ARTICLE AD

Everbridge, a critical event management (CEM) software company, is going private in a $1.5 billion all-cash deal that will see it taken over by private equity giant Thoma Bravo.

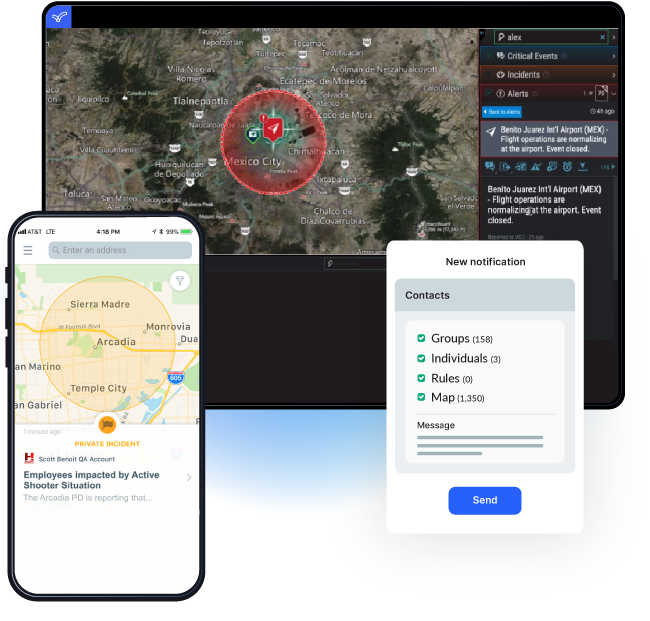

Founded in 2002 initially as 3N Global, Everbridge helps governments and enterprises from across the industrial spectrum respond to emergency situations — this includes risk intelligence to help asses the threat landscape around where employees live or travel to, as well as mass-notification tools to effectively communicate critical messaging during severe weather or terrorist attacks.

Everbridge went public on the NASDAQ in 2016, with its shares hitting an all-time high in September 2021 — the company reached a market cap of $6.4 billion, but this dropped by more than two-thirds within four months. Things never recovered, with its valuation hovering at below the $1 billion mark for the past six months.

Eventbridge Image Credits: Eventbridge

Premium plan

Thoma Bravo, a private equity firm renowned for snapping up underperforming enterprise software firms, is effectively paying a premium in excess of 50% on Everbridge’s market cap on Friday. However, looking at the volume-weighted average share price (VWAP) over the past three months, the deal represents a 32% premium, with shareholders netting $28.60 per share.

At a time when geopolitical instability is expected to increase due to the number of elections taking place, alongside existing threats related to climate change and economic headwinds, Thoma Bravo clearly sees Everbridge’s suite of SaaS tools as being integral to companies looking to manage these risks.

“We look forward to working with Everbridge to expand their ability to capitalize on opportunities in an expanding marketplace for risk, compliance, and safety solutions,” Thoma Bravo partner Hudson Smith said in a press release. “The Everbridge product portfolio is already used by some of the world’s most-respected corporations and organizations to comprehensively monitor risk and manage critical events, and we see an extensive runway ahead for product innovation and profitable growth.”

The transaction is still subject to certain regulatory and shareholder approvals, but the company said it expects to close the deal in Q2 2024.

1 year ago

78

1 year ago

78