implementation is slated to go live on testnet soon, with a mainnet launch expected in the fourth quarter of this year. This timeline presents an urgent opportunity for STRK holders to prepare for participation in the network’s staking ecosystem.

Unique minting mechanism

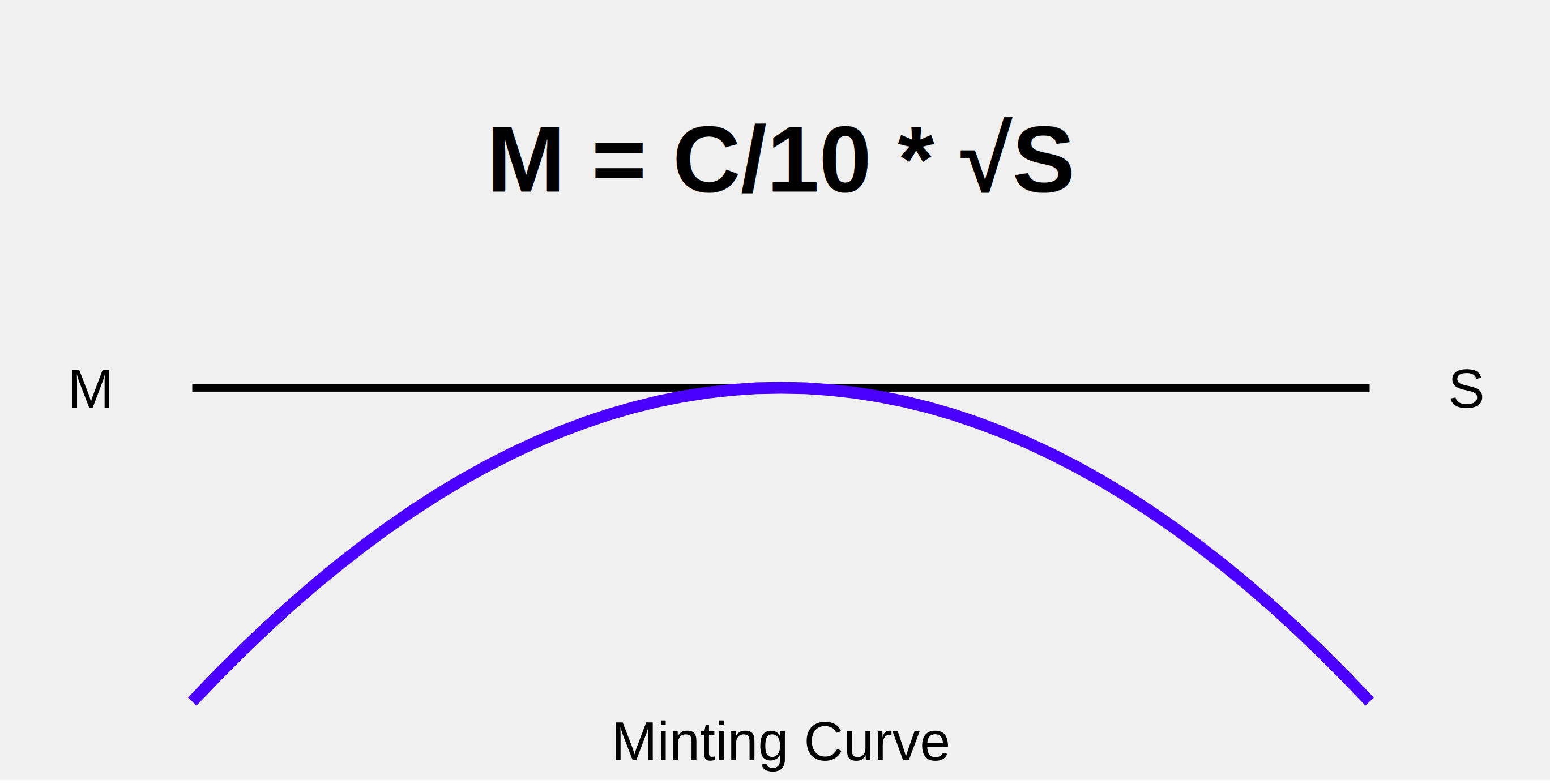

A key component of the approved proposal is the minting mechanism, which aims to balance staker rewards with inflation expectations. The mechanism utilizes a minting curve based on Professor Noam Nisan’s proposal, defined by the formula M = C/10 * √S, where S represents the staking rate as a percentage of total token supply, M is the annual minting rate, and C is the maximum theoretical inflation rate.

Minting Curve illustration. The blue curve represents how the minting rate (M) changes as the staking rate (S) increases. This shows how, as more tokens are staked, the minting rate increases, but at a decreasing rate due to the root function. Image generated from Claude 3.5 Opus.

Minting Curve illustration. The blue curve represents how the minting rate (M) changes as the staking rate (S) increases. This shows how, as more tokens are staked, the minting rate increases, but at a decreasing rate due to the root function. Image generated from Claude 3.5 Opus.Initially, the value of C will be set at 1.6, but the proposal includes provisions for future adjustments. Either a monetary committee created by the Starknet Foundation or the Foundation itself will have the authority to adjust C within a range of 1.0 to 4.0, based on staking participation rates.

To ensure transparency, any changes to the minting curve constant must be announced publicly on the community forum at least two weeks in advance, accompanied by a detailed justification.

Why stake STRK?

The introduction of staking carries significant implications for STRK token holders. It provides an opportunity for increased participation in network governance and the potential for earning rewards. However, the relatively low voter turnout of 0.08% of eligible voters underscores the need for greater community engagement in future governance decisions.

Looking ahead, Starknet plans to introduce additional governance features and responsibilities for stakers in phases. These may include potential roles in decentralizing the network’s sequencer and prover, further enhancing the platform’s commitment to decentralization. In recent news, the Starknet Foundation saw its former CEO Diego Oliva resign from the organization earlier in August.

Operating as a Layer 2 scaling solution for Ethereum, Starknet utilizes zero-knowledge STARK proofs to validate off-chain transactions, significantly increasing transaction throughput. The network boasts the capability to handle up to 100,000 transactions per second during peak times, potentially reducing transaction costs by a factor of 100 to 200.

Disclaimer

2 months ago

29

2 months ago

29