ARTICLE AD

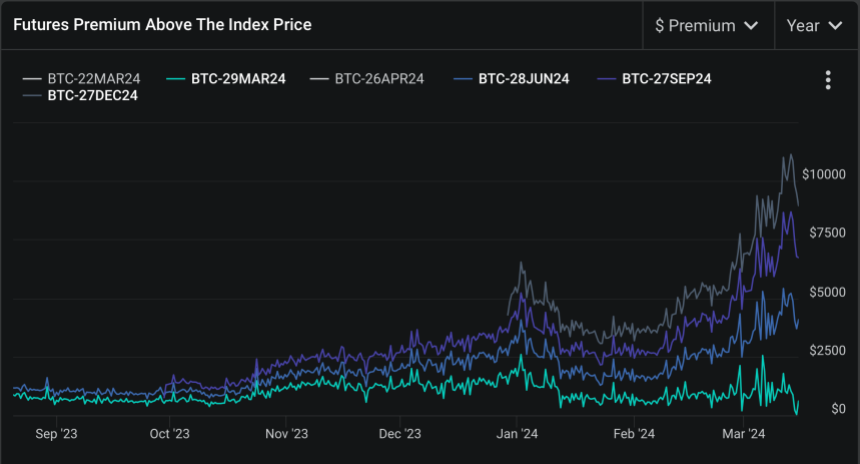

Bitcoin’s futures market is showcasing signs that have historically signalled bullish sentiment. Analysts are turning their attention to the Bitcoin futures basis—a metric representing the differential between the futures price of Bitcoin and its spot price.

Recent data has revealed that this basis has escalated to unprecedented levels since Bitcoin’s all-time high of $69,000 in November 2021.

Bullish Indications From Bitcoin Futures

Deribit’s Chief Commercial Officer, Luuk Strijers, has highlighted the current state of the Bitcoin futures basis, which ranges between 18% to 25% annually, a rate reminiscent of the market conditions in 2021.

According to Strijers’s comment, this elevated basis is not just a number but a lucrative opportunity for derivatives traders.

Bitcoin Futures Premium Above The Index Price. | Source: Deribit

Bitcoin Futures Premium Above The Index Price. | Source: Deribit

By engaging in trades that involve buying Bitcoin in the spot market and simultaneously selling futures contracts at a premium, traders can secure a “dollar gain” that will materialize at the contract’s expiry, irrespective of Bitcoin’s price volatility.

Strijers further noted that this strategy is particularly appealing in the current climate, fueled by the influx of new investments following the approval of Bitcoin ETFs and anticipation surrounding the Bitcoin halving event.

The significance of the heightened futures basis extends beyond the mechanics of derivatives trading. It further reflects broader market optimism, “bolstered” by recent regulatory approvals and macroeconomic factors influencing cryptocurrency.

The disparity between Bitcoin’s spot and futures prices suggests a confident market outlook, propelled by the anticipation of continued investment inflows and the impact of the upcoming Bitcoin halving.

Such conditions create a fertile ground for Bitcoin’s value to surge, as historical precedents have often linked bullish futures basis rates with periods of substantial price appreciation.

Market Sentiment And Halving Cycles

While Bitcoin’s current market performance exhibits a bearish trajectory, with a 3.9% dip bringing its price to $68,203, market analysts advise against interpreting this as a negative signal. Rekt Capital, a respected figure in crypto analysis, views the recent price correction as a “positive adjustment” preceding the much-anticipated Bitcoin halving in April.

Halving events, which reduce the block reward for miners, thus slowing the rate of new Bitcoin entering circulation, have traditionally catalyzed significant price rallies due to the resulting supply constraints.

Rekt Capital’s analysis parallels current market movements and historical patterns observed in previous halving cycles.

According to the analyst, despite the swift pace of these cycles, they exhibit a consistent sequence of a pre-halving rally followed by a retracement phase—both of which align with Bitcoin’s current trajectory. This cyclical perspective suggests that the recent dip is merely a temporary setback, setting the stage for the next bullish phase post-halving.

Though there are signs of BTC experiencing an Accelerated Cycle…

History still continues to repeat, nonetheless$BTC broke out into a “Pre-Halving Rally” right on schedule

And now, #Bitcoin is transitioning into its “Pre-Halving Retrace” right on schedule#Crypto https://t.co/Egqxs9ritl pic.twitter.com/lj0IdQtBEE

— Rekt Capital (@rektcapital) March 15, 2024

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

8 months ago

46

8 months ago

46