ARTICLE AD

THERE appears to be no respite yet for the Nigerian currency as it has been listed among the worst-performing currencies in Sub-Saharan Africa in 2024.This is according to the latest edition of Africa’s Pulse, a new report by the World Bank.

As of the end of August 2024, the naira had depreciated by approximately 43 per cent year-to-date, making it one of the region’s weakest currencies alongside the Ethiopian birr and South Sudanese pound.

The naira’s depreciation is attributed to several factors, including surging demand for United States dollars in the parallel market, limited dollar inflows, and delays in foreign exchange disbursements by the Central Bank of Nigeria.

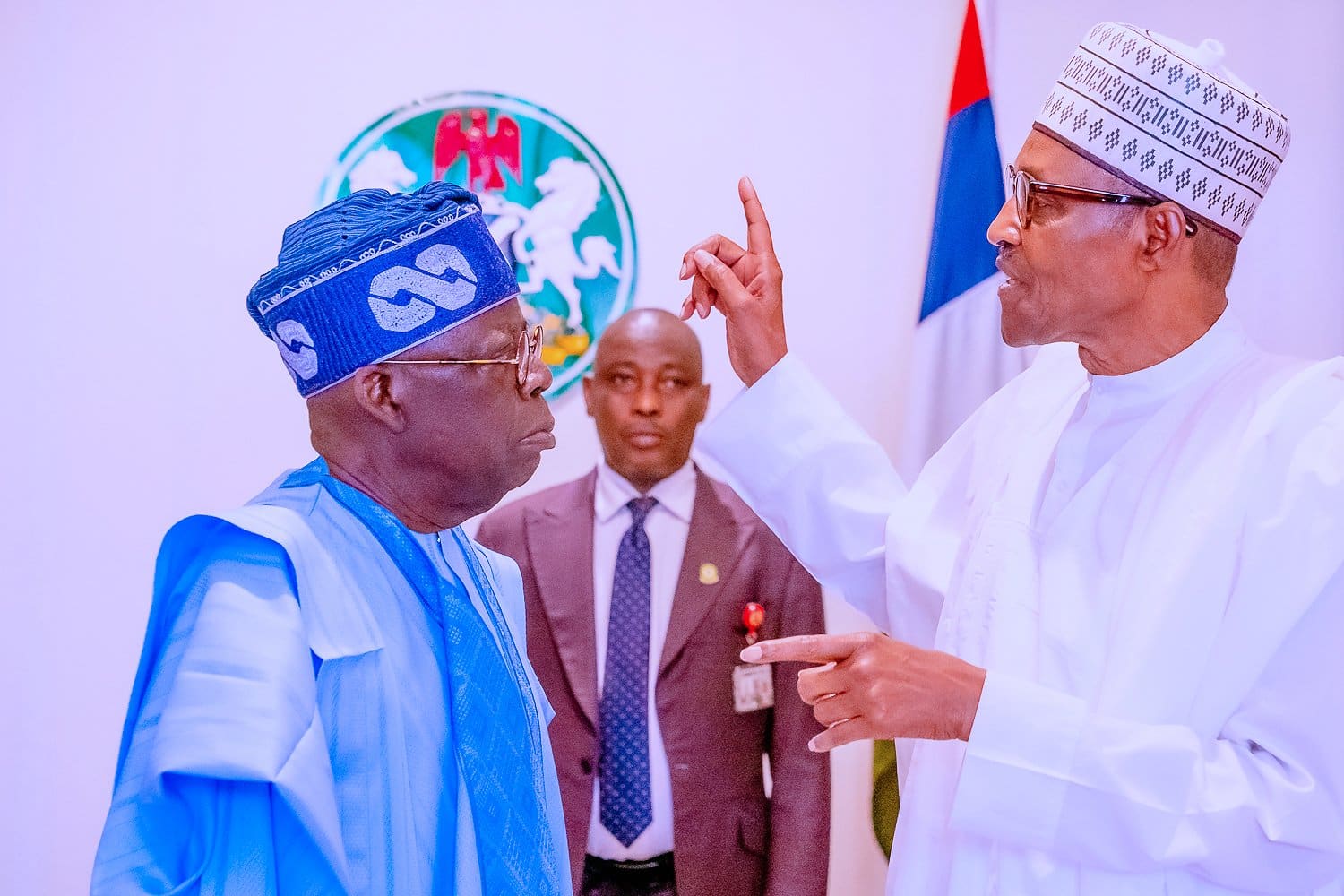

The naira entered into fresh trouble last June. The CBN, implementing Tinubu’s directive, initiated the unification of the naira rates, signalling the end of its control of the forex market. Since then, the currency’s exchange rate has been determined by market forces. Because the policy is not based on sound economics, the naira’s slide accelerated.

According to Tinubu, the main aim of the unification is to close the gap between the parallel and official market rates. Instead of that, it is widening; it was around N400 on January 23. Between the end of December 2023 and January 2024, at a time when government officials claimed that the naira would rebound due to some measures put in place, the naira rate hovered between N1,170 to N1,200.

As of May 2023, the official naira to dollar rate averaged N460.70 compared to N460.42 the previous month. The unofficial market rate was an average of N760. With the present figures, it is clear that the unification of the naira rates is a mere artificial policy. The fundamentals that should support the floatation of the currency are lacking.

Bloomberg ranks the naira among the world’s 10 weakest currencies, three of which –Zambian kwacha, Angolan kwanza, and Nigeria’s naira– are from Africa. Their weakness is attributed to unstable commodity prices, inflationary pressures, and lack of dollar liquidity, a point of view that enables Euro-American metropolitan economies to prey on Third World economies.

Governments at all levels should make the country attractive to investors and boost the ease of business. This involves fixing the perennial electricity power crises in the country. The binge borrowing by the Federal Government should stop and there should be commensurate efforts to intensify local food production and Small and Medium Scale Enterprises.

Currently, Nigeria is importing virtually everything. The Federal Government and the National Assembly must discipline their appetite for imported luxury items like luxury cars and planes to relieve the enormous stress these exert on the economy.

It is obvious that the floatation of the naira is not achieving the intended objectives. Therefore, the government must swallow the humble pie and review it. Before the merger of the rates, the exchange rate was N460.70/$1. The haphazard management of the currency has resulted in the exit of many multinationals from the country and the trend may continue in the months ahead.

3 weeks ago

13

3 weeks ago

13