ARTICLE AD

Almost 70% of institutional investors in Ethereum (ETH) are participating in ETH staking, with 60.6% of them using third-party staking platforms.

Ethereum Staking Landscape At A Glance

According to a report by Blockworks Research, 69.2% of institutional investors holding Ethereum are engaged in staking the platform’s native ETH token. Of these, 78.8% are investment firms and asset managers.

Notably, slightly more than one out of five institutional investors – or 22.6% – of the respondents said that ETH or an ETH-based liquid staking token (LST) constitutes more than 60% of their total portfolio allocation.

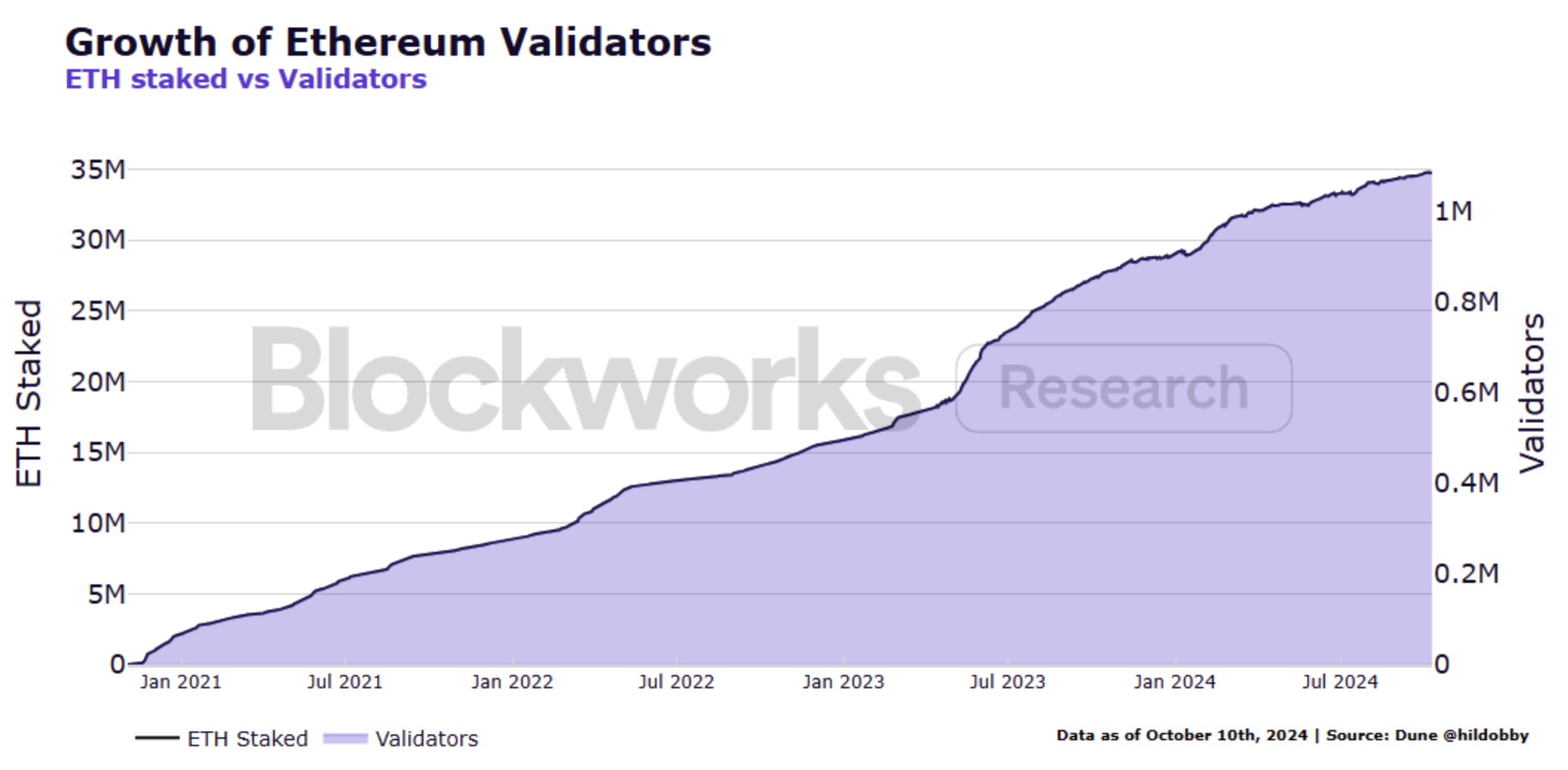

The report notes a seismic transformation in the Ethereum staking landscape since the network transitioned from a proof-of-work (PoW) to proof-of-stake (PoS) consensus mechanism during the Merge upgrade.

At present, there are close to 1.1 million on-chain validators staking 34.8 million ETH on the network. Following the Merge, Ethereum network participants were allowed to withdraw their ETH only after the Shapella upgrade in April 2023.

Source: Blockworks Research

Source: Blockworks Research

After the initial phase of ETH withdrawals, the network has seen steady inflows, indicating strong demand for ETH staking. At present, 28.9% of the total ETH supply is staked, making it the network with the highest dollar value of staked assets, valued at over $115 billion.

It’s worth noting that the annualized yield from staking ETH is around 3%. As more ETH is staked, the yield decreases proportionally. However, network validators can also earn additional ETH through priority transaction fees during periods of high network activity.

Third-Party Staking Overshadows Solo Staking

Anyone can participate in ETH staking, either as a solo staker or by delegating their ETH to a third-party staking platform. While solo staking gives the staker full control over their ETH, it comes with a high entry barrier of staking at least 32 ETH – worth more than $83,000 at current market price of $2,616.

Conversely, holders can stake with as little as 0.1 ETH through third-party stakers but must give up on some degree of control over their assets. Recently, Ethereum co-founder Vitalik Buterin stressed the need to lower entry requirements for ETH solo stakers to ensure greater network decentralization.

Currently, about 18.7% of stakers are solo stakers. However, the trend shows that solo staking is losing popularity due to the high entry threshold and the inefficiency of locked capital. The report explains:

Once locked in staking, ETH can no longer be used for other financial activities throughout the DeFi ecosystem. This means that one can no longer provide liquidity to a variety of DeFi primitives, or collateralize one’s ETH to take out loans against it. This presents an opportunity cost for solo stakers, who must also account for the dynamic network reward rates of staked ETH to ensure they are maximizing their risk-adjusted yield potential.

As a result, third-party staking solutions are becoming more popular among ETH stakers. However, such platforms – dominated by centralized exchanges and liquid staking protocols – raise concerns about network centralization.

Close to 48.6% of ETH stakers leveraging third-party staking platforms are using just one integrated platform such as Coinbase, Binance, Kiln, and others.

The report highlights key factors driving institutional investors to use third-party platforms, including platform reputation, supported networks, pricing, ease of onboarding, competitive costs, and platform expertise.

Although the Ethereum staking ecosystem is evolving, this growth has not yet been reflected in ETH’s price. ETH has significantly underperformed against BTC for an extended period, only recently gaining traction after the US Federal Reserve’s (Fed) decision to cut interest rates.

Nonetheless, some crypto research firms remain optimistic about ETH’s potential comeback against BTC later this year. As of press time, ETH is trading at $2,616, up 0.8% in the past 24 hours.

ETH trades at $2,616 on the daily chart | Source: ETHUSDT on TradingView.com

ETH trades at $2,616 on the daily chart | Source: ETHUSDT on TradingView.com

Featured image from Unsplash, Charts from Blockworks Research and Tradingview.com

1 month ago

15

1 month ago

15