ARTICLE AD

In its latest report, Sweden’s Riksbank stressed the necessity for extensive technical and regulatory development to ensure secure offline payments with e-kronas.

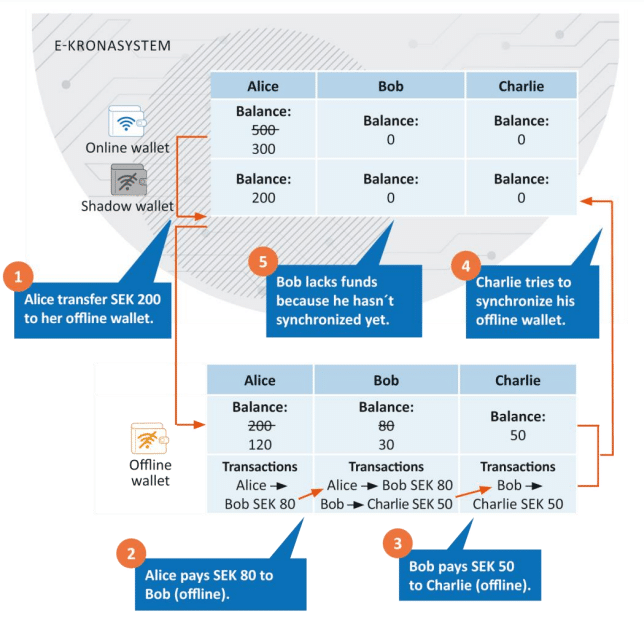

Sweden’s central bank, Riksbank, cautioned in its recent research note on CBDCs about the potential risks associated with unsynchronized data in offline payments. Highlighting the importance of synchronizing offline transactions with online balances, the bank addressed concerns regarding liquidity risks stemming from shadow wallets, and intermediary nodes that facilitate connections between offline and online wallets.

The risk becomes apparent when multiple users engage in consecutive offline transactions without proper synchronization. For instance, when individuals add CBDCs to their offline wallets, it’s crucial for the system to align this balance with their online counterparts. However, if users spend CBDCs offline, discrepancies emerge between the offline and online balances, resulting in reduced funds for recipients.

Liquidity problems in CBDC synchronization | Source: Riksbank

Liquidity problems in CBDC synchronization | Source: Riksbank

If a recipient attempts to synchronize their wallet after receiving CBDCs from an offline transaction but finds that the sender hasn’t synced their wallet, they face usability issues, the central bank explains, adding that this gap in security underscores the importance of sender synchronization to make funds available for recipients.

To tackle these challenges, Sweden’s central bank is exploring potential solutions, such as establishing liquidity pools for payments or imposing restrictions on offline CBDC usage. For instance, CBDCs received offline may only become available for offline transactions once synchronization occurs. However, the feasibility of these solutions remains uncertain, pending further analysis by the Riksbank.

While the central bank recently concluded its pilot of the e-krona solution, no decisions have been made regarding the issuance of a digital currency or the choice of technology.

8 months ago

32

8 months ago

32