ARTICLE AD

Tether Holdings Limited revealed a “record-breaking” quarterly net profit of $2.85 billion in 2023’s Q4 today. In its “Consolidated Reserves Report”, conducted by independent auditing firm BDO, the company’s quarter earnings reveal that approximately $1 billion of the net operating profits stemmed from interest on US Treasuries, with the remainder largely attributable to the appreciation of its gold and Bitcoin reserves.

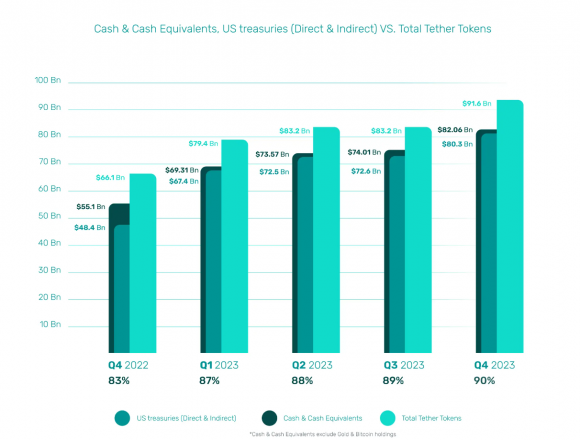

The report also shows that Tether holds over $97 billion in consolidated assets, such as US Treasuries, Reverse Repo, Money Market Funds, Bitcoin, and gold. The amount of cash and cash equivalents represents 90% of the company’s assets and is used to back the issuance of Tether USD (USDT) fully.

“Tether’s Q4 attestation underscores our commitment to transparency, stability, and responsible financial management. Achieving the highest percentage of reserves in Cash and Cash Equivalents reflects our dedication to liquidity and stability”, comments Paolo Ardoino, CEO of Tether.

Notably, the company’s excess reserves surged by $2.2 billion to a total of $5.4 billion, marking an all-time high. For the entirety of 2023, Tether’s net profit reached $6.2 billion, with about $4 billion derived from net operating profits related to, and the remaining from other asset classes.

An additional $640 million was strategically invested in various projects, including mining, AI infrastructure, and peer-to-peer telecommunications, under a new segregated venture capital umbrella to ensure these ventures do not impact the token reserves. Ardoino says that those investments can be seen as Tether’s “commitment to a more sustainable and inclusive financial future”.

Moreover, the report also informs the coverage of all $4.8 billion in secured loans, thus addressing any risk these loans might pose to token reserves. This move was in direct response to past concerns expressed by the Tether community regarding this aspect of the company’s portfolio.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

40

1 year ago

40