ARTICLE AD

The bankruptcy filing comes after a US federal judge ruled last month that Terraform Labs' LUNA and MIR tokens qualify as securities.

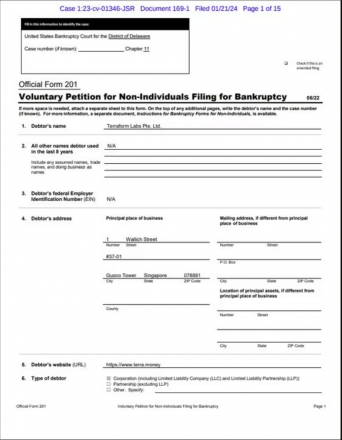

Singapore-based Terraform Labs Pte. has filed for Chapter 11 bankruptcy protection in Delaware as the embattled crypto firm faces growing legal pressures stemming from the collapse of its algorithmic stablecoin TerraUSD last year.

According to a report from Reuters and court documents dated January 21, Terraform Labs estimates its assets and liabilities to be between $100 million and $500 million.

“The filing will allow TFL to execute [on] its business plan while navigating ongoing legal proceedings, including representative litigation pending in Singapore and US litigation,” the firm said in a statement.

The bankruptcy filing comes after a US federal judge ruled last month that Terraform Labs’ LUNA and MIR tokens qualify as securities. This ruling effectively exposes the company to stricter regulations and oversight. Terraform Labs is currently battling an enforcement action from the Securities and Exchange Commission (SEC) accusing it of illegally selling unregistered securities to retail investors, allegations which the firm denies.

The SEC’s ongoing civil case against Terraform Labs and its co-founder Do Kwon stems from the disintegration of TerraUSD in May 2022, an algorithmic stablecoin engineered to maintain a $1 peg at all times. TerraUSD was closely tied to Luna ($LUNA), a crypto token used for governance and staking within the Terra ecosystem.

When TerraUSD lost its dollar parity last spring, Luna also plunged in value, wiping out an estimated $40 billion in investor funds.

A federal judge recently postponed the planned trial date to first allow Singapore authorities time to consider South Korea’s request to extradite Kwon to face criminal charges regarding his role in Terra’s collapse. The US court case remains active but is on hold, pending decisions on the extradition efforts.

In addition to its clash with US regulators, Terraform Labs, and its founder, Do Kwon, are defendants in a class action lawsuit brought by TerraUSD investors in Singapore. The bankruptcy case will allow the distressed cryptocurrency developer to restructure its operations even as it fights these high-stakes legal entanglements stemming from last May’s catastrophic depegging event that erased an estimated $40 billion in investor funds globally.

Unsecured creditors listed in the Chapter 11 filing include notable investment funds TQ. Ventures and Standard Crypto had financed Terraform Labs before the TerraUSD stablecoin broke its 1:1 dollar peg and rendered the entire Terra ecosystem obsolete seemingly overnight. Both investment funds are based in the US, with the latter operating as a San Francisco-based venture fund.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

80

1 year ago

80